Ahead Today

G3: Eurozone 4Q GDP, US Retail Sales, US Industrial Production

Asia: China Money Supply, Malaysia GDP, India WPI

Market Highlights

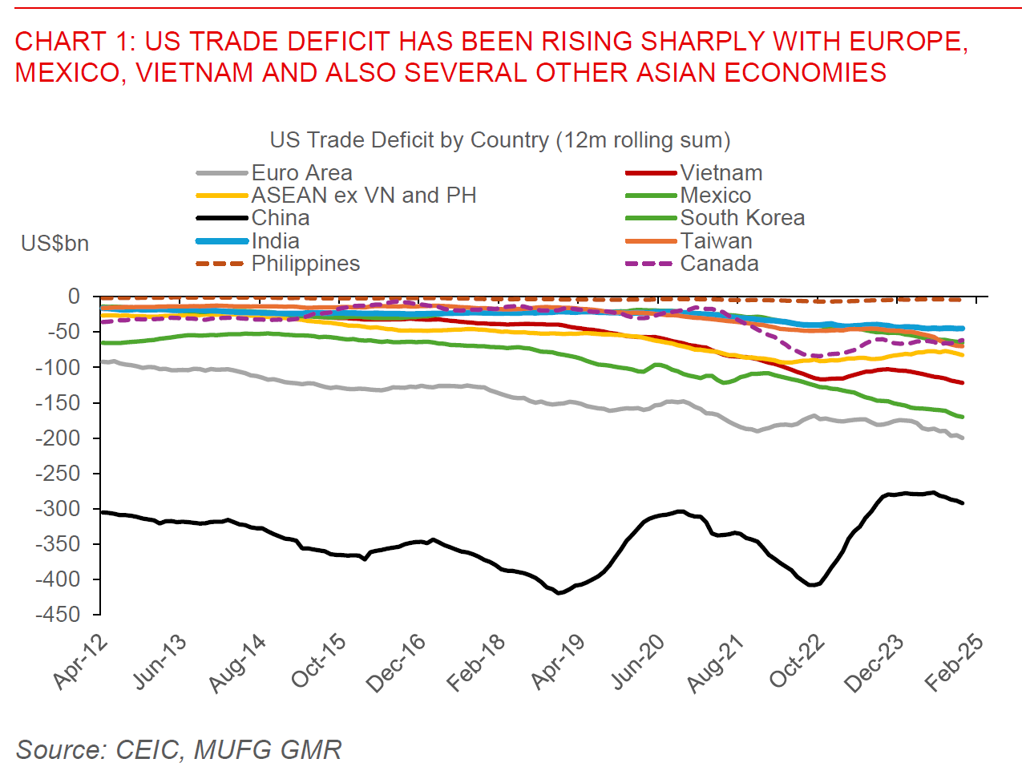

President Trump signed a measure on reciprocal tariffs, directing the US Commerce Secretary and Trade Representative to propose new levies on a country-by-country basis in an effort to help reduce the US trade deficit. According to officials, this study should be completed by 1 April and tariffs could be implemented after that. While exact details are still unclear, these import taxes seem to be customized to not just offset other countries’ import tariffs on US goods, but also target a whole range of non-tariff barriers such as unfair subsidies, regulations, value added taxes, exchange rates, together with other factors that limit US trade. With such a broad scope, it’s difficult to determine exactly which country will be more badly hit at this point, and it also raises the question of how much room for negotiations there will be. For what it’s worth, Trump highlighted a few countries both in the accompanying factsheet and in press comments - the European Union for its VAT and non-tariff barriers on seafood, Brazil for its ethanol tariffs, India for its high tariffs more generally including on agriculture and motorcycles, coupled with Japan and South Korea. Our analysis shows that India looks most vulnerable in Asia to full reciprocity in tariffs, a scenario which is probably unlikely in practice (see Asia FX talk – Reciprocal tariffs).

Overall, the Dollar continued to weaken and Asian currencies strengthened through the day, driven by other cross currents as well. While US PPI came in higher than expected, the components which feed into core PCE – the key inflation measure the Fed targets – were softer and as such likely leading to a more benign PCE inflation print than CPI numbers suggest. Meanwhile, the prospect of a deal between Russia and Ukraine has also lifted risk sentiment to some extent, together with near-term delays in tariff implementation.

Regional FX

Asian currencies were generally stronger, with outperformance in the likes of THB (+1.2%), KRW (+0.7%), MYR (+0.7%) and CNH (+0.4%).

The Philippines central bank surprised markets by keeping its key policy rate unchanged at 5.75% in its policy meeting on 13 February. Both the consensus and ourselves were calling for a 25bps cut.

Nonetheless, BSP Governor Remolona maintained a dovish tilt in his post policy comments, in two key ways.

First, he highlighted that the central bank was still in an easing cycle, and the central bank is likely to continue shifting to a less restrictive stance. The exact timing of rate cuts was still not sure given global uncertainties such as tariffs and elevated US rates key deciding factors for the rate path, with the balancing act more difficult than usual this year. Overall, Governor Remolona said that 50bps cuts in total was still possible in 2025.

