Ahead Today

G3: RBA Cash Rate, Germany Zew Expectations, Eurozone CPI, US Retail Sales, us industrial production

Asia: China FDI

Market Highlights

Risk assets rallied, US yields fell while the Dollar turned weaker, as markets continued to digest developments in the French elections even as China’s monthly macro data for May was a mixed bag. Far-right leader Marine Le Pen said she won’t push out President Macron if she wins France’s snap parliamentary elections in an appeal to moderates and investors, and that she is respectful of institutions. French spreads with German yields and CDS narrowed slightly on the back of the news. Nonetheless concerns and uncertainty remain around the policy platform of both the far-right and the new left alliance in France especially on fiscal policy, given that both parties could meaningfully increase spending and the budget deficit over the medium-term.

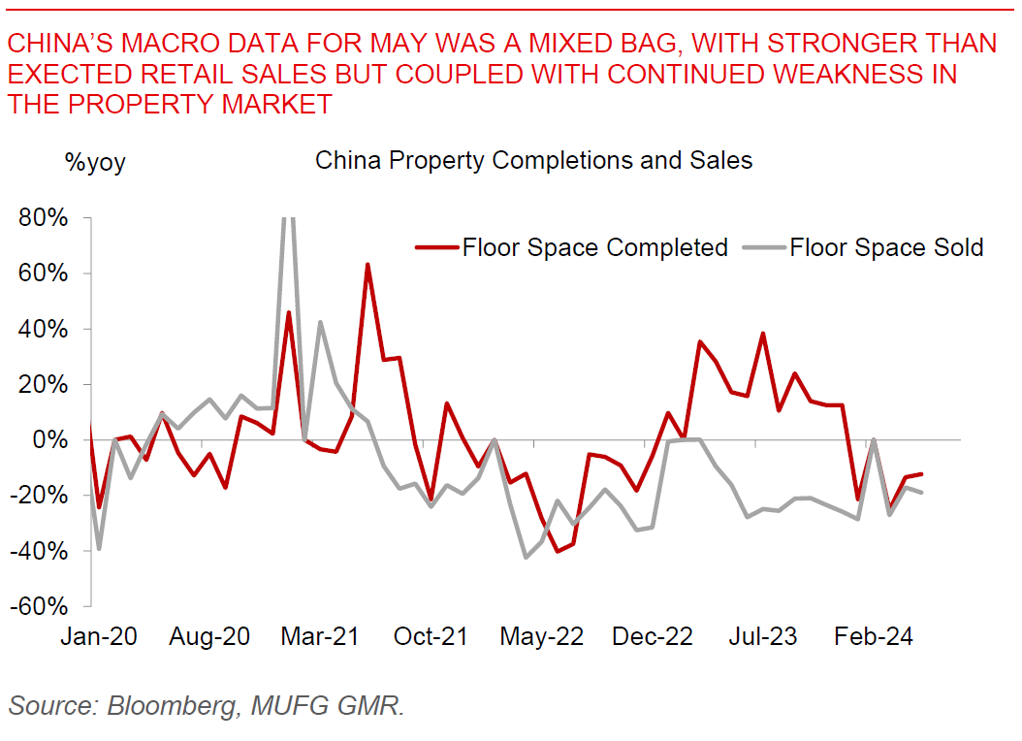

Meanwhile, China’s May activity data delivered a mixed bag, with industrial production and fixed assets investment missing expectations, although this was coupled with better than expected retail sales growth of 3.7%yoy. The property indicators for May were also weak, with new and used home prices declining further by 0.7% and 1%mom, coupled with a 31%yoy decline in residential property sales. Overall, these numbers suggest that further stimulus policies including on the property sector are likely needed, and markets will watch closely for the upcoming Third Plenum in July coupled with the Politburo meeting held at the end of the month for further clues.

Regional FX

Regional FX

Asian FX markets were slightly stronger on the back of a weaker Dollar and better risk sentiment, although weighed down by the mixed China macro data, with KRW (+0.14%), SGD (+0.1%) and MYR (+0.1%) strengthening. The biggest idiosyncratic development came out of Indonesia heading into the weekend, with USD/IDR breaking closer to the 16,400 level. Markets were concerned about fiscal plans proposed by incoming President Prabowo to raise the government debt level to 50% of GDP from 39% in 2023, although we note that Prabowo’s expansionary fiscal plan is not entirely new to markets (see USD/IDR – Markets continue to test BI’s resolve). We have become more cautious on the Rupiah and have revised up our USDIDR forecast to 16,420 in 3Q from 15,900 previously, and to 16,360 in 4Q from 15,700 previously. We see a good chance of Bank Indonesia hiking rates again in its 20 June meeting, especially if the Rupiah falls further to 16,450 in the coming week. Meanwhile, former Thai Prime Minister Thaksin Shinawatra is set to be formally indicted in a royal defamation charge today, even as the Constitutional Court weighs a petition to disqualify current Prime Minister Srettha Thavisin. These political developments and uncertainty have weighed on THB in the near-term, and leading to continued weakness in Thai risk assets and equity markets.