Ahead Today

G3: US mortgage applications, initial jobless claims, S&P Global US manufacturing PMI; eurozone manufacturing PMI

Asia: China Caixin manufacturing PMI, Indonesia CPI, HSBC India manufacturing PMI, Singapore PMI

Market Highlights

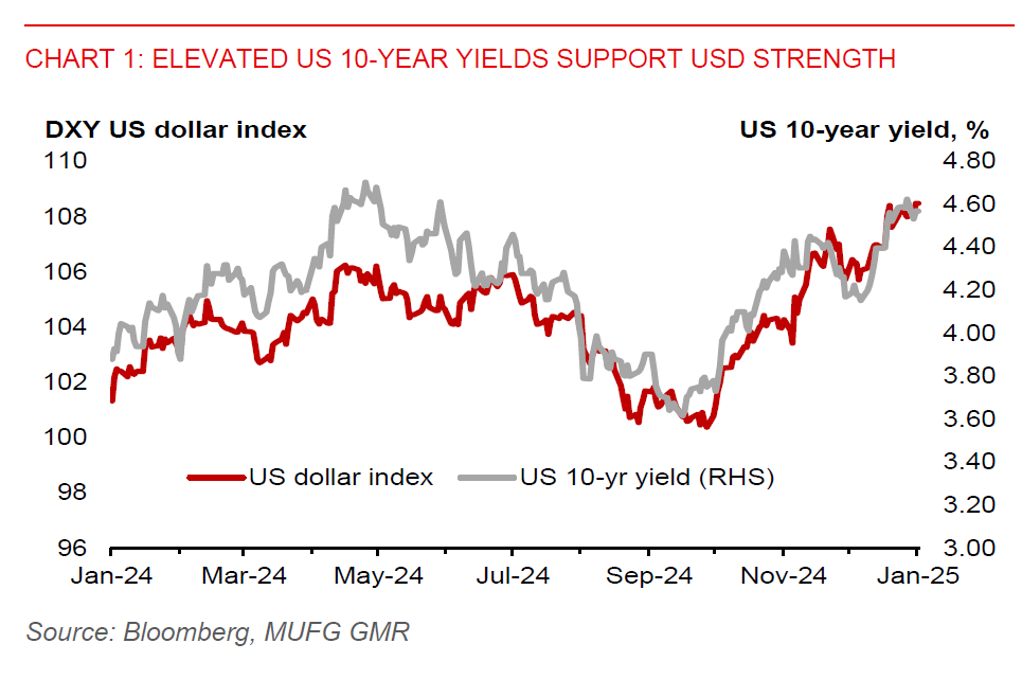

The broad US dollar index (DXY) rose by 7.1% in 2024, driven by significant weakness in the euro (-6.2%) and the Japanese yen (-11.5%). There is likely still room for the US dollar to strengthen towards the 110.00 level. US long-term yields could remain elevated, supported by Trump's inflationary policies such as trade tariffs and a wider budget deficit, which could further bolster US dollar strength. Since the US election on November 5, the US 10-year yield has increased by nearly 30bps to 4.5690%, and it had risen by 68bps in 2024.

A hawkish Fed in 2025 will also provide support for the US dollar. Markets anticipate about 42bps of rate cuts in 2025, while the Fed’s December median dot plot indicates just two rate cuts. A key US macro data highlight today is the initial jobless claims, which are expected to indicate a still resilient US labour market. Bloomberg consensus is for 221k initial jobless claims for the week ending December 28, remaining at historically low levels.

Meanwhile, the USD/JPY could be supported by a slow pace of Bank of Japan (BOJ) rate hikes in 2025. Markets have postponed expectations for the next BOJ rate hike to March, from the previously anticipated December 2024 or January 2025 meeting.

Regional FX

Among major Asian ex-Japan currencies, only the Malaysian ringgit (+2.7%) gained against the US dollar in 2024, while the Thai baht remained flat, and the rest fell. We continue to anticipate broad weakness in Asian currencies leading up to Trump’s inauguration on 20 January, driven by weak market sentiment ahead of potential tariff hikes.

Notably, the KRW fell by 14.3% against the US dollar in 2024. And it is likely to remain vulnerable due to market expectations for US tariff hikes and ongoing domestic political uncertainty. These factors will help offset an improved export performance. South Korea’s exports rose by 6.6%yoy in December, while imports increased by 3.3%yoy, resulting in a widening of the monthly trade surplus to US$6.5 billion, from US$5.6 billion in November and US$4.5 billion a year ago.

Meanwhile, Singapore’s economy grew by 4% in 2024. However, we believe Singapore’s economy remains highly vulnerable to Trump’s potential tariff hikes. The SGD fell 3.4% against the US dollar in 2024, despite a tight MAS S$NEER policy. We maintain our outlook for USD/SGD exchange rate to rise to 1.3800 in Q1.