Ahead Today

G3: US mortgage applications, ADP employment change, wholesale inventories, Fed beige book, Fed Chair Powell’s monetary policy testimony to Congress

Asia: Singapore COE bidding

Market Highlights

Some signs of easing in US economic activity have appeared to emerge, spurring a modest uptick in US rate cut bets in the futures market. The US ISM services index eased to 52.6 in February, from 53.4 in January, along with softer services prices paid. But the index remained in expansion territory, reflecting still resilient, albeit softer, services activity. This is in contrast with a contraction seen in US factory activity. The ISM manufacturing index was at 47.8 in February (<50 indicates contraction).

US 10-year yield fell 6bps to 4.15%, further retreating from year-to-date highs of around 4.32%. And the broad US dollar index was stable. Markets will be anticipating Fed Chair Powell’s semiannual monetary policy testimony to Congress, and we retain our expectation that there won’t be surprises regarding his stance of not rushing into rate cuts.

In Europe, PMI data for February shows services activity expanded in Italy and Spain, but it contracted in Germany and France. Eurozone services PMI was at the neutral-50 mark.

Regional FX

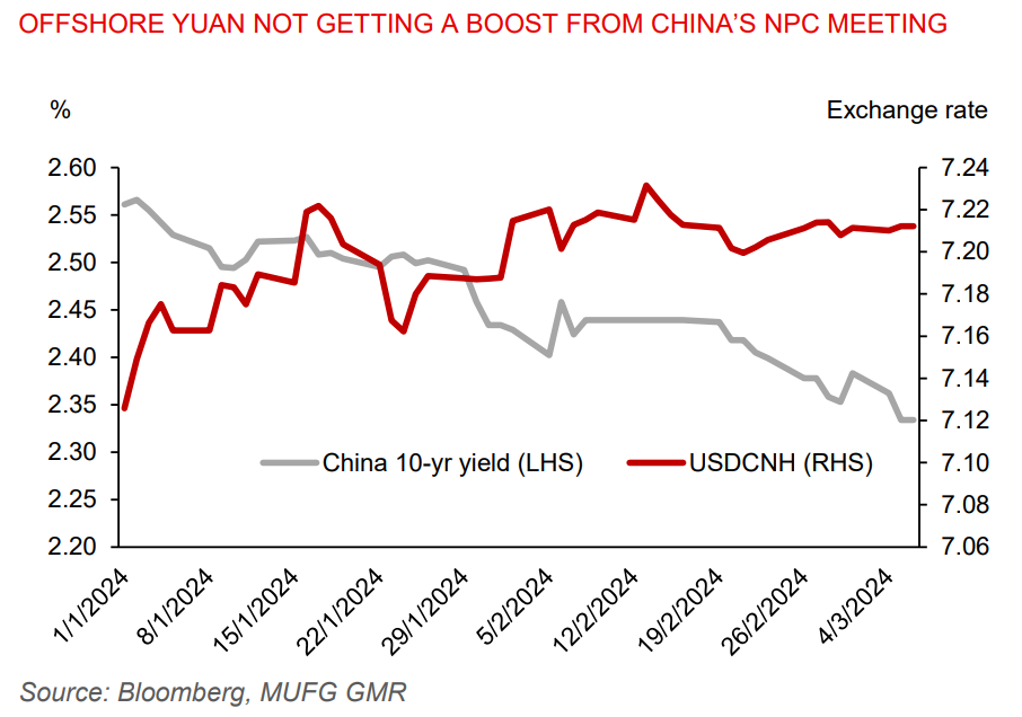

Offshore Chinese yuan was flat against the US dollar, trading at the 7.21 level and reflecting a lack of optimism towards China’s growth outlook for this year. Asian currencies that are relatively sensitive to CNH moves have not gotten much boost from the National People’s Congress (NPC). KRW, TWD, and MYR depreciated 0.2%-0.3% against the US dollar, while SGD was relatively flat.

At the National People’s Congress (NPC), China has set a growth target of 5% for 2024, unchanged from its 2023 target. This was despite higher base effects from a year ago when GDP grew 5.2%. Premier Li said it won’t be easy to meet this growth target, acknowledging an uncertain global growth environment and continued low consumer confidence in the country. The 5% growth target thus implies that more macro policy support will have to be implemented, while close policy coordination among authorities is needed. There is, however, a lack of a large fiscal push, understandably so given the fiscal constraints. The government has announced an on-balance sheet budget deficit of 3% of GDP, representing a fiscal tightening from a revised 3.8% of GDP deficit in 2023. It has also planned to issue RMB1tn of ultra-long special treasury bonds to drive strategically important projects, while also setting a special bond issuance quota for local government worth RMB3.9tn, slightly higher than RMB3.8tn set in 2023. Still, augmented fiscal deficits (including off-balance sheet spending) will likely reflect fiscal consolidation.

Other broad policy plans being announced include upgrading supply chains, deepen structural reforms (such as expanding market access for foreign companies), and fostering self-reliance in tech.

In Southeast Asia, Thailand’s inflation was -0.8%yoy in February, printing negative since October 2023. Core inflation was muted at 0.4%yoy, from 0.5% in January. Bank of Thailand may use the policy space it has to cut rates to support growth. But Philippines inflation rose to 3.4%yoy from 2.8%, driven by higher food prices. Singapore retail sales fell 0.7%mom sa in January, from a revised +0.1% in December.