Ahead Today

G3: Speeches by Fed’s Collins and Harker, Germany’s industrial production

Asia: Trade data from Philippines and Taiwan, China CPI

Market Highlights

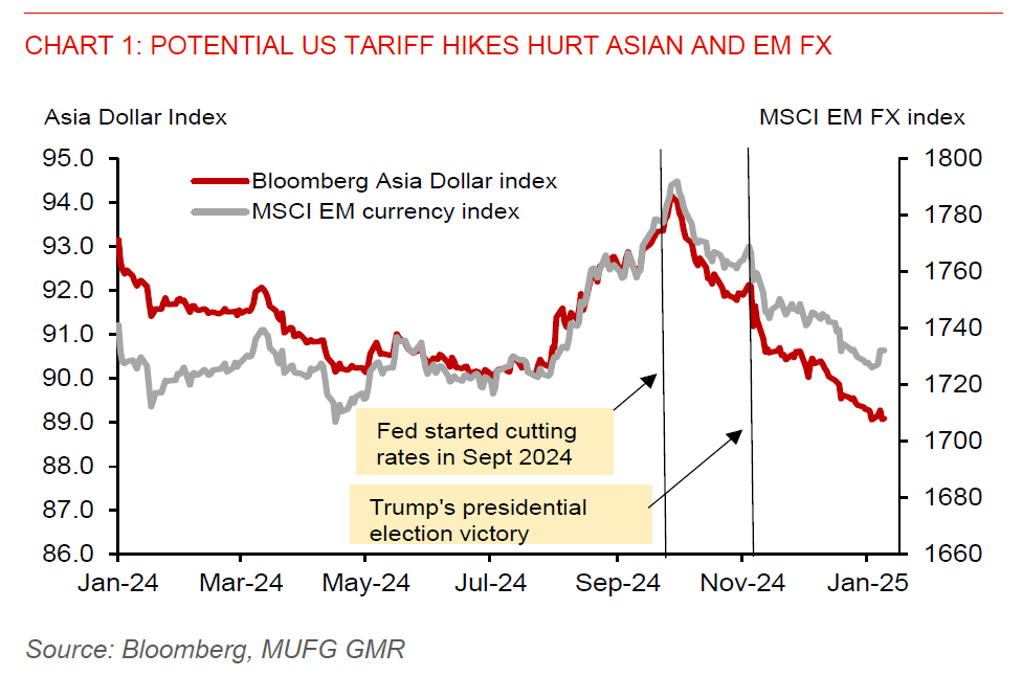

The broad US dollar index (DXY) gained by 0.5% in Wednesday’s session, amid persisting “Trump trades” and several recent stronger than expected US economic data. Several G10 currencies fell against the US dollar, more notably the GBP (+1%). USDJPY has also risen above the 158.00 level. Donald Trump has reportedly considered declaring a national economic emergency to impose tariffs on trading partners. During his presidential campaign, he pledged to impose 60% tariffs on imports from China and 10% on imports from everyone else. Meanwhile, US initial jobless claims fell to 201,000 in the week ending 4 January, from 211,000 in the prior week, remaining historically low.

Notably, a weaker than expected ADP employment data and relatively dovish comments from Fed’s Waller have not swayed the market’s positive sentiment on the US dollar. Private sector employment rose by 122k in December, less than the 146k increase in November and missing Bloomberg consensus of 140k. Meanwhile, Fed’s Waller has said inflation will continue to decline towards the Fed’s 2% target, supporting more rate cuts this year. However, he added that the pace of rate cuts will still depend on inflation progress. He also mentioned that tariffs are not likely to have a persistent effect on inflation, and thus potential tariff hikes will not affect his view of more policy easing.

Regional FX

Asian ex-Japan currencies were broadly weaker against the US dollar. The KRW (-0.6%) led losses, followed by the TWD (-0.5%), while major ASEAN currencies (SGD, MYR, THB, IDR) fell by about 0.3%-0.4%.

USDCNY has been hovering near the upper bound of its trading band in recent days. PBOC has continued to set its daily fixing rate for USDCNY below the 7.2000 level to slow the pace of CNY depreciation. However, it may be inevitable for the PBOC to tolerate a weaker CNY to help offset the negative impact of potential higher US tariffs. Moreover, China’s CPI inflation is likely to remain weak in December, pointing to still sluggish domestic demand. This suggests more monetary and fiscal stimulus measures are needed to revive domestic demand and counter deflationary pressures.

Meanwhile, a pickup in Indonesia’s foreign reserves (US$155.7bn in December vs. US$150.2bn in November) has enhanced Bank Indonesia’s ability to perform direct spot FX intervention to defend the rupiah.