Ahead Today

G3: US Trade Balance

Asia: China Trade, Philippines CPI, Philippines Trade, Malaysia IP, Taiwan CPI, Taiwan Trade

Market Highlights

The Dollar strengthened slightly overnight while US 10-year yields inched up to 4.63%, as markets adjusted to the market environment post non-farm payrolls. This even as several Asian currencies experienced outsized moves, with IDR and MYR strengthening by more than 2% and PHP and KRW rising by 1.5%. Europe’s Services and Composite PMI numbers for October were unchanged from the preliminary print, and confirmed an economy which remained weak. Meanwhile, Bank of England’s Chief Economist said that the BOE’s MPC feels it needs to keep rates restrictive for at least a while, but that the middle of next year seems reasonable for considering rates stance.

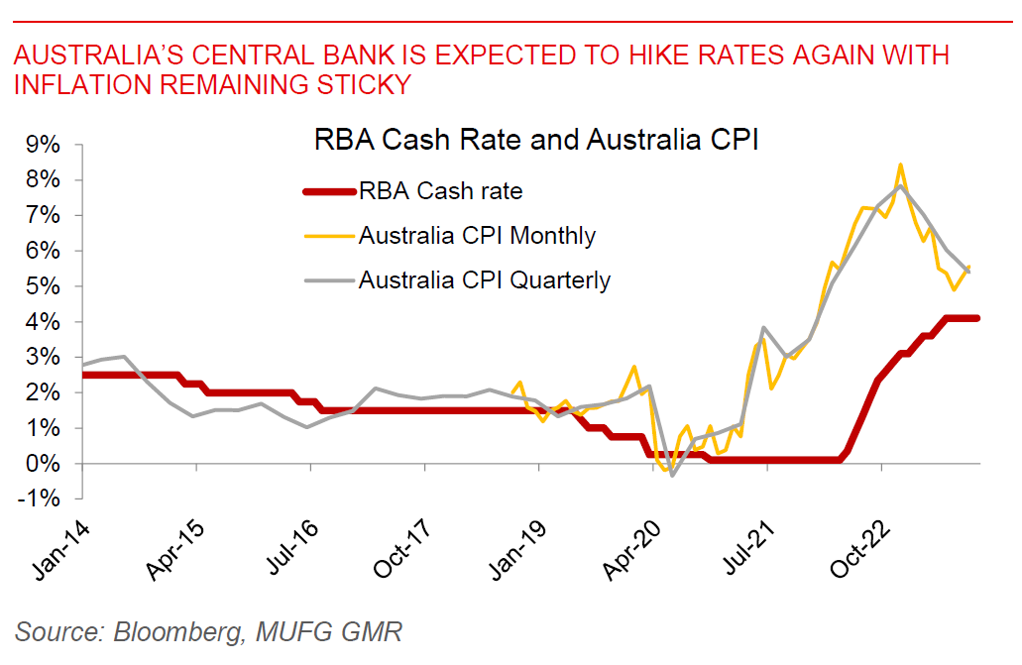

Looking ahead, we will have the Reserve Bank of Australia’s policy decision, with the vast majority of economists are calling for a 25bps hike to bring the cash rate to 4.35%. This comes as the latest Australia inflation print surprised on the upside and remained sticky, with the central bank also providing updated forecasts during the meeting.

Regional FX

Most Asian currencies were stronger against the Dollar, following the broader dollar sell-off. IDR (+2%), MYR (+2.1%), KRW (+1.53%) and PHP (+1.4%) outperformed, while we saw some underperformance in INR (+0.05%). Indonesia released its 3Q GDP data, which came in a touch softer than expected at 4.9% (vs consensus of 5%yoy). The details were decent, with still robust private consumption, a pickup in investment, although accompanied by a slowdown in government spending. Meanwhile, Thailand’s headline inflation was weak at -0.3%yoy down from 0.3%yoy the previous month. The Bank of Thailand recently changed its stance to neutral, and we think the central bank is unlikely to hike rates again this year. Looking ahead, markets will watch closely for the Philippines’ inflation data to see if the BSP may hike again at its upcoming policy meeting this month.