Ahead Today

G3: University of Michigan sentiment index

Asia: Singapore industrial production, Thailand foreign reserves

Market Highlights

There are mixed signals about whether there have been some talks about trade between US and China. President Trump has said his administration was engaging with China, after China denied that a talk took place and demanded the US to unilaterally remove all tariffs. Beijing has said it requires the US to show more respect, name a point person for dialogue, have a more consistent US position, among others, before agreeing to trade negotiations.

Meanwhile, the Fed’s beige book has said that trade uncertainty has been elevated, but economic activity has so far been little changed. Tariffs were mentioned 107 times, doubled that seen in the prior beige book. Variations of the word “uncertain” was also used 89 times. President Trump’s tariff plans have been quite volatile, creating huge uncertainty for both businesses and consumers globally. Also, based on the latest AmCham Singapore survey in April, slightly more than half of respondents selected “others” when asked about mitigation strategies, reflecting that firms may be holding off major decisions until there is greater clarity about US trade policy, while a smaller portion of respondents have thought about diversifying their business in response to tariffs. Several central banks, including the ECB and BOE, have warned about uncertainty that’s going to hurt businesses and consumers going forward.

In terms of the latest Fed speak, Fed’s Waller has said he would support rate cuts should there be a significant deterioration in the labour market. Fed’s Hammack has ruled out a May rate cut but said the Fed could cut as early as June if there’s clear evidence of where the economy is heading.

Regional FX

Trump-inspired respite for the US dollar appears to be short-lived, with the broad US dollar index (DXY) falling 0.5% in Thursday’s session. Asian FX performance was mixed. MYR (+0.4%) and SGD (+0.3%) gained against the US dollar, while the KRW fell 0.4%. It is still early to determine if the DXY has reached a bottom, despite Trump’s recent softening in tone on Fed Chair Powell and the trade war with China. With the US dollar under pressure, this could still provide some reprieve for several Asian currencies.

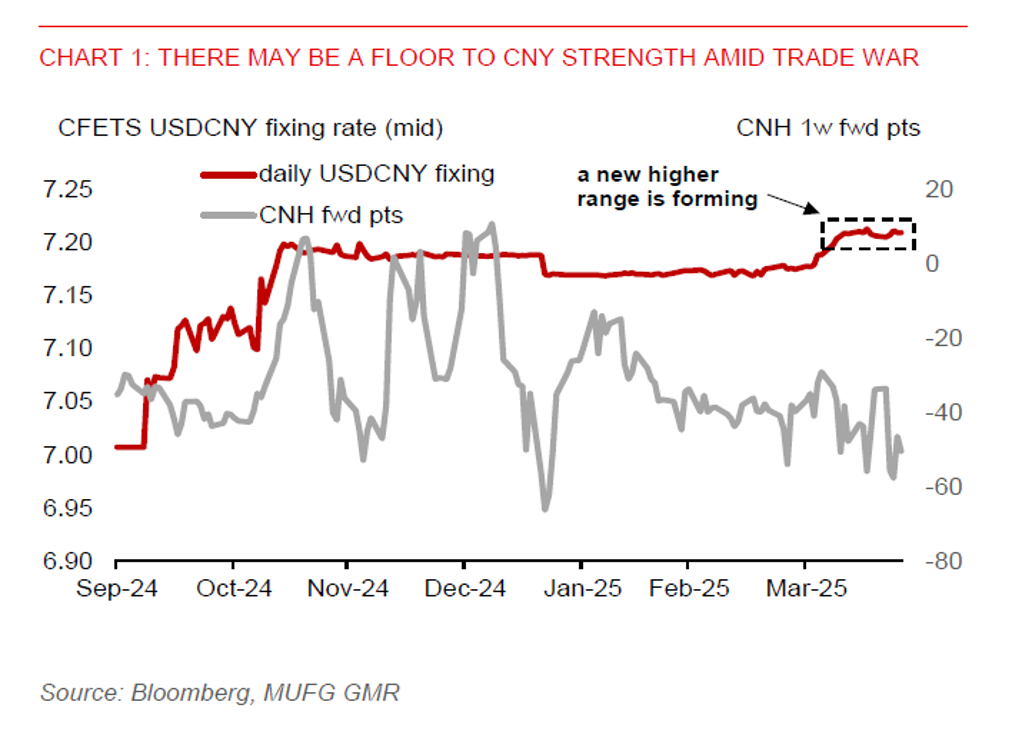

Nonetheless, the trade war and US policy related uncertainty have persisted. Asian economies still face the risk of higher reciprocal tariffs. Even if tariffs on imports from China are reduced from the current 145%, they will likely remain high. With the PBOC continuing to set a daily USDCNY fixing rate at above 7.2000-level, there may be a floor to CNY strength. Short-term offshore funding costs are also at a recent low. Export oriented Asian currencies also face downside risk.