Ahead Today

G3: US PPI, initial jobless claims; Germany CPI

Asia: BSP policy rate decision

Market Highlights

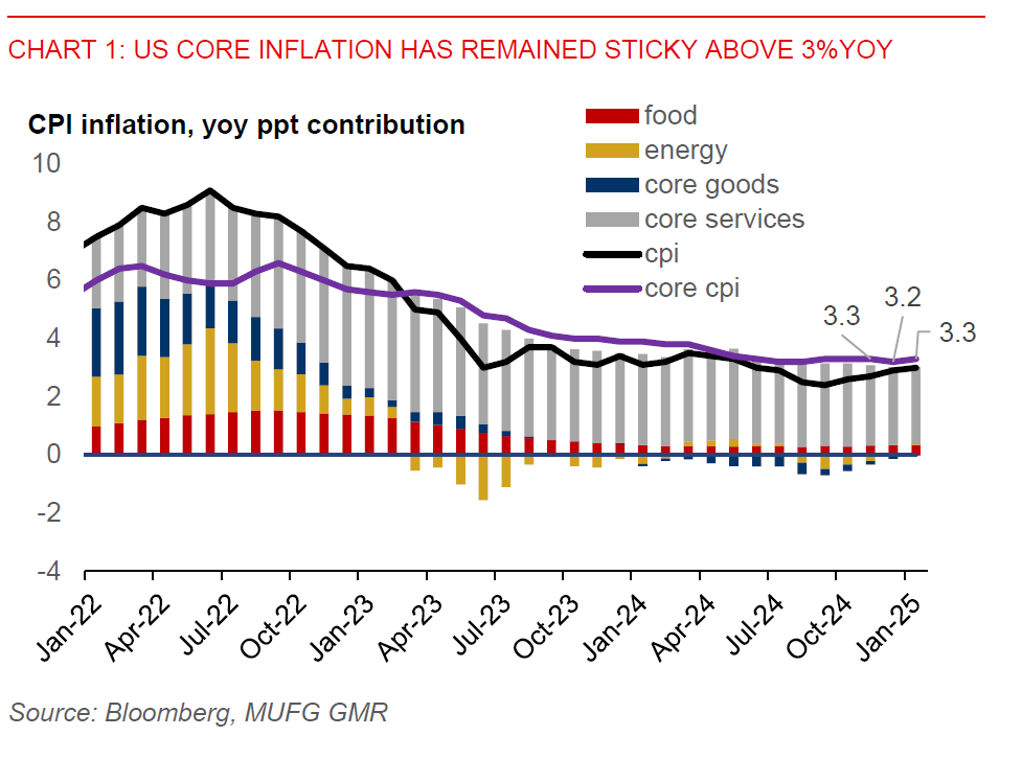

US headline inflation rose 0.5%mom in January, from 0.4%mom in December and larger than Bloomberg consensus of 0.3%. This was mainly due to core services inflation, which was up by 0.5%mom, contributing 0.3ppt to the month-on-month headline inflation rate. Contributions from core goods and food categories had also risen slightly. And from a year ago, headline inflation was 3.0%yoy, up from 2.9%yoy in December.

US core CPI rose by 0.4%mom in January, from 0.2%mom in December, beating Bloomberg consensus of 0.3%mom. From a year ago, the core gauge picked up to 3.3%yoy from 3.2%yoy in December. This positive inflation surprise for markets, along with global trade uncertainties, have lent support for the US dollar. Moreover, Fed Chair Powell has signalled for no rush in adjusting the policy rates. The broad US dollar index (DXY) continued to hover at around the 108.00-level. US 2-year yield rose 8bps while the 10-year was up by about 12bps following the inflation report.

The yen lost more than 1% against the US dollar, following the hotter US CPI report. BoJ Governor Ueda has said the size of rate hikes will depend on the economy, inflation, and financial conditions at the time.

Regional FX

Asian currencies broadly weakened against the US dollar in Wednesday’s session. SGD and KRW rose 0.3% each, leading gains in the region. The rise in US yields will continue to weigh on Asian currencies. The key highlight today is the BSP policy meeting. Market expects the BSP to cut the policy rate by 25bps to 5.50% to support the Philippine economy. This likely won't weaken PHP much, given the rate-cut expectation has been priced in. The BSP has also been signalling for a measured policy easing, but a more dovish forward guidance on the policy rate path could be a headwind for the PHP.

Meanwhile, India’s headline inflation slowed to 4.3%yoy in January, from 5.2%yoy in December and below Bloomberg consensus of 4.5%yoy. With India's inflation moving closer to the RBI’s 4% target, there may be scope for policy rate cuts ahead. A constraint to RBI easing is INR weakness.