Ahead Today

G3: US Personal Spending and Income, US PCE, Eurozone Consumer Confidence

Asia: Philippines Trade Deficit, India Infrastructure Index, Thailand Industrial Production

Market Highlights

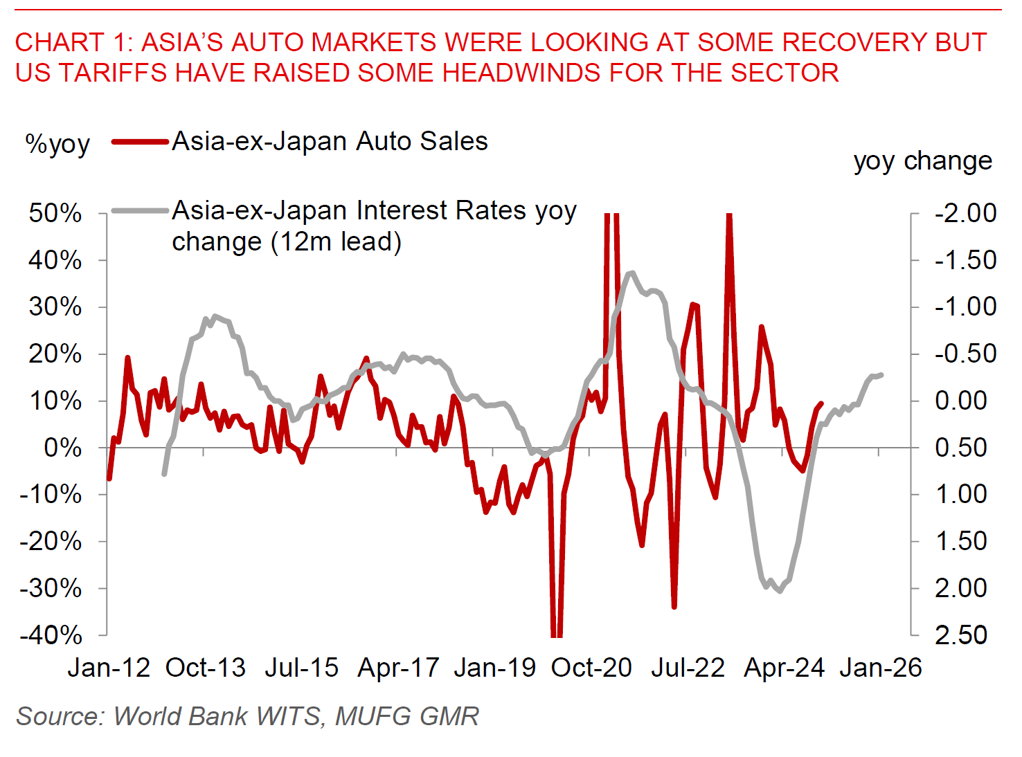

Following President Trump’s announcement of 25% tariffs on auto imports initially targeting fully assembled vehicles, the policy has sparked a range of responses with some threats of retaliation raising the risk of tit-for-tat tariffs, even as exact moves are still unclear. EU Commission President Ursula von der Leyn warned that Europe would defend its economic interests, with the Financial Times reporting that the EU may consider hitting US services exports including restrictions on intellectual property of Big Tech companies and procurement of government projects. Japanese Prime Minister Shigeru Ishiba said he won’t rule out taking countermeasures against the auto tariffs with “all options on the table”, while Ontario Premier Doug Ford said it was “virtually guaranteed” that Canada would retaliate. South Korea’s Industry Minister will announce emergency measures for the automobile industry by April to help the industry respond to the new 25% tariffs on auto imports.

From a markets perspective, what’s interesting is that the reaction including in FX to the 25% auto tariffs has been relatively muted so far. Whether this reflects a view by the market that the spillover impact to global and non-US growth will be manageable perhaps given the broad-based nature of the tariffs on the sector, or that the market views with skepticism the permanence of these tariffs for instance remains to be seen.

Regional FX

Asia FX moves were generally mixed yesterday, with USD/CNH at 7.2689, while KRW (-0.23%), SGD (-0.28%) underperforming slightly, while IDR (+0.2%) and PHP (+0.4%). In China Reuters reported that the global heads of Germany automakers and Mercedes, as well as chip giant Qualcomm are among foreign business leaders due to meet Chinese President Xi Jinping this week. This follows on from the recent China Development Forum (CDF), with executives from Apple, Pfizer, Mastercard, among others also meeting key officials according to the news report from Reuters. These moves also come from meetings with President Xi Jinping with key domestic tech companies in China, in a move which may help private sector confidence and help to put a floor on China’s growth prospects this year amidst tariff risks. Meanwhile, we saw a meaningful rally in PHP, with some news reports highlighting suspected FX intervention by the central bank to help smooth FX intervention. While the Philippines is much more insulated relative to other countries from Trump’s tariff risks, today’s trade deficit print could be important to gauge the extent of current account deficit widening moving forward which could impact PHP as well in 2025.