Ahead Today

G3: US nonfarm payroll, unemployment rate, average hourly earnings, University of Michigan sentiment; Germany industrial production, eurozone final Q3 GDP

Asia: RBI policy decision, Vietnam CPI, Thailand foreign reserves

Market Highlights

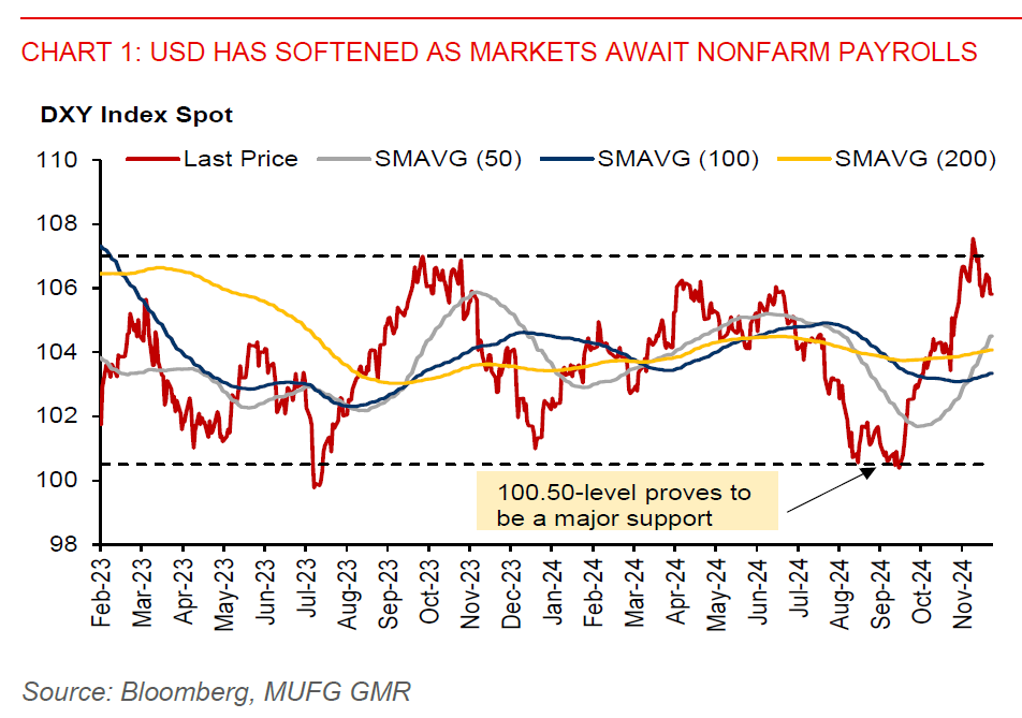

US initial jobless claims rose to 224k in the last week of November, from 215k in the prior week. But this was still at historically low levels, suggesting the US labour market has remained resilient. In his latest speech, Fed Chair Powell thinks the downside risk to the US labour market has receded and the US economy is in “remarkably good shape”. The key US macro data release today is the nonfarm payrolls and unemployment rate. Bloomberg consensus is for nonfarm payrolls to rise by 180k in November and the unemployment rate to remain at 4.1%. For now, markets continue to expect a 25bps cut to the fed funds rate in the 17-18 December FOMC meeting.

Meanwhile, political uncertainty in France persists. French President Macron now has to find a replacement for Prime Minister Michel Barnier, whose government has been toppled by a “no confidence” vote in parliament. The 2025 budget has also not been passed. But for now, markets have not priced in greater political risk, with the spread between France’s and Germany’s 10-year yield narrowing to 78bps after nearly touching 90bps, while EURUSD bounced by 0.5%.

And in South Korea, the domestic political situation remains unstable. The opposition party has launched impeachment proceedings on President Yoon for his declaration of martial law, which has been short-lived. Financial markets have stabilized for now, after Bank of Korea pledged to provide ample market liquidity.

Regional FX

Asian currencies have broadly gained against the US dollar on Thursday, with MYR (+0.6%) and PHP (+0.6%) leading gains in the region. Notably, USDCNY has retreated from the 7.3000-level, with the PBOC supporting the currency via keeping its USDCNY daily fixing below the 7.2000-level. Meanwhile, Philippine inflation picked up to 2.5%yoy in November from 2.3%yoy in October. But this is still within the central bank’s inflation target, giving room for BSP to cut rates by 25bps in December. RBI’s policy meeting today will be a close call between either a rate cut or a pause. RBI could also cut the cash reserve ratio by 50bps to shore up banking system liquidity following its recent FX intervention to slow rupee depreciation.