Ahead Today

G3: US Dallas Fed Manufacturing Activity

Asia: Thailand Trade

Market Highlights

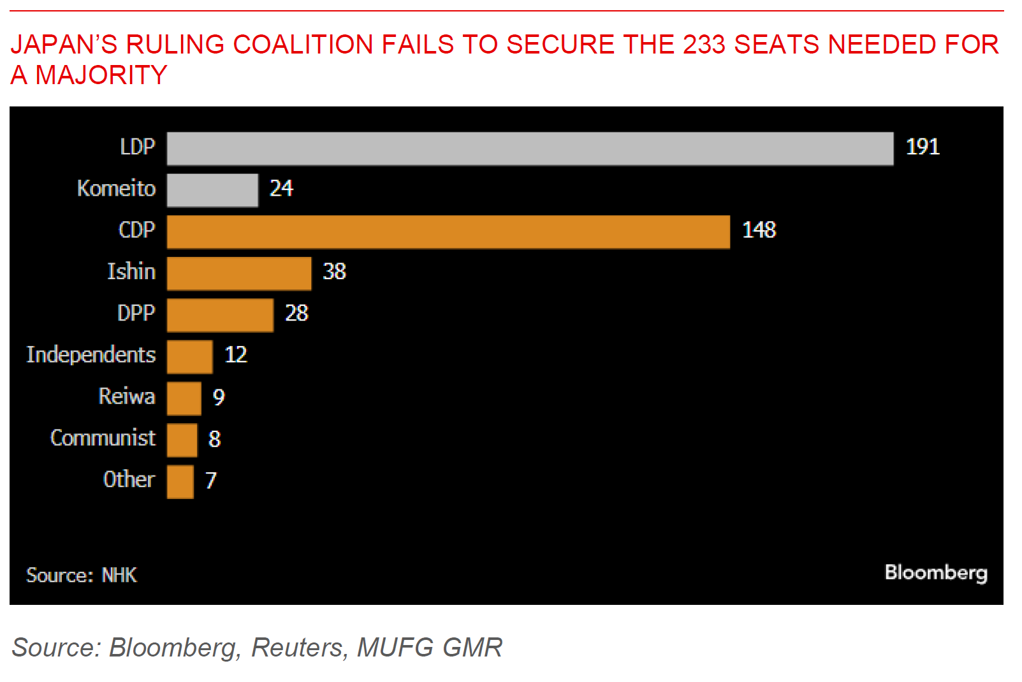

The Japanese Yen weakened while oil prices fell sharply to start the week, with increased political uncertainty in Japan after the Lower House Elections together with a somewhat modest military response by Israel which avoided oil-related assets in Iran. In the Japan Elections, the incumbent LDP-Komeito coalition combined for 215 seats (191 for LDP and 24 for Komeito), short of the 233 seats needed for a majority in the Lower House, according to a tally by public broadcaster NHK. The main opposition Constitutional Democratic Party of Japan (CDPJ) secured 148 seats, up from its pre-election count of 98, while the Democratic Party for the People (DPFP) won 28 seats, up from 7 seats previously.

The path ahead from here in terms of forming a government in Japan is uncertain. The leaders of key opposition parties CDP, DPFP and Ishin have said before the Lower House elections that they will not be interested in joining a LDP-Komeito coalition, although DPFP leader Tamaki Yuichiro suggested that cooperation on an issue-by-issue basis is possible. Some political analysts suggest that a LDP-Komeito minority government is the most likely outcome but would certainly not be the most stable in terms of governance and vulnerable to intra-LDP conflict (see link here to Observing Japan post). A coalition between LDP-Komeito with opposition Ishin and/or DPFP remains open and subject to negotiations in the coming days but would need a change in thinking among these key opposition parties in terms of support for LDP.

Our G10 FX team does not expect major changes in the economic policy framework in Japan after the election (see link here), but uncertainty around whether Ishiba can continue as Prime Minister and also the formation of the next government in Japan will likely keep some weakening pressure in JPY in the near-term. The Bank of Japan’s meeting later this week will also be closely scrutinized to see if there is any indication of another rate hike later this year given JPY weakness, even as BOJ Governor Ueda is likely to reiterate that they have some time to assess whether to hike rates further.

Regional FX

Asian FX markets were weaker on the back of a stronger Dollar and weaker JPY, with USDCNH rising to 7.1435, while MYR and SGD both softening by around 0.2%. Israel’s attack on Iran on Saturday was limited to missile and air defense sites, and was more restrained than many expected and raises some hopes that this may help diplomatic efforts to return hostages and limit further escalation across the region. Oil prices fell on the back of these developments. Meanwhile, China announced that the National People’s Standing Committee (NPSC) meeting will take place from 4 November to 8 November, and presumably to take the results of the US elections into account. The fiscal deficit approval will have to go through the legal process in this meeting, while Vice Finance Minister Liao Min said that the size of this round of policies will be of “quite large scale” and centered around lifting domestic demand including consumption. Philippines central bank governor Eli Remolona said that the Philippines peso may again hit its record low of 59 against the dollar “over time” if geopolitical worries and risks related to the US election do not dissipate. It’s interesting that the BSP Governor said that the central bank remains on course to gradually reduce rates towards 4.5% by end 2025 from the current 6%, indicating the Governor views that as the likely terminal rate.