Ahead Today

G3: US: initial jobless claims, S&P Global US services PMI, factory orders, durable goods orders, IS services index

Asia: Australia trade balance, HK retail sales

Market Highlights

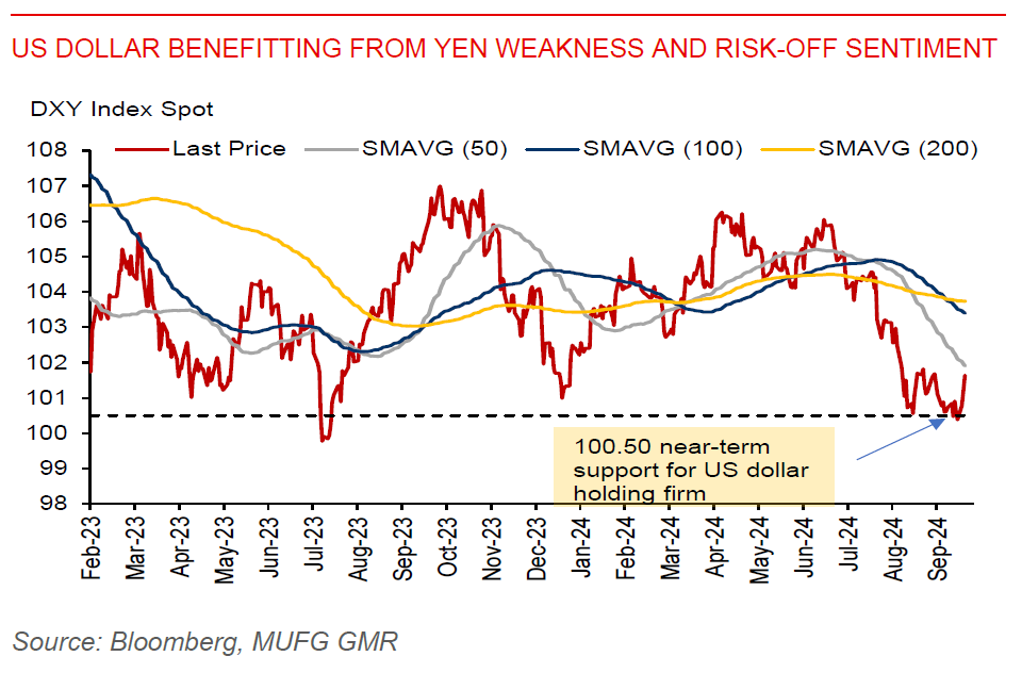

The US dollar index extended its gains by 0.4% on Wednesday’s session, with the 100.50 support level continuing to hold firm. The September US ADP employment data shows that the private sector added 143k jobs, picking up from 99k in August and beating Bloomberg consensus for 125k increase. The rise by 3 big figures in USDJPY has also supported the US dollar index. This follows from comments by Japan’s new Prime Minister Ishiba that the Japanese economy is not ready for further interest rate hikes. BoJ Governor Ueda also delivered a dovish signal to markets following his meeting with PM Ishiba. He said that the global economic outlook is uncertain and financial markets are unstable, so the BoJ will be watching these global developments with a high sense of urgency for now.

Meanwhile, the US dollar has likely also benefitted from a rise in global risk aversion resulting from heightened geopolitical tensions between Iran and Israel, which could lead to a broader regional conflict. Brent prices have gained for the second day. And there is upside risk to global oil prices, which would weigh on the terms of trade of many Asian economies, given their heavy reliance on oil imports.

A key macro data highlight for the US today will be the ISM services index, which will shed light on whether services activity has held up, especially in light of continued weakness in US manufacturing activity. Indeed, the ISM manufacturing index shows a prolonged slump in US manufacturing activity since November 2022.

Regional FX

Asia ex-Japan currencies weakened against the US dollar on Wednesday’s session, on the back of rising tensions in the Middle East. KRW (-0.6%) and THB (-0.6%) led losses in the region, while IDR (-0.5%), and MYR (-0.4%) also declined. Heightened geopolitical tensions in the Middle East will dominate market sentiment for now, which could partially offset market optimism about China’s recent policy stimulus measures.

Notably, the Thai baht has taken a breather after closing at 32.17 at the end of Q3, as the recent rally looked stretched. Finance Minister Pichai also plans to meet with BoT governor Sethaput to discuss about the Thai baht, policy rate, and inflation target. Meanwhile, a potential downside risk for the Thai baht stems from rising public debt levels. The Thai cabinet has approved a public debt management plan for FY2025, with new borrowing of THB1.2tn being earmarked to finance the budget deficit. This is THB61.7bn higher than the THB1.14tn in FY2024.The government projected the fiscal debt to GDP ratio will be at 66.8% of GDP for FY2025, nearing the legal cap of 70% (which was adjusted upward in 2021 from 60% previously). A credible medium-term debt management plan will likely be necessary to keep government borrowings in check.