Ahead Today

G3: US New Home Sales

Asia: China Industrial Profits, Thailand Trade

Market Highlights

The US S&P PMIs for November were mixed, with the Manufacturing PMI disappointing consensus at 49.4 (down from 50 previously), but with the Services Component stronger than expected at 50.8 (vs 50.6 previously). Meanwhile across the Atlantic, economic activity in Germany remained weak, with IFO expectations inching up slightly, while the final estimates for 3Q GDP contracting 0.1% qoq. The recent news from Germany it plans to suspend its constitutional debt brake for a fourth consecutive year underlines the lack of fiscal space Germany will have going forward, and presents some downside risk to growth.

Overall, market movements were relatively muted over the US holidays, with the Dollar weakening by 0.14%, and US 10-year yields rising to 4.46%.

Regional FX

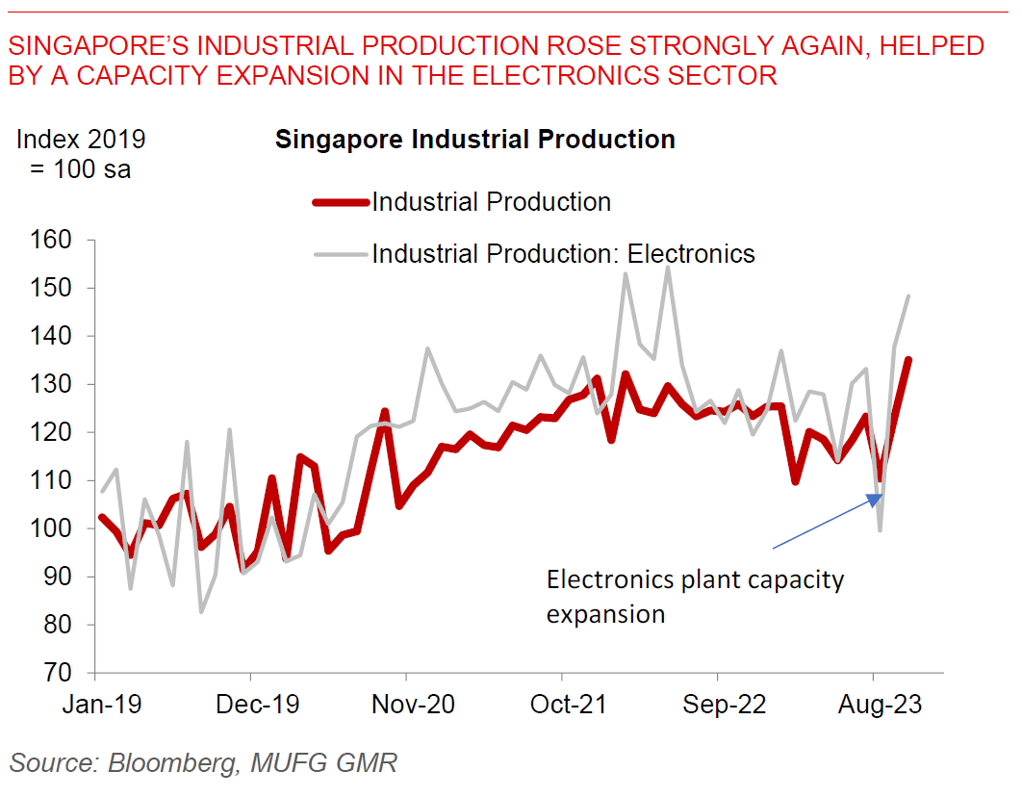

Asian FX pairs were generally stronger against the Dollar on back of a weaker USD. Chinese authorities said they opened investigations into the money management business of Zhongzhi Enterprises, even as the privately owned wealth manager said it is severely insolvent. Meanwhile, China may allow banks to offer unsecured short-term loans to qualified developers for the first time, according to Bloomberg News. Singapore released industrial production data which rose strongly again by 9.8%mom sa in October, from a 10.7% mom sa rise previously. We think part of this boost was probably due to a capacity expansion by a new semiconductor plant by GlobalFoundries, but more broadly, does point to regional export and manufacturing improvements across Asia.