Ahead Today

G3: Germany Factory Orders, Eurozone Retail Sales, Eurozone Consumer Confidence

Asia: Vietnam Domestic Vehicle Sales

Market Highlights

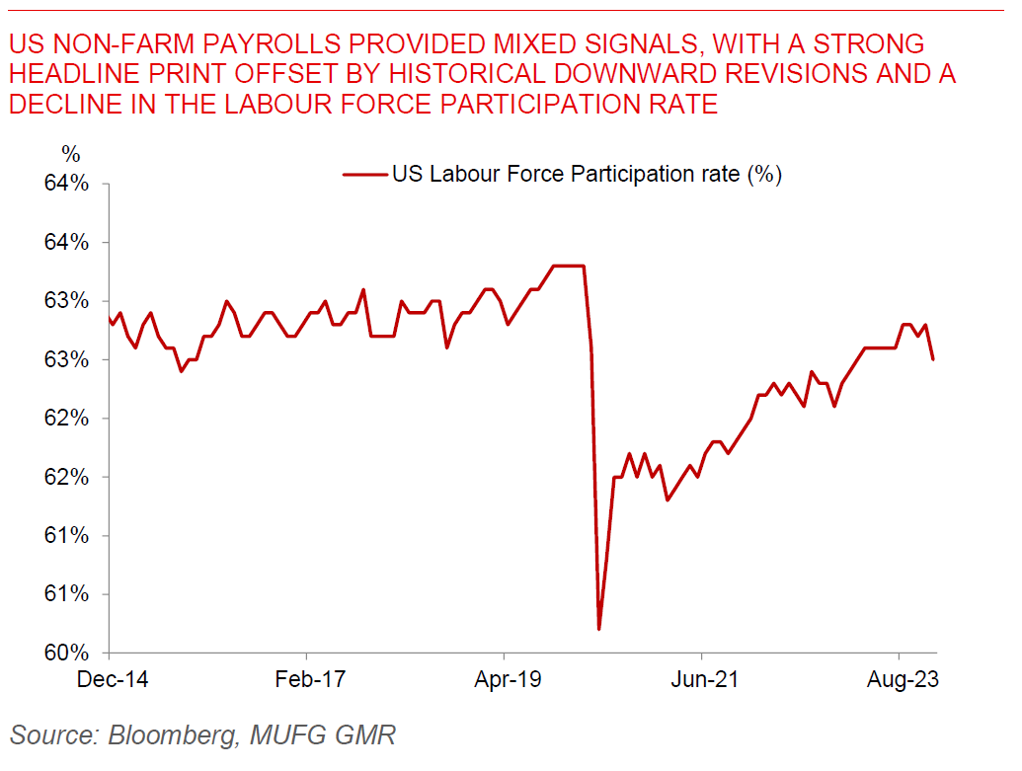

US non-farm payrolls provided mixed signals to the markets. The headline print NFP print was strong at 216k (vs consensus for a 175k rise), wage growth rose more than anticipated at 4.1%yoy, while labour force participation rates fell to 62.5% indicating some stalling increased labour supply. Nonetheless, this also came with a downward revision to historical numbers of 71k, together with a sharp decline in estimated employment proxied in the household survey.

While US yields and the Dollar rose initially on the non-farm payroll print, the mixed signals combined with a sharp drop in the ISM Services Employment component resulted in some reversal in market sentiment through the day. Meanwhile, Dallas Fed President Lorie Logan said it is now appropriate to begin discussing the factors driving slowing the pace of balance sheet reduction, and favouring a slower pace of balance sheet reduction.

Looking ahead, markets will focus on Eurozone consumer confidence today, together with US and China CPI estimates for the upcoming week

Regional FX

Asian FX were mixed with THB underperforming (-0.1%), and INR outperforming (+0.15%). India’s advance FY2023/2024 GDP came in stronger than expected at 7.3%, helped by strong investment activity, while the India Services PMI also rose further, offsetting the recent moderation in manufacturing PMI. Overall, portfolio flows into India have been strong heading into the start of the year, but RBI’s FX intervention have also been equally strong, leading to continued low volatility in USDINR. Meanwhile, inflation in the Philippines moderated slightly more than expected to 3.9%yoy, down from 4.1%yoy. Post the inflation print, the BSP said that it will keep monetary policy sufficiently tight until a sustained downward trend in inflation becomes evident. Nonetheless, Governor Remolona also signalled less FX intervention, while also ensuring no unnecessary monetary policy tightening.