Ahead Today

G3: Eurozone CPI, US Housing starts

Asia: Malaysia Trade, Philippines Balance of Payments

Market Highlights

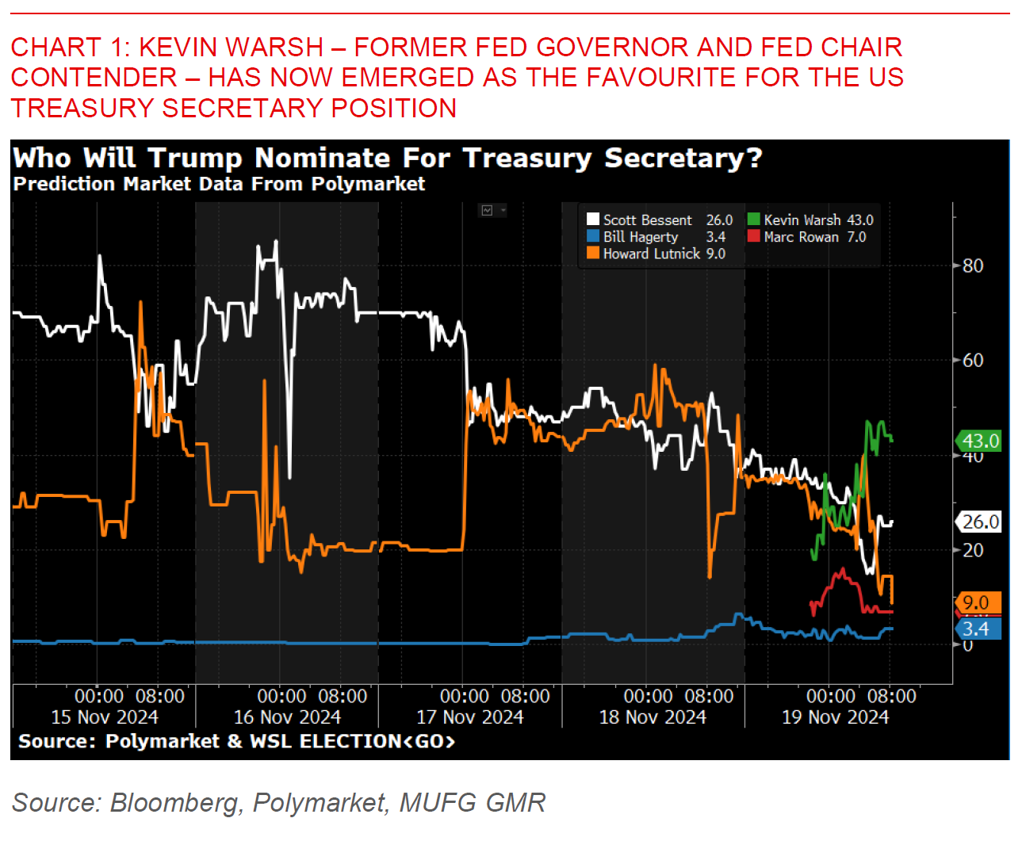

The Dollar weakened overnight, as better risk sentiment in equity markets coupled with a stall in US yields helped. With nothing clearly obvious in the macro data, what contributed to this was probably continuing developments in the US Treasury Secretary appointment. Latest news suggests that Trump might be considering to tap Kevin Warsh – a former Fed Governor and previously candidate for Fed Chair – in the Treasury Secretary role, with hedge fund manager Scott Bessent as director of the White House’s National Economic Council. If this is right, the market likely views this as being reasonably friendly for risk sentiment, even as the broad strategy of raising tariffs is unlikely to change under the Trump 2.0 administration.

Meanwhile, the Japanese Yen underperformed among key currency pairs, as Bank of Japan Governor Kazuo Ueda avoided giving a clear hint that he will raise interest rates at a December meeting at a closely watched speech given in Nagoya. He said that the timing of adjustments will continue to depend on “developments in economic activity and prices as well as financial conditions going forward”. USD/JPY rose to as high as 155.20 before coming down towards 154.39 on the broader Dollar move

Regional FX

Asian currencies were stronger with the weaker Dollar, with THB (+0.9%), KRW (+0.4%), and SGD (+0.2%) underperforming, while USDCNH fell to 7.229. Thailand’s 3Q GDP surprised on the upside at 3%yoy from 2.2%yoy the previous quarter. This was stronger than the consensus expectations of 2.4%yoy but in line with our own expectations. The strong GDP print could also be one reason why THB performed quite well yesterday. Looking at the details, a pickup in government spending and also investment activity including through the public sector helped boost economic activity, and this is in line with our view that better fiscal disbursement should help the Thai economy. Further disbursement and plans on the digital wallet cash handout program should boost growth in 4Q and beyond, even as the imposition of US tariffs are likely to weigh on Thailand’s export growth.

Meanwhile, Reuters reported that RBI Governor Das’ term is likely to be extended when it comes due on 10 December possibly for an additional year. This should provide some stability and clarity to markets at a time when significant changes in the RBI Monetary Policy Committee are already in the pipeline, with recent changes in 3 external members and a change in Deputy Governor Michael Patra in January 2025. The policy leanings of the new external MPC members are still being discovered, but given Deputy Governor Patra's generally hawkish stance, a change there in January could ultimately imply a slightly more dovish MPC net-net for 2025. We think RBI should cut rates by around 50bps this cycle, although recent spikes in vegetable prices likely delays the timing somewhat. With Governor Das still helming the MPC at least for one more year (if this news is right), RBI's aggressive FX intervention should still continue for the time being implying USD/INR vol should still be capped