Second, the BSP tilted dovish by guiding towards a 200bps cut in the Reserve Ratio Requirement from 7% currently to 5%, and likely in the April 2025 policy meeting.

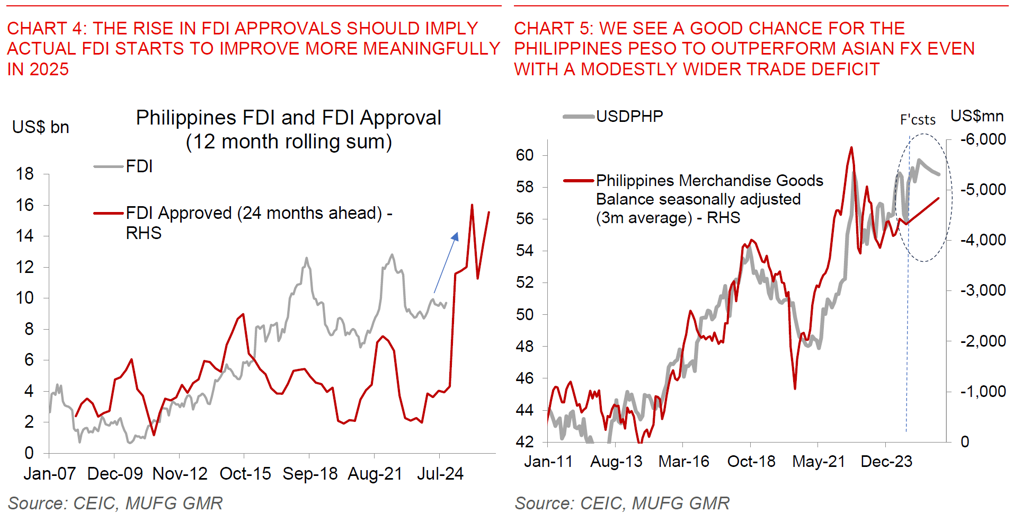

Overall, we think the Feb 2025 policy decision gives us greater confidence on our view that the Philippines Peso could outperform Asian currencies in 2025, and we are forecasting USD/PHP at 58.80 by end-2025. Beyond the interest rates path, we see factors such as manageable inflation, improving growth prospects driven by infrastructure spending and higher wage growth, coupled with surging FDI approvals supporting the Philippines Peso from a domestic perspective this year. From a global perspective, we continue to think that the Philippines Peso is more insulated directly from Trump 2.0’s tariff threats and policies, and also indirectly from a potential slowdown in China’s economy.

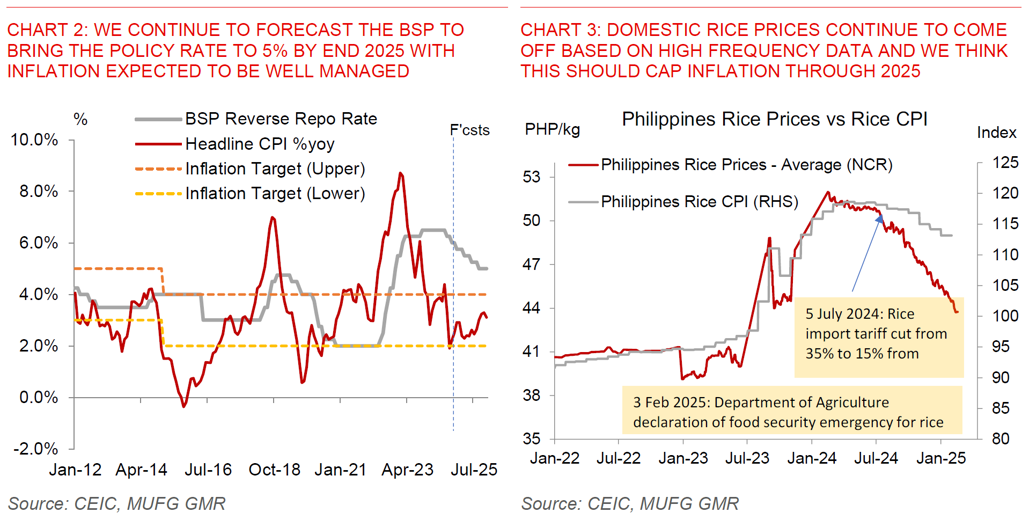

From a rates perspective, we have been forecasting the BSP to cut rates by 75bps through 2025, bringing it to 5% from 5.75% currently. Ultimately, we see rate cuts as delayed and not denied, and are for now happy to keep our current magnitude of forecasted rate cuts even if the exact timing is pushed out later. We think that inflation in the Philippines in 2025 will likely come in lower than the BSP’s forecasts given modest global rice and oil inflation pressures, coupled with a negative output gap, and this will likely provide policy space for the BSP to cut rates through 2025.