Ahead Today

G3: CPI data from euro-area, France, and Italy; France’s final Q3 GDP

Asia: Thailand current account, HK retail sales, Taiwan Q3 GDP, India Q3 GDP

Market Highlights

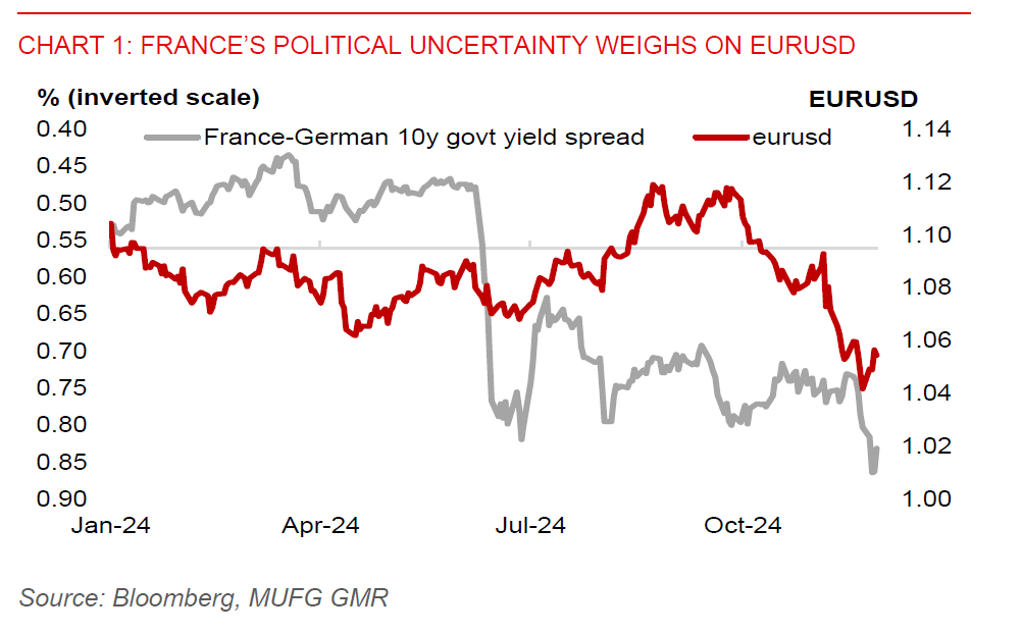

French bonds and EURUSD have come under pressure amid political uncertainty in France. Markets are concerned about an impasse in passing the budget for 2025. Marine Le Pen’s far right National Rally party opposes plans to raise electricity taxes. It appears that Prime Minister Michel Barnier could make concessions, failing which Le Pen’s party could trigger a ‘no confidence’ vote to topple his administration. France’s 10-year yield has now matched that of Greece for the first time on record, while the spread with German’s 10-year bond yield has widened to 86bps at one point, higher than during the snap election in France in mid-2024, before somewhat easing to 83bps. This, along with sustained US dollar strength and Trump’s potential tariff hikes, will likely continue to weigh on the EURUSD.

Meanwhile, the US is mulling about imposing more restrictions on the sale of semiconductor equipment and AI memory chips to China. The PBOC has announced a stronger daily fixing rate to help contain depreciation expectation on the CNY.

In Japan, the cabinet is set to approve an extra budget worth JPY13.9tn, which is larger than the JPY13.2tn last year, as Prime Minister Ishiba looks to fulfil his campaign promise of a bigger budget.

Regional FX

Asia ex-Japan currencies had a mixed performance against the US dollar ahead of the Thanksgiving holiday in the US. THB (+0.4%) and IDR (+0.4%) led gains in the region, KRW (-0.4%) and SGD (-0.2%) fell, while the other regional currencies were broadly stable.

A likely strong showing by President Prabowo’s ruling coalition party in Indonesia’s regional election on 27 November has eased domestic political uncertainty, lending some support for the rupiah. Based on quick counts, candidates backed by Prabowo are on track to win crucial provinces including West Java, Central Java, and East Java. These provinces are vital battlegrounds, given the size of voter populations there. This could help allow Prabowo to push though his economic agenda, including the nutritious meal programme. The rupiah could stabilize around 15,900 through year-end, before encountering headwinds from potential US tariff hikes early next year. Moreover, BI appears to stand ready for now to intervene to limit USDIDR below the 16,000-level.

In Thailand, we expect a larger current account surplus of US$1bn for October compared to US$559mn in September, underpinned by higher visitor arrivals during the month. This could help lend some support to the Thai baht. We forecast USDTHB to end the year at 34.70, before rising to 36.10 by Q1 2025 on the back of potential US tariff announcement.

Meanwhile, Taiwan’s preliminary Q3 GDP data release today is likely to show growth in line with the advance reading of 3.97%, and so this likely won’t have much of an impact on the TWD. BoK’s 25bps rate cut yesterday has surprised markets, weighing on the KRW while reflecting policymakers’ concern about growth and looming tariff risks. BoK cut South Korea’s 2025 GDP growth forecast to 1.9% versus 2.1% in its August projection.