Ahead Today

G3: US durable goods orders, University of Michigan sentiment, Fed’s Waller on neutral rate, Germany final Q1 GDP

Asia: Singapore industrial production, Thailand gross FX reserves, Malaysia inflation

Market Highlights

Latest US macro data suggests the US economy has stayed resilient. Initial jobless claims fell to 215k last week vs 222k prior and 220k expected, confirming a still resilient US labour market. US composite PMI rose to 54.4 from 51.3 prior and 51.2 expected. The services PMI was 54.8 in May vs. 51.3 prior. Factory activity has also continued to expand, with the manufacturing PMI rising to 50.9 in May from 50. Along with sticky US core services inflation and hawkish Fed minutes, the Fed likely won’t be cutting rates anytime soon.

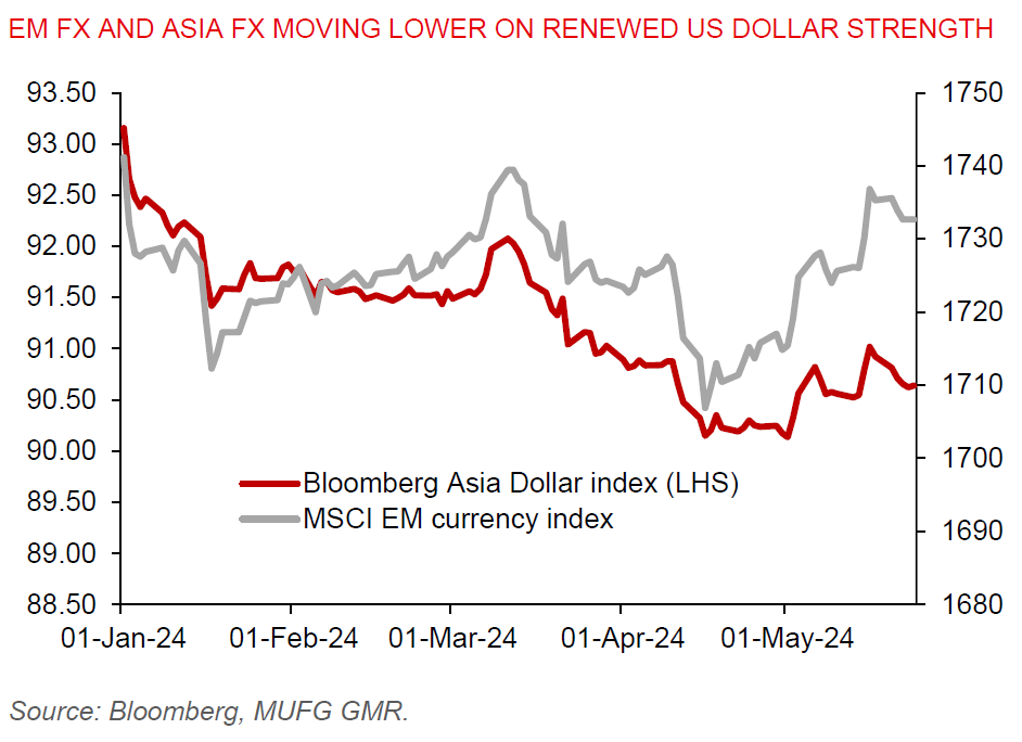

The DXY USD index has continued to march higher, recovering its post-US CPI losses to trade above the 105 level. The emerging market currency index sold off, while the Dow Jones Industrial Average Index retreated from the 40,000 level.

Meanwhile, the Eurozone composite PMI rose to 52.3 in May vs. 51.7 prior and 52.0 expected. This marks the third straight month of expansion and the highest level since a year ago, suggesting a brighter economic outlook for the eurozone ahead. Services activity expanded, while factory activity saw a smaller contraction, with the manufacturing PMI rising to 47.4 in May vs. 45.7 prior and 46.1 expected.

Regional FX

Asia FX weakened against the US dollar yesterday on the back of a renewed pickup in US dollar strength. USDCNH inched towards the 7.2600 level, while the THB underperformed with a 0.6% fall. Indonesia’s markets were closed yesterday for a public holiday. THB was partly negatively impacted by domestic political woes, with Thailand’s Constitutional Court accepting a petition from senators looking to relief PM Srettha from his duty. Meanwhile, Singapore’s Q1 GDP growth cooled sequentially to 0.1%qoq vs. 1.2% prior, though leading indicators suggest growth will improve in the coming quarters. Singapore’s core inflation remained sticky at 3.1%yoy in April, which should thus keep MAS on hold in July’s policy meeting (see Singapore GDP: Growth to gather steam following a flattish Q1).