Ahead Today

G3: US: CPI, FOMC rate decision and dot plot, and avg hourly earnings, Germany CPI

Asia: China CPI, BoT policy rate decision, India CPI and industrial production

Market Highlights

Markets will take their cues from the upcoming FOMC meeting, where the policy rate decision will be announced on 13 June at 2am Asia time. We expect the Fed will leave its policy rate unchanged at 5.25%-5.50% at its June meeting. Fed officials will also update their quarterly dot plot, where the median plot could shift to two rate cuts this year, from three in March, with interest rates staying higher over the longer run. Global funds have been heavily net short the US dollar in the week ending 4 June 2024, giving scope for a near-term dollar up move. The US labour department will also publish the CPI data just hours before the FOMC decision, which will likely set the tone for what’s to come in Powell’s press conference. Market consensus is for CPI to slow to 0.1%mom in May from 0.3%mom in April.

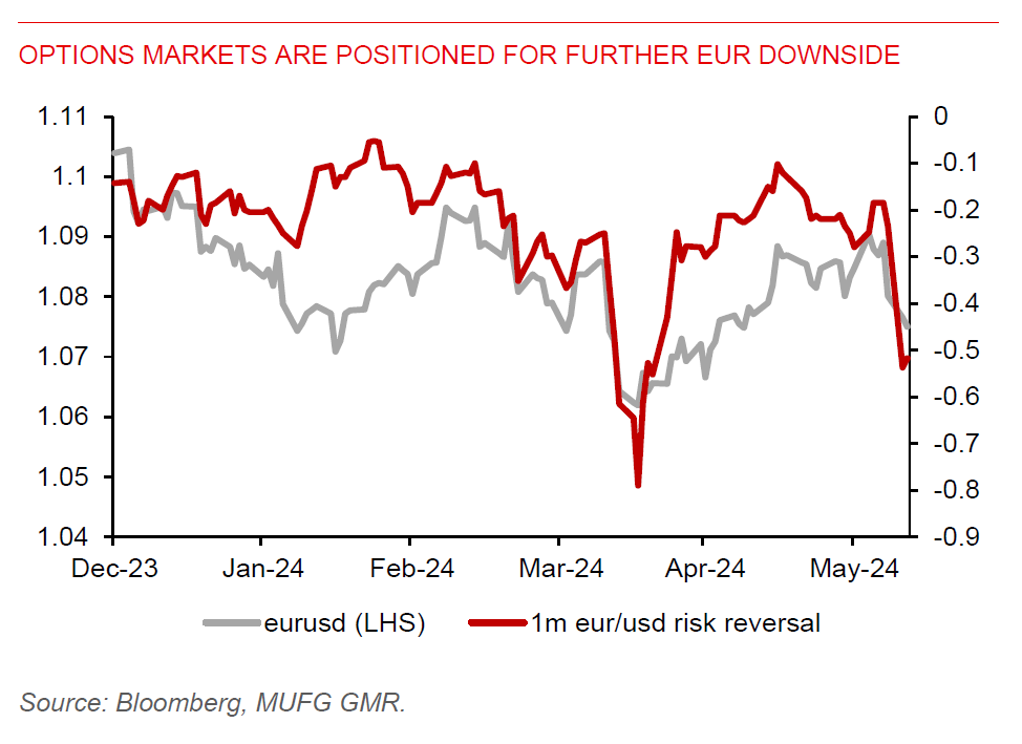

Meanwhile, the political risk has picked up in France, with President Macron calling a snap national election following a bruising defeat in the EU election, thereby creating unforeseen political risks. The EUR has already weakened by around 1% against the USD over the past week as market participants move to price in a higher political risk premium ahead of the parliamentary elections, with the first round on 30 June, and the run-off on 7 July.

Regional FX

Positioning adjustment ahead of the upcoming US CPI data and FOMC meeting has been taking place, with regional markets taking off some risk exposure. Following a decent performance last week, we have seen the KRW and THB partially unwinding those gains. The IDR and MYR also reversed their gains over the past week and weakened further to start the week, with the former trading at a four-year low. Meanwhile, CNH has inched weaker versus the US dollar, while onshore CNY continues to trade near the upper bound of its 2% trading limit band.

Asia FX could thus face volatility from a potential upward shift in the Fed’s median dot plot, which could push US yields and the US dollar higher. Low-yielding currencies such as the KRW, THB, and MYR could be vulnerable. Election-induced market volatility could also spill over negatively to regional sentiment. However, before getting to the FOMC monetary policy decision, regional markets will have to brace for the Bank of Thailand policy rate decision. Despite persistent government pressures for rate cuts, we continue to look for policy inaction, as an early rate cut would bring increased volatility and stoke higher imported inflation.