Ahead Today

G3: US PPI

Asia: Taiwan Elections, China CPI, China PPI, China Trade

Market Highlights

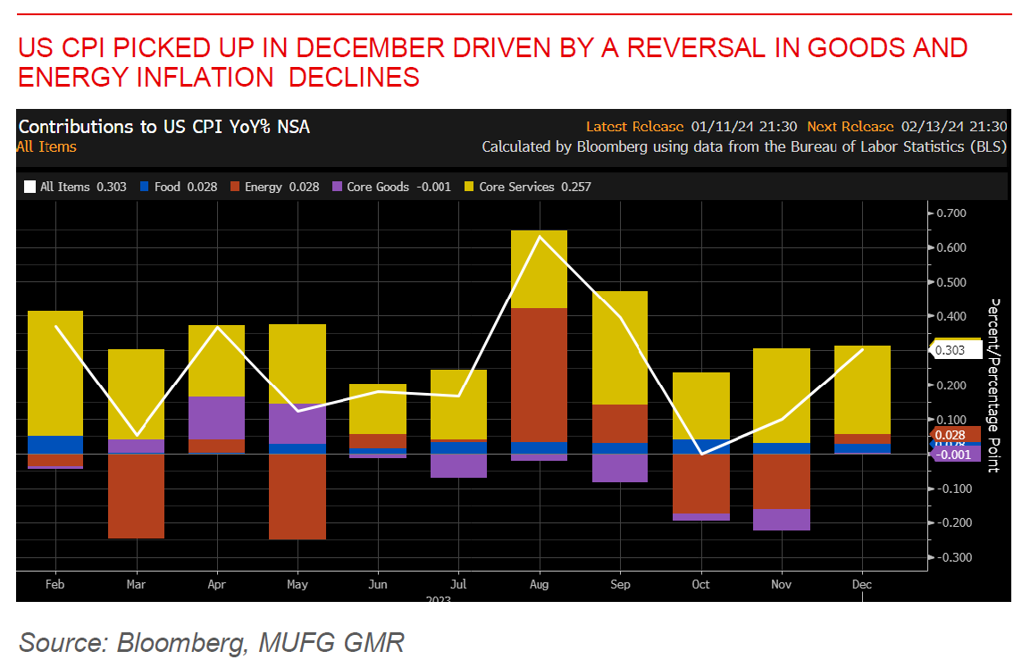

US December CPI inflation came in a touch higher than expected at 0.3%mom for both the headline and core measure. The details showed a bounce in core goods inflation, driven up by surprisingly strong new and used car price increases. Meanwhile, services inflation was boosted by a pickup in medical care services and still sticky rents as measured in CPI.

The market initially reacted with higher US yields and stronger Dollar, but these moves faded as the day went by. We see two possible reasons for the move. First, some of the gains in core goods inflation such as car prices are likely to reverse based on high frequency indicators. Second, latest indications point to a soft core PCE inflation print – the measure the Fed ultimately looks at – and assuming the PPI measure coming today remains contained.

Taiwan will hold its elections over the weekend. Markets will likely focus on the extent of victory of the new President, the degree of power sharing needed in the Legislative Yuan between different parties, coupled with comments from the new President especially on China relations. Ahead of Taiwan’s elections, China’s President Xi Jinping said China wants to work with the US to improve ties.

Regional FX

Asian FX were mixed against the Dollar, with VND (-0.4%) and TWD underperforming (-0.25%), while KRW outperforming (+0.3%), and USDCNH at 7.16, even as the Dollar was overall weaker. The Bank of Korea kept its policy rates on hold at 3.5%, but in its statement, dropped language that said “it will judge the need to raise the base rate further”. Nonetheless, BOK Governor Rhee Chang-yong pushed back against market expectations of rate cuts, saying that cutting rates over the next six months will not be easy. In recent weeks, concerns have risen in South Korea around financial stability and possible knock-on impact from the country’s property and project finance sector, with Taeyoung Engineering starting debt restructuring talks.