Ahead Today

G3: US: Q2 GDP, personal consumption, durable goods orders, initial jobless claims, Fed Chair Powell speech

Asia: Singapore industrial production, HK trade

Market Highlights

The DXY US dollar rose 0.4% on Wednesday’s session to recapture the 100.50 key support level. US treasury yields also rose yesterday, with the 10-year yield notably rising more than the 2-year, resulting in a wider negative spread between the 2-10 yields. US dollar strength was broad based, with gains seen against the EUR (+0.4%), JPY (+1.1%), GBP (+0.7%), CAD (+0.4%), SEK (+0.8%), and CHF (+0.8%).

With the Fed set to bring policy rates much lower through 2025, any US dollar rebound could still prove to be short-lived. Meanwhile, the 30-year mortgage rate has declined to 6.1% from around 7% in mid-2024, spurring a nascent pickup in mortgage applications. Overall mortgage applications increased 14% as of 20 September compared to a week ago, marking the fifth straight weekly gains.

The key economic data highlights for the US today include third estimates for Q2 GDP, personal consumption, durable goods orders, initial jobless claims, and pending home sales. Bloomberg consensus is for US GDP to grow 3%qoq annualized in Q2, reflecting resilience in the US economy. However, a weaker than expected US Conference Board consumer confidence reading, along with a cooling labour market, are a growing concern among policymakers and investors. Markets are now pricing in a 59% chance of another jumbo 50bps Fed rate cut in the November FOMC meeting.

Regional FX

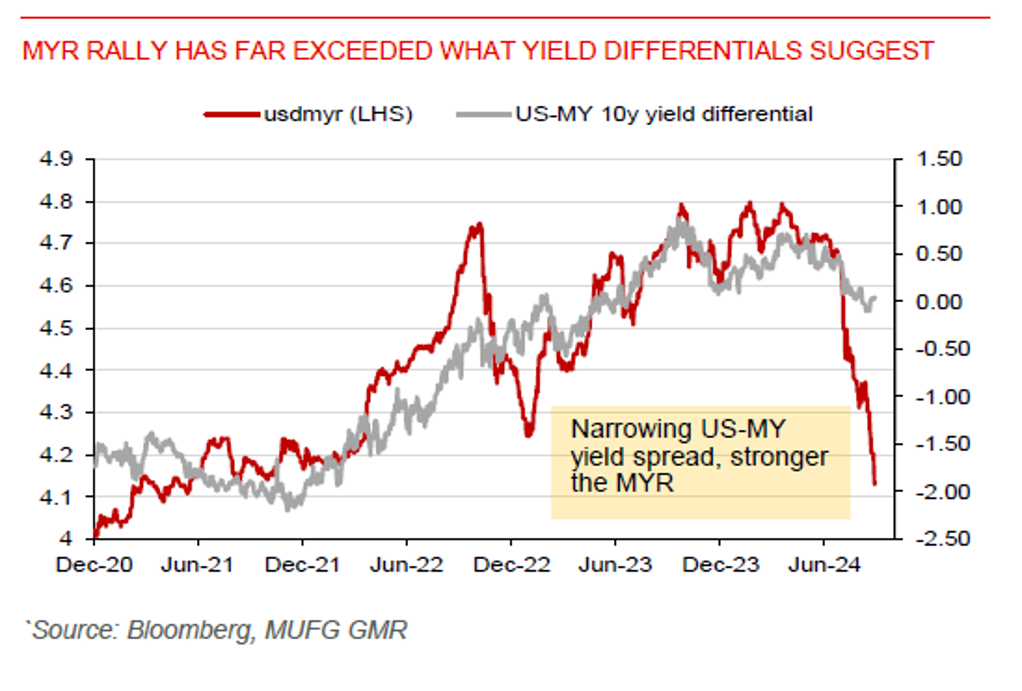

Many Asia ex-Japan currencies have extended their gains against the US dollar on Wednesday’s session, despite the pickup in broad US dollar strength. MYR (+0.7%), PHP (+0.7%), and IDR (+0.6%) led gains in the region yesterday. But KRW and SGD weakened against the US dollar. Meanwhile, China’s huge monetary policy easing surprise, including a 30bps cut to the 1y MLF rate, led to USDCNH briefly breaking the psychological 7-handle in early hours of trading yesterday, before reversing to stay above CNY7/USD. We think the outlook for Asian currencies remains positive, driven by a confluence of positive global and regional developments. Moreover, Taiwan’s industrial production accelerated to 13.4%yoy in August from 12.3% in July, beating market expectation for a 9.4% rise. However, given recent sharp gains in the MYR and THB, they could take a breather.