Ahead Today

G3: US import and export price index, CPI data from France and Spain, Japan industrial production

Asia: -

Market Highlights

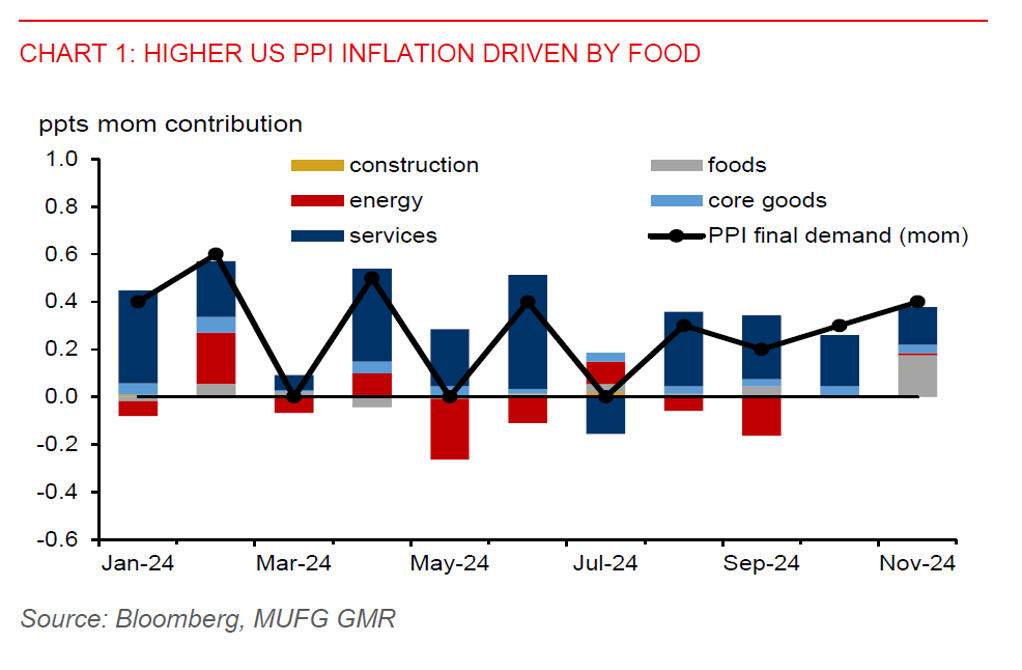

Markets are still anticipating a December Fed rate cut. The US producer price index (PPI) for final demand rose 0.4%mom (3.0%yoy) in November. But this was mainly driven by higher contribution from wholesale food inflation. Core PPI inflation was 2.5%yoy, only 0.1ppt higher than in October. Meanwhile, the US labour market has been resilient. The weekly initial jobless claims picked up to 242k in early December vs. 224k in end-November, but the 4-week average stayed low at 224k.

The ECB lowered its deposit facility rate by 25bps to 3.00% and signalled for further easing amid weakening euro area growth. Markets are pricing in more aggressive ECB rate cuts (-129bps) versus the Fed (-55bps) in 2025, which could weigh on the euro, especially with looming US tariff hikes. ECB President Lagard indicated downside risks to growth and mentioned that a potential 50bps rate cut was discussed. And the Swiss National Bank cut rates further by 50bps to 0.50%, exceeding market expectations of a 25bps cut.

Meanwhile, markets have pared back expectations for a February rate cut by RBA after a stronger-than-expected jobs market. But more labour market data are available before the next policy decision. Potential weaker jobs data amid a slowing economy could still lead to an RBA pivot in February.

Regional FX

In the Asia region, the Bloomberg Asia dollar index was unchanged in Thursday session. Chinese policymakers have pledged to lower rates and the reserve requirement ratio for banks at an appropriate time and to keep the CNY stable following the two-day Central Economic Work Conference.

Meanwhile, the KRW has stayed under pressure amid domestic political uncertainty. We expect USD/KRW to rise to 1,450 over the next 6 months, with risks to the upside. The opposition party has filed for a second impeachment motion against President Yoon, more ruling party members have come out in support of impeaching him, while he has continued to defend his martial law decision. The political crisis in South Korea is occurring amidst a slowing domestic economy and the threat of higher US tariffs. Being a leading memory chip producer, South Korea may face slower memory chip sales growth in 2025.

However, the Thai baht gained 0.2% against the US dollar, supported by pro-growth policies. Still, it may face renewed depreciation pressures after the peak tourism season and from higher US tariffs. The government's stimulus measures, including ending business monopolies, cash handouts, electricity cost cuts, and debt relief (suspend interest payment for 3 years and reduce principal instalment), are likely to cushion some of the tariff impacts.

India’s CPI eased to 5.5%yoy in November, from 6.2%yoy in October, While the CPI print has strengthened expectation of a policy rate cut in February among analysts, inflation is still higher than the RBI’s 4% target.