Ahead Today

G3: Eurozone consumer confidence

Asia: Thailand trade, Malaysia CPI

Market Highlights

US initial jobless claims were little change at 223,000 in the week ended 15 March, remaining at relatively low levels. This underscores a still largely resilient US labour market. Nonetheless, with President Trump planning to shrink the federal workforce, some labour market weakness could be likely over the coming months. Job-cuts announcements had doubled in February, led by the government sector, while the Fed has raised its outlook for the unemployment rate to 4.4% this year, from 4.3% in its previous projections.

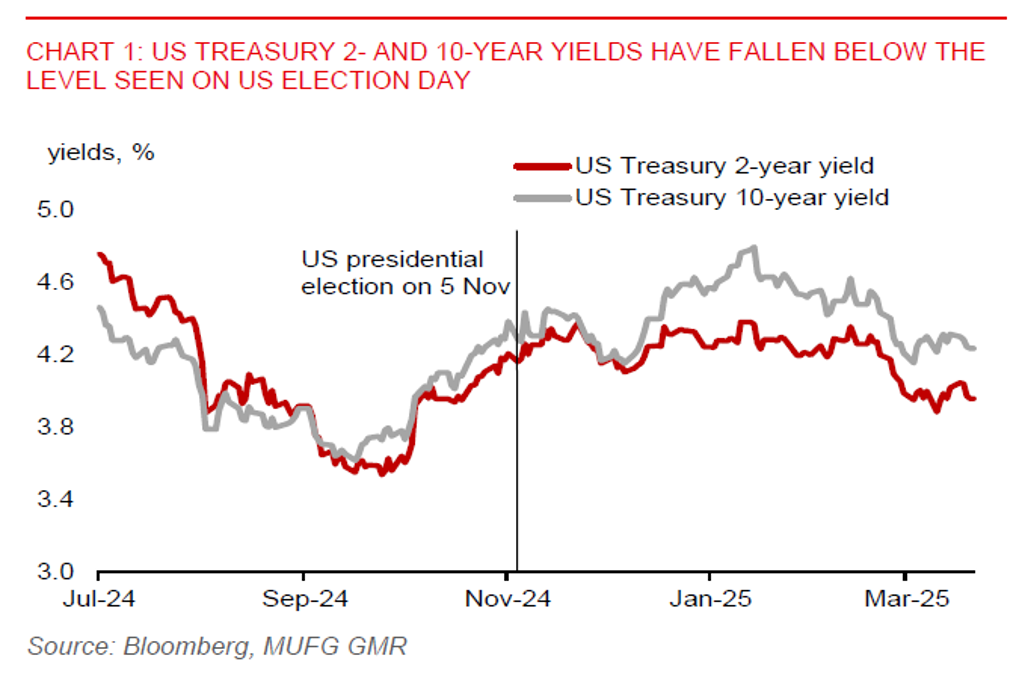

US Treasury yields have continued to move lower following the FOMC meeting, with the Fed having downgraded its 2025 outlook for US GDP growth to 1.7% from 2.1% previously. President Trump has again urged the Fed to cut interest rates, as his administration prepares to unleash a wave of reciprocal tariffs on 2 April.

Meanwhile, Brent prices have picked up, amid the US sanctioning a Chinese buyer of Iranian oil, which could weigh on Iran’s crude oil exports. However, Brent prices have stayed well below their mid-January peak, and they could weaken more, given a confluence of bearish forces. OPEC+ has green-lighted a gradual plan to restore more oil production starting in April, higher US tariffs could act as a drag on global oil demand, while President Trump is negotiating an end to the Ukraine-Russia war. Low oil prices will bode well for many Asian economies, which are net oil importers.

Regional FX

Asia ex-Japan currencies had a mixed performance against the US dollar in Thursday’s session. SGD (-0.4%), CNY (-0.3%), and KRW (-0.3%) led losses against the US dollar, while several other regional currencies have made modest gains.

China has left its 1-year and 5-year loan prime rates (LPR) unchanged at 3.10% and 3.60%, respectively. A lack of monetary stimulus in the form of LPR cuts may have weighed on market sentiment, with the Hang Seng Index falling.

Meanwhile, Malaysia’s exports were up by 6.2%yoy in February, with electronics exports growing at a strong pace of 18.1%yoy. The monthly trade balance was in surplus of MYR12.6bn in February, which is wider than the MYR11.2bn surplus from a year ago. This, along with strong domestic investment pipelines, could provide some support for the ringgit. However, a potential 25% US tariffs on semiconductors could pose a significant drag on the outlook of Malaysia’s economy and the ringgit.