Ahead Today

G3: US: mortgage applications, ADP employment, S&P Global US services index, factory orders, durable goods orders, ISM services index; eurozone services PMI

Asia: China: National People’s Congress, Caixin services index; Singapore retail sales; Philippines inflation

Market Highlights

Market sentiment has weakened, while equity volatility has spiked, as global trade war escalates. US tariffs will likely be larger, sooner, and more pervasive this time around. US President Trump has imposed 25% tariffs on most Canadian and Mexican imports, while further raising tariffs on China by 10% following the recent 10% tariff hike in February. Canada has retaliated by imposing 25% tariffs on US$20.7bn of US imports immediately, and it will widen the scope to include another US$86.2bn of US goods if US tariffs still remain in the next 21 days. China’s retaliatory response is more measured, targeting US agricultural produce with up to 15% tariffs.

While Trump can use tariffs as a negotiating tool, he can also use it to address widening trade imbalances in the US. Trump’s latest tariff actions have raised the risk that he will also follow through his threat on reciprocal tariff hikes on 2 April. In Asia, we identify India, South Korea, and Thailand as being the most vulnerable economies to Trump’s reciprocal tariff hikes. Trump’s threat of imposing tariffs on autos, pharmaceuticals, and semiconductors is still on the table.

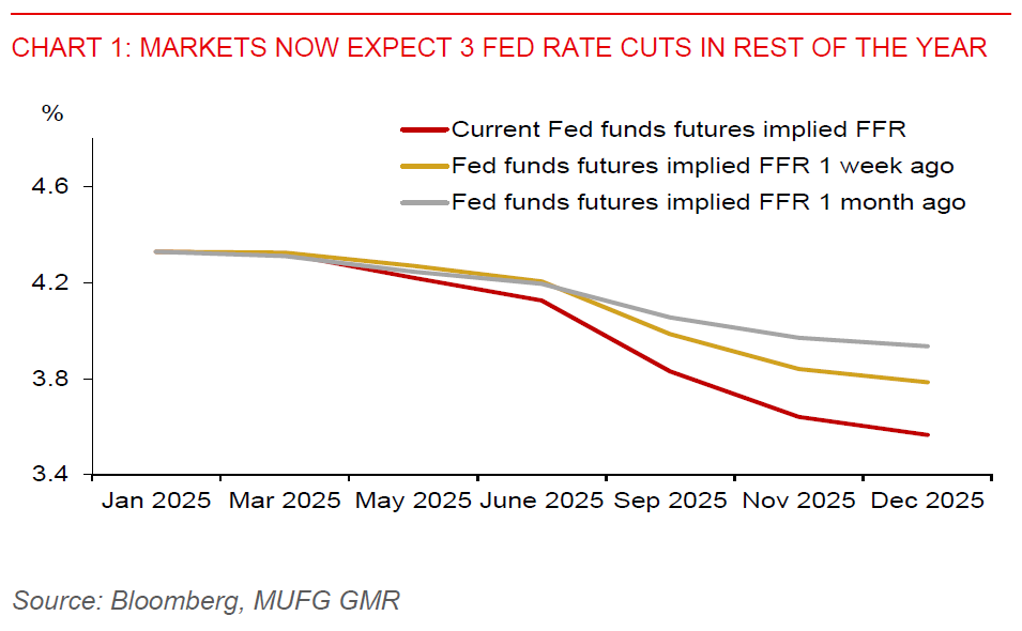

Markets have become increasingly concerned about the tariff impact on US economic growth, outweighing the risk of tariff-induced inflation. The fed funds futures markets have priced in slightly more than 3 rate cuts in the rest of this year, while the US dollar has fallen 1.4% so far this week. But given heightened global uncertainties, it remains to be seen if the recent decline in the US dollar could be sustained. The ISM services index to be released later today could shed more light on the state of US economy.

Regional FX

Asian ex-Japan currencies have broadly strengthened against the US dollar, despite the latest round of US tariff hikes and retaliatory actions from Canada and China. Markets remain increasingly concerned that higher tariffs could also slow the US economy, leading to lower US yields and a weaker US dollar. Notably, THB (+1%) led gains against the US dollar in Tuesday’s session.

China’s National People’s Congress (NPC) session will convene today. Broadly, we expect the government to set a 5% growth target, announce a higher budget deficit of around 4% of GDP, and maintain its focus on supply-centric industrial policies to boost tech and innovation. Meanwhile, the PBoC has maintained the daily fixing rate for USDCNY at ~7.17 over the past month, likely implying that it is less inclined for now to weaken RMB to offset potential negative tariff impact. However, should exports weaken leading to greater deflationary pressures, the PBOC could then allow CNY to depreciate.

The Bank of Thailand has said that its monetary policy stance is robust enough to cope with the latest US tariff hikes on several trading partners, adding that the 25bps policy rate cut in February – a move that we had anticipated (see Thailand: BoT could cut rates again in February) – is sufficient to provide a buffer against external shocks. However, the central bank has also said that it may consider to cut the policy rate further should there be a significantly large negative economic shock. In our view, the BoT has set quite a high bar for a policy rate cut. We maintain our outlook for BoT to keep the policy rate unchanged at 2% for rest of this year. While the Thai baht has proved to be more resilient than we had anticipated, we still look for an eventual move weaker towards the 36.00-level against the US dollar by Q2.