Ahead Today

G3: Germany industrial production

Asia: Trade data for Philippines and Taiwan, foreign reserves from Indonesia and Malaysia, Singapore COE auction

Market Highlights

US Treasuries have continued to rally following the soft April US jobs report last Friday. But the broad US dollar index (DXY) sell-off has stalled after finding support at the 105 level. The US data docket is relatively light this week. Key data only include the initial jobless claims and University of Michigan survey, which may not provide much of a catalyst for the next move in the US dollar. The EURUSD has inched higher on the back of an improving outlook for the eurozone economy, while the USDJPY has gained 1.1% to 154.80 this week after dropping sharply from its high of 160 last week.

Meanwhile, geopolitical tensions in the Middle East continue to simmer, with a truce deal hanging in the balance. Hamas militant group has apparently agreed to a ceasefire proposal from Egypt and Qatar. But Israel has taken control of Gaza’s Rafah border crossing for the first time since the conflict with Hamas broke out. However, the oil market has continued to price out the risk of contagion in the Middle East region, with Brent prices falling to US$82.79/bbl from US$87.86/bbl as of end-April. Rising oil inventories could also have a part to play in weighing on oil prices.

Regional FX

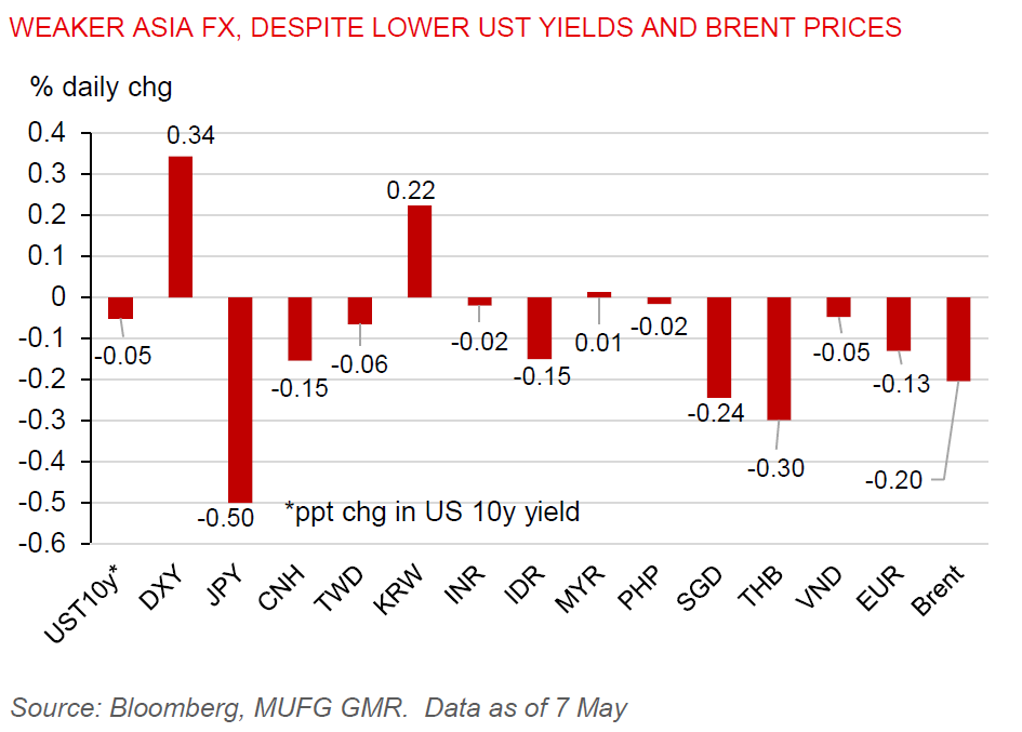

Asia FX weakened modestly against the US dollar, despite declines in US Treasury yields and oil prices. The JPY and THB underperformed, but the KRW is an exception, as it gained 0.2% versus the US dollar.

Philippine CPI inflation picked up to 3.8%yoy in April from 3.7%yoy in March. This was below Bloomberg consensus of 4%. With growth likely to have been robust in Q1, inflation still contained, and the PHP not much weaker compared to the levels in H2 2023, the BSP is likely to continue to hold rates at 6.50%. A rate cut will likely have to wait till next year to avoid causing unnecessary PHP volatility.

Taiwan inflation data for April have also surprised to the downside, despite the electricity tariff hikes. Headline CPI moderated to 1.95%yoy, from 2.14%yoy in March, missing Bloomberg consensus for a pickup to 2.2%.

Meanwhile, China’s Xi went to France for a state visit to strengthen bilateral ties and urged French President Macron to help China avoid a new ‘cold war’. This is especially critical, given the US presidential election in November. Aside from this political event, China has tightened rules for hedge funds. Private investment funds now need to raise at least RMB10mn to set up initially and thereafter to maintain at least RMB5mn in assets or face liquidation.