Ahead Today

G3: US Non-Farm Payrolls, Eurozone Dec CPI, US ISM Services

Asia: Philippines CPI, Thailand CPI, Singapore Retail Sales, HSBC India PMI Composite, Taiwan CPI, India 2024 GDP Advance

Market Highlights

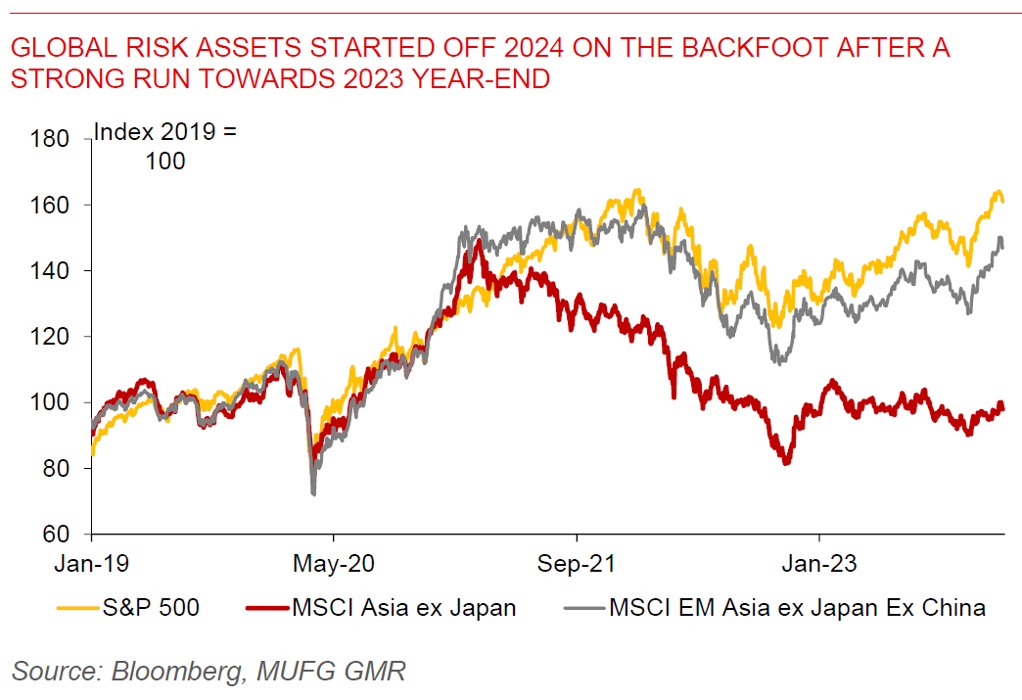

Data overnight brought with it a combination of better-than-expected US labour market and European growth numbers, coupled with slightly lower than expected inflation out of Germany. In particular, the US ADP employment estimates rose by 164k in December, while initial jobless claims rose by 202k (down from 218k the previous month). Meanwhile, Germany’s inflation picked up to 3.7%yoy as past energy subsidies faded out of the year-ago base. Overall, markets continued the year on a backfoot, with US 10-year yields rising further to 3.99%, the S&P500 down 0.3%, with mixed performance in the Dollar and EURUSD up to 1.094.

Looking ahead, the key event will be US non-farm payrolls. Consensus is expecting a moderation to 175k from 199k in December as the returning auto workers from strikes in November are not repeated again. Beyond the headline NFP estimates, markets will also look closely at whether wage growth continues to slow and labour force participation rates rise further, indicating continued improvements in labour demand and supply.

Regional FX

Asian FX were mixed, with KRW and THB underperforming (-0.2%), and SGD outperforming. China’s China Services PMI was stronger than expected at 52.9, up from 51.5 previously, and this was also on the back of stronger than expected Caixin Manufacturing PMI. Meanwhile, Singapore’s COE premiums fell sharply, with premiums for smaller cars declining to $65,010 from $85,000 previously, while premiums for larger cars declining to $85,010 from $110,001. While this sharp drop could be an aberration, lower car prices could provide some relief at the margin for Singapore’s inflation through 2024, partly offsetting administrative price increases in the pipeline such as GST increases, water tariff hikes, and carbon taxes. We expect MAS to keep its exchange rate policy on hold in 2024, with S$NEER likely to continue trading close to the top end of the band. The Philippines will release its inflation print later today, where consensus is expecting a moderation to 4%yoy from 4.1%yoy previously. We think BSP will remain on hold for now and will cut rates by 50bps in 2H2024 as inflation falls towards the top half of its inflation target.