Ahead Today

G3: Speech by ECB Chief Economist Philip Lane, Germany IFO survey, Japan leading index

Asia: China industrial profits, Hong Kong trade

Market Highlights

The impact of a hawkish Fed minutes has lingered on, prodded by US macro data on Friday that beat market expectations. Durable goods orders rose 0.7%mom vs. 2.6% prior and market expectation of -0.8%. Capital goods new orders (ex-defense, aircraft, & parts) were up 0.3%mom vs. 0.1% prior and expected. The final University of Michigan sentiment index reading for May was revised up to 69.1 from 67.4, pointing to a less “bad” fall in consumer confidence, though still 8pps lower than in April.

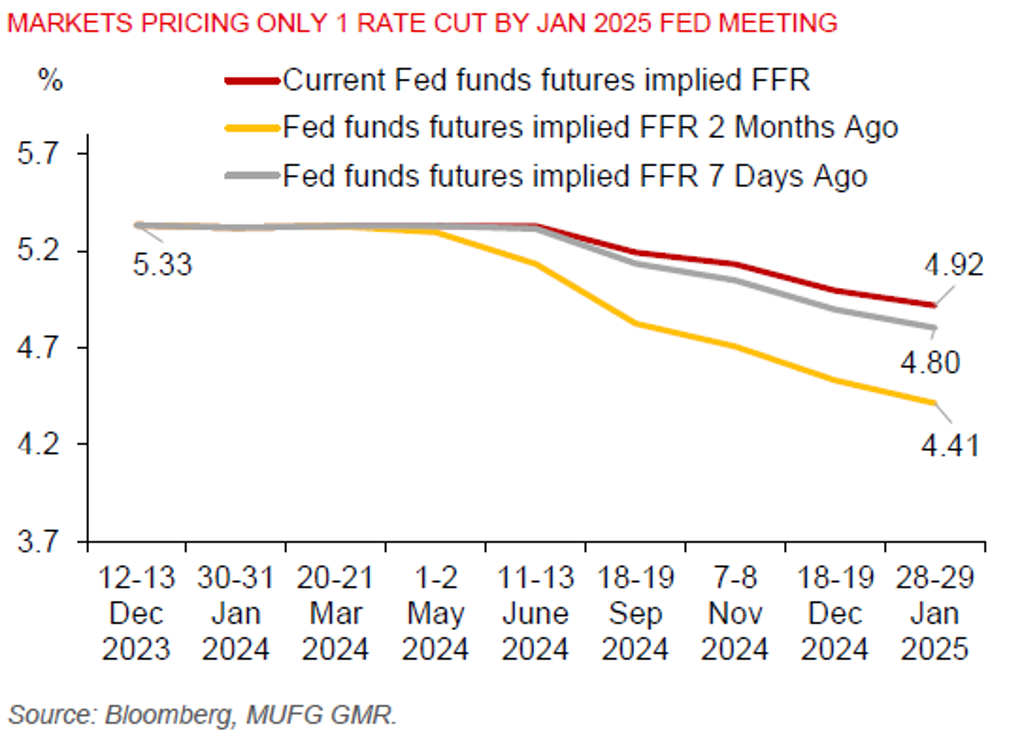

Markets have pared back US rate cut bets last week. Only 1 US rate cut is priced for this year. And less than 2 rate cuts are now being priced through January 2025 vs. 2 rate cuts being fully priced in just a week ago. US 2y yield rose 12bps last week vs. just 4.5bps on the 10y yield, leading to a steeper yield curve inversion. However, there could be some profit-taking on the US dollar, with the DXY USD index falling modestly after reaching the 50DMA at the 105 level.

China, Japan, and South Korea have started their trilateral summit in Seoul, the first summit since 2019, covering sustainable development, people-to-people engagement, economy, and trade. There could be some economic cooperation forged, but security issues relating to North Korea and Taiwan are unlikely to see major breakthrough.

Regional FX

Asia FX mostly weakened against the US dollar following hawkish Fed minutes and fading positive sentiment from China’s property support measures. USDCNH moved above the 7.2600 level, with the CFETS USD/CNY fixing rate moving above the 7.1100 level last Friday for the first time since January. The KRW (-0.5%) and THB (-0.4%) underperformed, while FX movements were relatively muted in other regional currencies. USDVND continues to trade at the upper bound of the spot exchange rate band of ±5%, on the back of a lack of USD liquidity. However, the INR outperformed with a 0.2% gain against the US dollar, on the back of a larger than expected RBI dividend payment to the government. With the US market closed for a public holiday, Asia FX movement could be determined by Japan’s leading index and China’s industrial profit data.