Ahead Today

G3: US nonfarm payrolls, unemployment rate, hourly earnings, University of Michigan sentiment; Germany industrial production

Asia: Indonesia foreign reserves, Malaysia industrial production, RBI policy rate decision, Taiwan CPI and exports

Market Highlights

US treasury yields nudged marginally higher across the curve, while the broad US dollar index (DXY) gained 0.1% in Thursday’s session. This follows from a 1.3% decline over the prior two days, Treasury Secretary Scott Bessent has said that the Trump administration plans to lower the US 10-year yield. Bessent believes this can be achieved through increasing energy supply, which will translate to lower energy prices. Inflation could be contained in this way, bringing long-term yields lower. Bessent has also clarified that Trump wants lower long-term yields, rather than pressuring the Fed to cut rates.

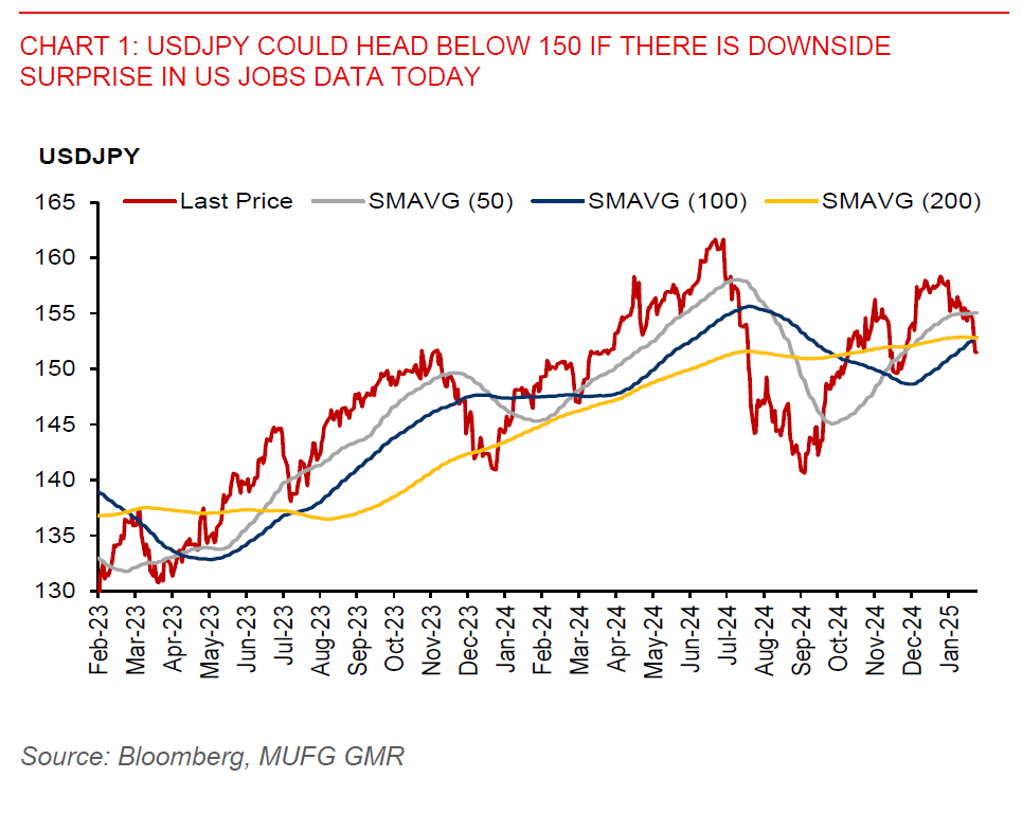

However, we are not expecting a sharp imminent fall in the US dollar. The US labour market is still holding up well. While initial jobless claims rose to 219k in the week ending 1 February, from a slight upward revised 208k in the prior week, they were still at relatively low levels. The jobs data for January, to be released today, could also show nonfarm payrolls still growing at a healthy pace, despite moderating from a 256k increase in December. Global trade uncertainty has also persisted, with an ongoing review by US authorities of existing trade relationships with trading partners likely to conclude by 1 April.

Meanwhile, GBPUSD fell 0.6% to 1.2435, following the Bank of England cutting interest rates by 25bps to 4.50%. Two policymakers with a hawkish voice had advocated a larger 50bps cut at today’s meeting. The BOE has also signalled for future rate cuts amid slower economic growth. However, USDJPY has fallen by 0.9% to below the 152.00-level, dragging on the broad US dollar index. Former BoJ Governor Haruhiko Kuroda has commented that deflation has ended, and that the BOJ will likely continue to raise rates. Moreover, Japan’s CPI ex-fresh foods has stayed above the 2% inflation target. One of the most hawkish voices sitting on the BoJ’s board has also said the policy rate should double to 1% by early 2026.

Regional FX

Asia ex-Japan currencies have pared back some recent gains against the US dollar. Notably, THB (-0.6%) and VND (-0.4%) led losses in the region in Thursday’s session.

Thailand’s headline inflation rose 1.3%yoy in January, in line with market expectations. CPI inflation also came within the Bank of Thailand’s 1%-3% target for the second straight month, driven by higher fuel prices resulting from a low base from a year ago. This, along with a likely pickup in economic activity in Q4, should allow BoT to keep the policy rate on hold at 2.25% at the 26 February monetary policy meeting.

Meanwhile, Indian rupee has weakened further to INR87.58/USD on market expectations for RBI policy easing. Markets expect RBI to cut the policy rate by 25bps in today’s policy meeting, amid cooling inflation and slowing growth.