Ahead Today

G3: US NFIB Small Business Index, US Trade Balance, Germany Industrial Production

Asia: Taiwan Exports

Market Highlights

US equity markets rallied and bond yields fell, as the NY Fed inflation expectations fell sharply to its lowest since 2021 to 3%, from 3.4% previously. Part of the better sentiment may also be attributed to a 1.2% decline in oil prices, as Saudi Arabia cut selling prices, helping to offset rising Middle East tensions.

Fed speakers were cautiously optimistic in their remarks. Fed President Bostic said that inflation is on the path to 2%, but it’s still too soon to declare victory. Fed Governor Bowman, one of the most hawkish members of the FOMC, said that it will eventually become appropriate to begin the process of lowering policy rates as inflation moves closer to 2% goal to prevent real rates from rising, but that we are not there yet.

Meanwhile across the Atlantic, Europe’s data remains weak and at recessionary levels, but activity has stopped deteriorating further. Consumer confidence and economic confidence both rose slightly, while Germany’s exports were stronger than expected. Moving forward, we expect Europe’s growth to remain soft in 2024 weighed down by tighter fiscal policy, but offset by the lagged impact of lower inflation and rates.

Regional FX

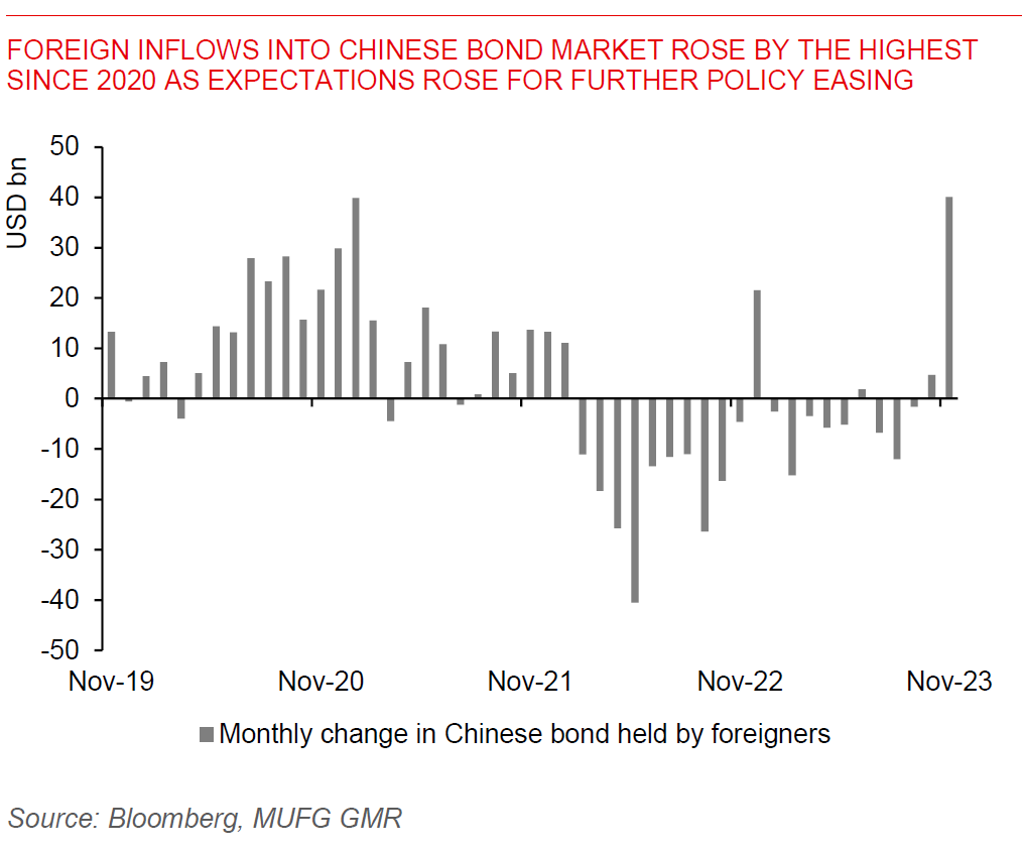

Asian FX were mixed with MYR and PHP underperforming (-0.35%), and INR outperforming (+0.11%). Chinese authorities said that they may lower reserve requirements and open market operations to provide “strong” support for reasonable growth in credit, according to Zou Lan, the head of PBOC’s monetary policy department. Expectations are growing for further monetary easing in China given relatively stable FX, with consensus looking at 10bps cuts in MLF and the Loan Prime rate out later this month. Foreign inflows into China’s bonds have also been strong based on latest available data. We are calling for 20-30bps of rate cuts with 30-50bps of RRR cuts in 2024 (see Annual Foreign Exchange Outlook 2024). Meanwhile, Indonesia’s FX reserves rose to US$146bn from US$138bn the previous month, driven in part by valuation gains as the Dollar weakened, and driven up by the government’s foreign loan withdrawal according to Bank Indonesia.