Ahead Today

G3: US initial jobless claims and housing starts; eurozone consumer confidence

Asia: Policy rate decisions from China and Indonesia, Malaysia trade, and Taiwan export orders

Market Highlights

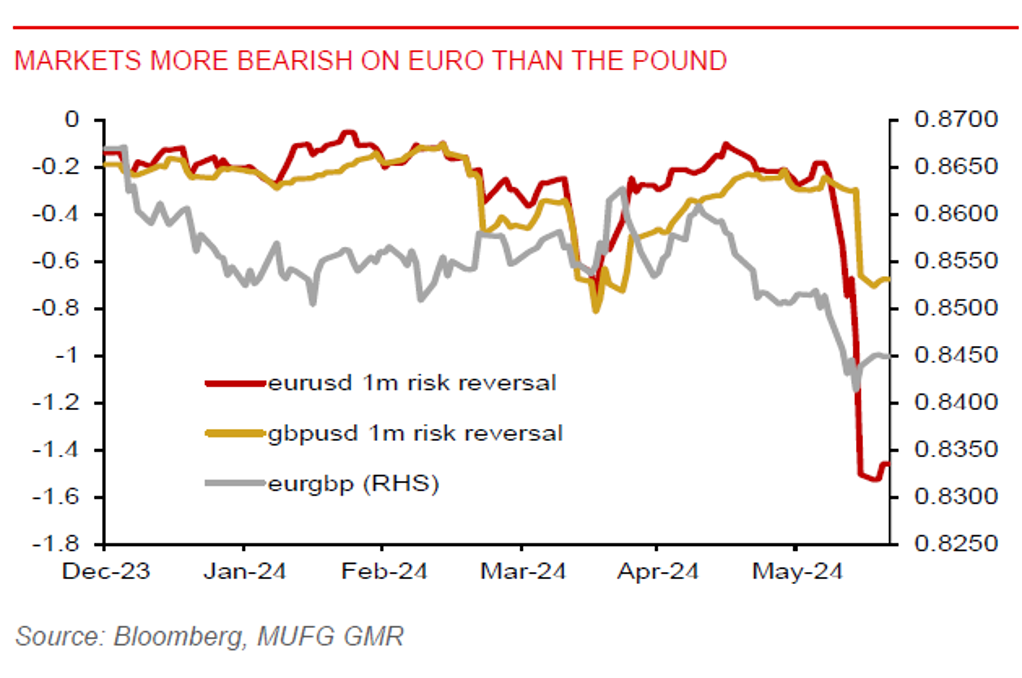

Both France and the UK face election uncertainty but the market impact appears to diverge. Market sentiment has turned more bearish on the euro. This is the most since 2022 when the euro dropped below parity against the US dollar. FX positioning has turned net short on the euro, while the CAC 40 index has broken the 200-day moving average. In a latest opinion survey by Ifop on 17 June, it showed Le Pen’s National Rally would garner one-third voter support in the first legislative election round on 30 June, a left-wing alliance called New Popular Front would get 26.3%, while President Macron’s Renaissance Party would come in third on 18%. Macron still has about 3 years left in his second presidential term, while a victory for Le Pen’s party in the 577-seats lower house of parliament that falls short of an outright majority would lead to a hung parliament, making legislation difficult to pass. Moreover, there is risk to the fiscal outlook under Le Pen’s party, with the first measure possibly a sales tax cut on energy.

By comparison, markets have been anticipating a UK election and have set the base case on the Labour Party winning a parliamentary majority, which the polls are currently also predicting. The pound has not changed much since PM Sunak called for the election on 22 May. Meanwhile, UK inflation returned to its 2% target in May, but services inflation was still running hot at 5.7%yoy. This, along with an upcoming election, will likely lead to the BOE holding off a rate cut this month.

Regional FX

The key highlights for Asia today are the policy rate decisions from China and Indonesia. The PBOC is likely to keep its 1y and 5y loan prime rates unchanged, after leaving its 1y medium-term lending facility (MLF) unchanged at 2.50% earlier to avoid causing significant weakness in the CNH. But PBOC governor Pan has signaled that there will be room for easing as several major central banks have started their rate cutting cycle. Moreover, China’s property sector investment has worsened to -10.1%yoy YTD in May from -9.8%yoy YTD in April, dragging on urban fixed asset investment. The central bank is also considering adding government bond trading to its monetary policy toolkit, stressing this is aimed at ensuring market liquidity and not quantitative easing. USDCNH has moved towards 7.2800, and momentum continues to favour continued CNH weakness.

Bank Indonesia will meet later today. We maintain our view that BI will keep its policy rate unchanged at 6.25%. The recent underperformance of the Indonesian rupiah (which has fallen to a 4y low) has increased the risk of a BI rate hike. However, the rupiah has yet to weaken past 16,450 per US dollar at the time of writing, a threshold that we deem will have made it likely for a policy rate hike at this meeting. USDIDR fell 0.2% to 16365 after Indonesian markets reopened yesterday following a public holiday.