Ahead Today

G3: US mortgage applications, Richmond Fed manufacturing index, Fed beige book, Germany inflation data

Asia: Vietnam inflation, retail sales, and trade data

Market Highlights

The US Conference Board consumer confidence index rebounded to 102 in May vs. 97 prior and Bloomberg consensus of 96. But this was still weaker than the Q1 average of 106.3. US home prices have also risen further, despite mortgage rates hovering at around 7%. But the pace of increase slowed, with the Federal Housing Finance Agency (FHFA)’s measure of home prices rising 1.1%qoq in Q1 vs. 1.5%qoq in Q4 2023, partly supported by low inventories of homes for sale.

Fed’s Kashkari said that the current monetary policy stance is restrictive. But additional rate hikes remain on the table. Wage growth is still strong, which is not consistent with the Fed’s 2% inflation target. Kashkari said the number of US rate cuts this year certainly won’t exceed two cuts. He has also noted about the stress in commercial real estate, which presents a risk for the US economy.

Meanwhile, eurozone 1y inflation expectations eased to 2.9%yoy in April vs. 3% prior, marking the slowest pace since September 2021. ECB’s Villeroy said consecutive ECB rate cuts in June and July cannot be ruled out.

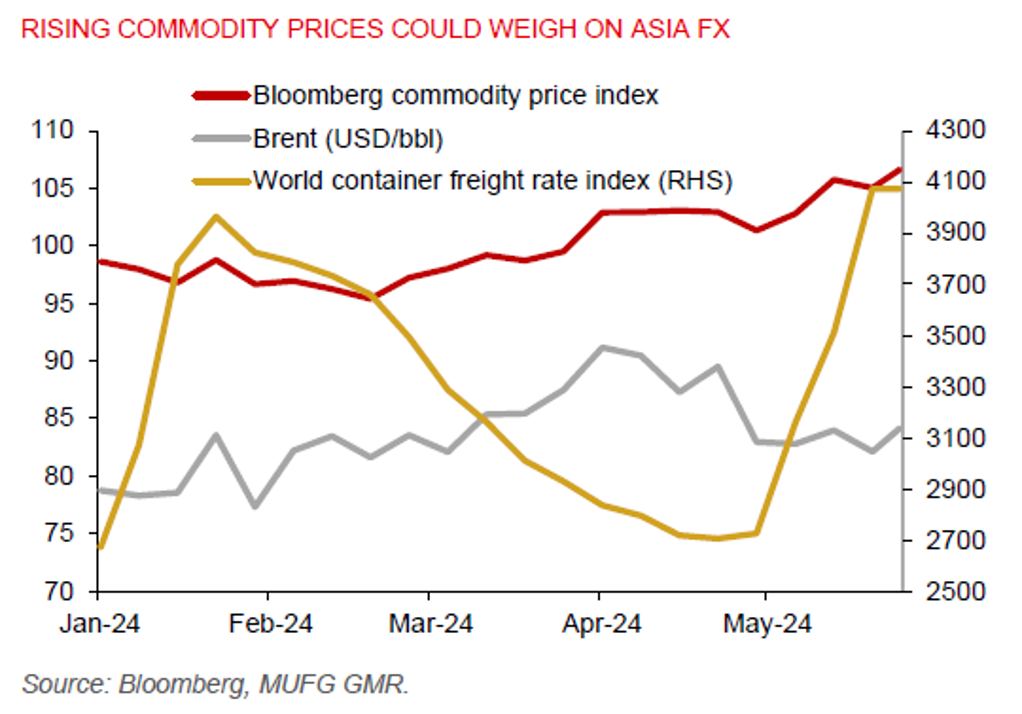

US 10y yields rose marginally, the 2y yield held steady, while the DXY USD index weakened. The NASDAQ moved past 17,000 for the first time. Freight rates and commodity prices also have risen, which could weigh on the pace of global disinflation.

Regional FX

Asian FX market performance was mixed. KRW outperformed with a 0.4% rise against the US dollar, moving in tandem with an advance in the KOSPI index. The PHP also gained 0.3% to trade below the 58 per US dollar level. But the IDR weakened 0.2%, while FX movements were muted in CNH, INR, and THB. South Korea’s retail sales jumped 10.8%yoy in April, driven by online sales, pointing to an improvement in private consumption. Apple’s iPhone shipments to China rose 52% in April, reflecting smartphone demand is returning. Meanwhile, rising commodity prices and container freight rates are a concern for the outlook of Asia FX.