Ahead Today

G3: US CPI, mortgage applications

Asia: China’s Central Economic Work Conference, MAS survey of professional forecasters

Market Highlights

The US dollar index (DXY) has gained some upside momentum as markets await the US CPI data later today. We think US core CPI inflation is likely to remain sticky at 3.3%yoy in November, unchanged from October, amid rising small business optimism (101.7 in November vs. 93.7 in October, beating Bloomberg consensus of 95.3). A stronger USD has in turn weighed on the AUD (-0.6%). RBA held the cash rate at 4.35%, in line with market expectation, given still high underlying inflation (3.5%yoy). But RBA governor said she has more confidence of inflation falling back to the RBA’s 2%-3% target. This hints at a potential rate cut in February. Moreover, Australia’s economy is showing signs of slowing, while it needs to brace for higher US tariffs.

Meanwhile, Taiwan’s TSMC – the world’s largest chip foundry – saw revenue jump 34%yoy to US$8.5bn in November, driven by the ongoing AI boom. As the sole supplier of AI chips to NVIDIA – a US-based chip design firm – TSMC will stand to benefit from high global demand for NVIDIA’s new Blackwell chips. Moreover, Taiwan produces 70% of advanced chips (including AI chips), while South Korea produces the rest. AI related chip sales growth will thus reduce the drag from potential US tariff hikes on the Taiwan Dollar. AI-driven chip demand is likely to extend into 2025. According to IDC (a global ICT data provider), it forecasts non-memory chip (including AI chips) growth to accelerate to 13.5%yoy in 2025 from 9.4%yoy in 2024.

Regional FX

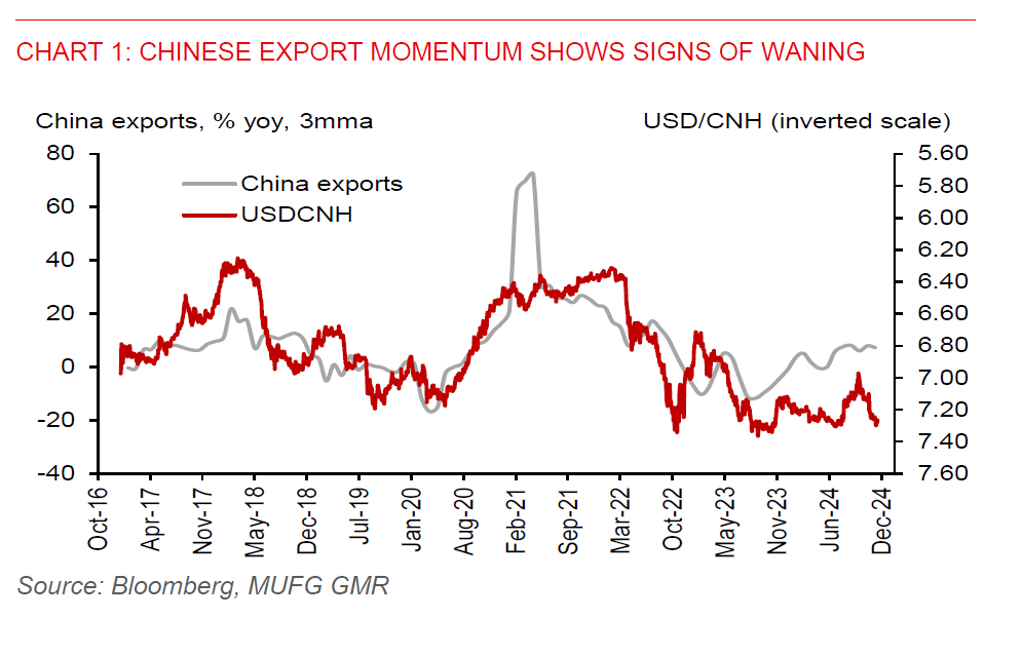

Asian FX markets have been relatively calm against the US dollar as they await the US CPI data later today and the start of China’s 2-day annual Central Economic Work Conference (11-12 December), where economic priorities will be crafted for the year ahead. A more pro-growth policy stance adopted by Chinese policymakers at the conference could provide near-term support for the CNY, though any positive impact would be limited given tariff concerns. Moreover, China’s export growth slowed to 6.7%yoy in November from 12.7%yoy in October. On a sequential month-on-month basis, we estimate Chinese exports had also slowed in November.

Meanwhile, we have maintained our outlook for USDMYR to rise to 4.57 by Q1 2025. We look for a deceleration in Malaysia's economic growth to 4.6%yoy in Q4, from 5.3%yoy in Q3. And we also look for growth to slow to 4.7% in 2025 amid higher global trade uncertainties, from an estimated 5%yoy this year. Malaysia's industrial production slowed to 2.1%yoy in Oct from 2.3%yoy in September. Sequentially, industrial production was -0.1%mom, following a 2.2%mom drop in September.