Ahead Today

G3: Europe PMI, US S&P PMI

Asia: India PMI, Singapore CPI

Market Highlights

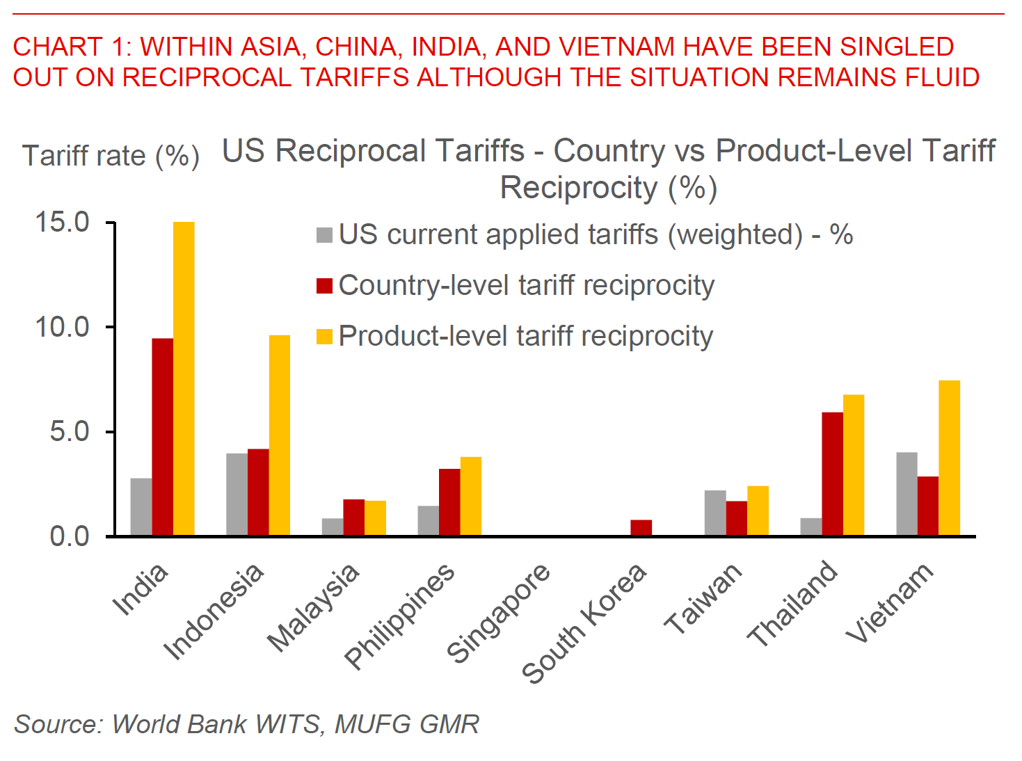

Both Bloomberg and WSJ reported over the weekend that President Trump’s reciprocal tariffs to be announced on 2 April are likely to be narrower than initially planned. For one, the sector-specific tariffs such as on autos, pharma, and semiconductors may not be announced on the same day, according to these reports. Second, the reciprocal tariffs may not be cumulative on previously announced tariffs such as on Mexico, Canada, steel, aluminum, although in practice it is unclear how this will be applied. Third, the countries impacted by reciprocal tariffs will be focused on the top 15% of countries with largest trade imbalances with the US, or the so-called “dirty-15” as US Treasury Secretary Scott Bessent previously mentioned. The exact list of countries to be targeted are unclear, with the reports highlighting China, India, South Vietnam and South Korea in Asia, together with EU, Mexico, Japan, Canada, Australia, Brazil, and Russia, among others.

While this may be narrower relative to what Trump mentioned previously, it’s important to note that we do not know in absolute terms the extent and magnitude of tariff increases. The WSJ article highlighted that targeted countries will be “especially hard hit with higher tariffs’, exemptions seem increasingly unlikely, and the approach seems tilted towards an immediate implementation, at least for now.

Regional FX

Asia FX pairs were generally slightly stronger into the Asia session open with the Dollar weaker post the articles on narrower reciprocal tariff scope. USD/CNH was at 7.253, while INR outperformed substantially heading into the weekend rising by 0.5% with inflows into the bond and equity markets. We have been having a cautious view on India’s FX due to a softer growth outlook, higher FDI repatriation, modest deterioration in the credit cycle, coupled with our expectation for a less interventionist central bank. Nonetheless, the macro data over the past week has admittedly been better than we anticipated, with a smaller trade deficit, higher services exports coupled with lower inflation all helping to boost rate cut expectations and hence also capital inflows. We do however think that USD/INR markets are right now underpricing the risk from Trump’s reciprocal tariffs specifically for India, and think the risk-reward may be tilted towards weaker INR from here. Meanwhile, China held its China Development Forum over the weekend, with China premier Li Qiang telling a forum of global business leaders and scholars that China is “prepared for potential shocks that go beyond their expectations and are mainly external”. On that front, it’s interesting to note that China’s media devoted television coverage to Manus AI for the first time over the weekend, while the Chinese startup also registered its China-facing AI assistant for generative AI apps in China, clearing an important regulatory hurdle. We wrote about the potential impact of Manus AI here (see Asia FX Talk – recession fears and will US exceptionalism continue?).