Ahead Today

G3: FOMC meeting

Asia: China loan prime rates, Bank Indonesia policy meeting, Taiwan export orders

Market Highlights

As we had expected, the BOJ exited its negative interest rate policy of -0.1% yesterday and guided for the unsecured call rate to be at 0%-0.1%. Still, monetary policy conditions in Japan remain very accommodative. There aren’t any hints from the BOJ of more rate increases ahead either. Also, the BoJ ended its yield curve control (YCC) but pledged to buy long term government bonds at “roughly the same pace as before”. We see no catalyst for sustained JPY strength versus the US dollar until the US Fed cuts rates. USDJPY has traded above 150 following the BOJ policy decision.

Markets now turn their focus to the upcoming FOMC meeting, where Fed officials will update their quarterly economic outlook and dot plot chart. We think the US Fed will keep its policy rate unchanged, while the updated dot plot could show a less dovish Fed. US core inflation has been sticky, labour market still resilient, while housing starts bounced back sharply in February. Markets are now pricing less than 3 US rate cuts this year as well as a higher probability that the first cut will come in September.

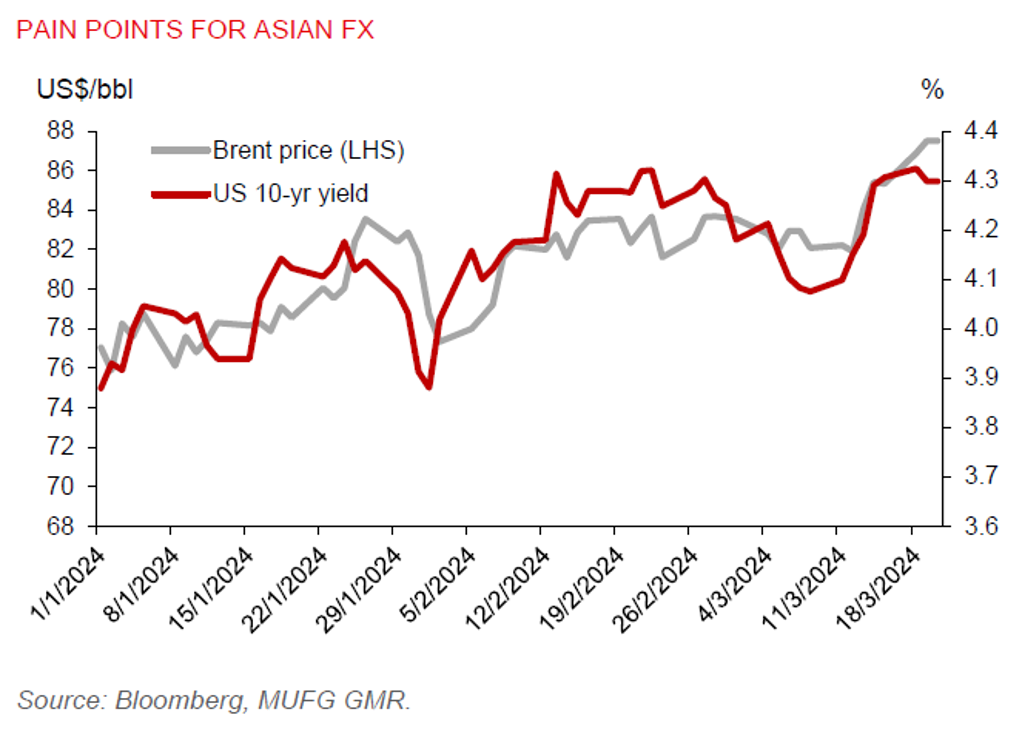

Oil prices have also pushed above US$87/bbl amid a tighter market, OPEC+ production cuts until June, and Ukraine’s attacks against major Russian refineries.

Regional FX

Asian currencies weakened versus the US dollar amid broad US dollar strength, with KRW (-0.5%), MYR (-0.4%), PHP (-0.7%) underperforming regional peers. USDCNH pair has also continued to drift higher since last week, trading above the 7.21 level and weighing particularly on the KRW, TWD, THB, and MYR.

Today, the PBOC will announce its decision on the 1-year and 5-year loan prime rates. With yuan loans stock growing in February at the slowest pace (of 9.7%y/y) since 2003, we think there is scope for a lower 1-year loan prime rate. Market consensus is for the PBOC to stand pat. Bank Indonesia will also be announcing its policy rate decision later today. We expect BI to keep policy rates unchanged at 6%. BI rate cut is not likely for now as the Fed is taking a cautious approach to cutting rates.