Ahead Today

G3: US: nonfarm payroll, unemployment rate, average hourly earnings

Asia: Philippines inflation, Singapore retail sales, Thailand international reserves

Market Highlights

The US dollar index extended its gains by 0.3% to 102.00 on Thursday’s session, underpinned by broad-based weakness across other G10 currencies and safe haven flows due to rising Middle East tensions. GBP led G10 FX losses against the US dollar after Bank of England Governor Andrew Bailey said the central bank may accelerate policy easing if inflation remains contained. USDJPY also extended gains as markets pared back expectations for a third BoJ rate hike in December.

Meanwhile, the latest set of US macro data points to economic resilience. US initial jobless claims remained historically low at 225k in the week ending 28 September, albeit higher than the 218k in the prior week and Bloomberg consensus for 221k. The ISM services index jumped to 54.9 in September, from 51.5 in August and beating Bloomberg consensus for 51.7. Services new orders surged to 59.4 vs. 53.0 in August and beating market expectation for 52.5. But ISM services employment fell to 48.1 (<50 indicates contraction) in September, from 50.2 in August. Overall, with the services sector holding up well, this should help offset manufacturing headwinds keeping the US economy resilient.

A key macro data highlight for the US today will be the nonfarm payroll and unemployment rate. A stronger than expected JOLTS jobs opening in August and ADP employment data for September suggest reduced downside risks to the Fed’s employment mandate.

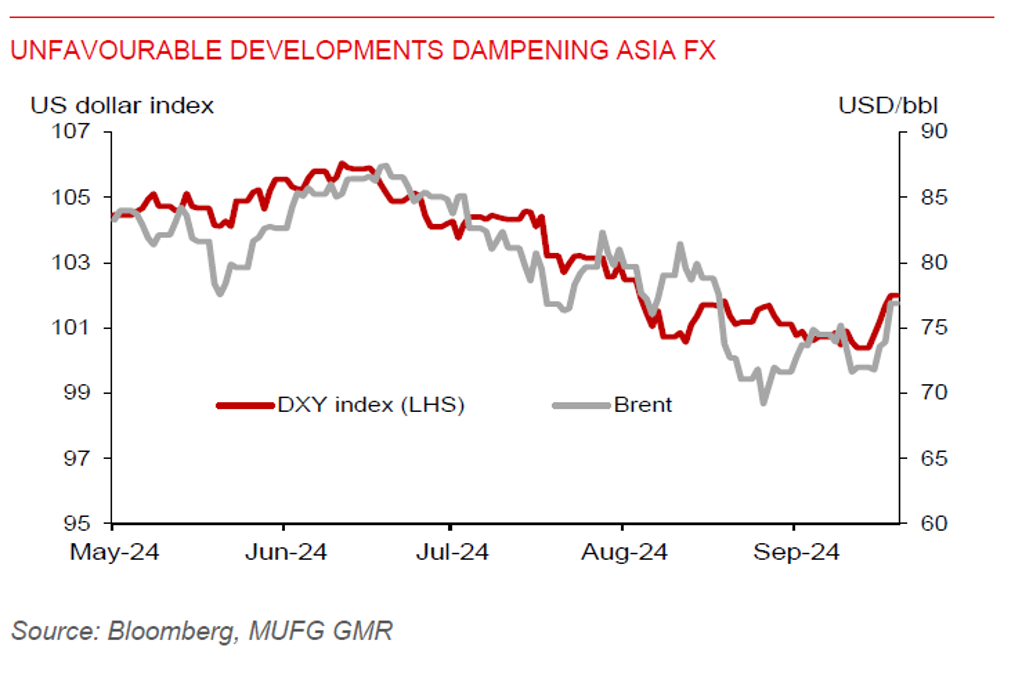

Regional FX

Asia ex-Japan currencies extended their weakness against the US dollar on Thursday’s session. MYR (-1.1%), IDR (-1%), and THB (-1%) led losses in the region, with heightened geopolitical tensions in the Middle East dominating market sentiment for now. The risk is that a major retaliatory strike by Israel on Iran’s oil exporting facilities would severely disrupt global oil supplies, pushing up oil prices sharply. This would hurt many Asian economies, given their high reliance on oil imports. Also, higher oil prices could slow or stall Fed rate cuts, putting renewed downward pressures on Asian currencies.