Ahead Today

G3: US Consumer Confidence, US Richmond Fed Manufacturing, Germany Q2 GDP

Asia: Thailand exports, China industrial profits

Market Highlights

Global markets started off the week on a softer note with the Dollar stronger and equity markets down post the Jackson Hole inspired rally, even as Asian currencies such as IDR, THB and MYR rebounded strongly into the start of the week. Part of this was likely due to geopolitical concerns, with Brent oil prices rising by 4% to US$81/bbl. This comes as Libya’s eastern government said it will shut down all crude oil output and exports amidst a row over who will lead the central bank. Libya produces 1.2 mn bbls per day of oil, which is quite sizeable. Meanwhile Israel took out thousands of Hezbollah missile launchers in what was called a preemptive strike, although the temperatures seemed to have died down somewhat post Monday.

Meanwhile, San Franciso Fed President Mary Daly echoed comments from Chair Powell, saying that adjusting policy is appropriate, although it’s still too early to know the pace of coming rate cuts and she is not seeing “real” weakness in the labour market yet. Yesterday’s US durable goods orders print was soft on an underlying basis and was another print in the direction of more modest activity in the US. Core orders rose 0.2%mom coupled with a downward revision to the previous month’s print, with the strong headline print entirely driven by aircraft orders. Looking ahead, markets will focus on US consumer data coupled with China’s industrial profit numbers.

Regional FX

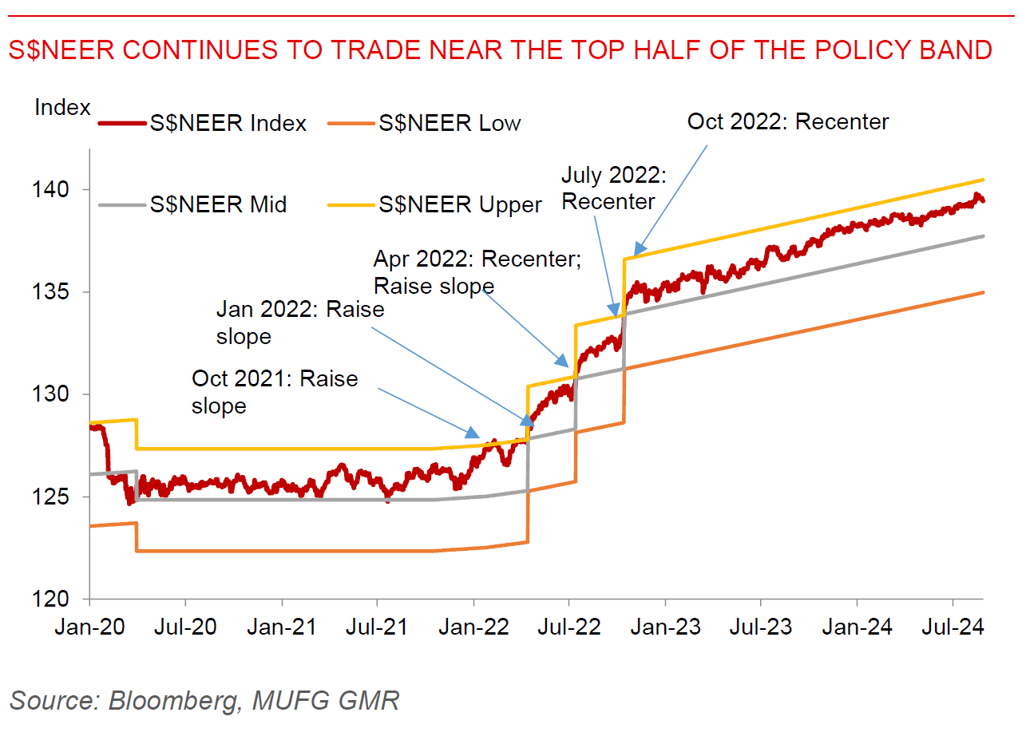

Asian FX markets performed well heading into the start of the week, although it has since softened on the back of overnight developments with the stronger Dollar. IDR (+1%), THB (+1%), and MYR (+0.44%) were the outperformers, while INR was marginally stronger (+0.06%) but continued to lag the rest of Asia. We had industrial production data out from Singapore for July, which was stronger than expected, rising 10%mom sa, helped in part by volatile biomedical output. Nonetheless, several other components and notably electronics were strong as well. We continue to expect MAS to keep its tight exchange rate policy for now, although the recent softer than expected inflation numbers have raised some expectations among market participants around an earlier MAS easing move. Nonetheless, with growth prospects for Singapore still good, there is likely still scope for S$NEER to continue trading near the top half of its policy band, as it has been for some time. Looking more broadly at Asian exports and manufacturing, the good news is that they have generally been quite robust across the likes of Taiwan and Korea, all be it that some of it could have been boosted by front-loading of exports pre-tariff imposition. The lead indicators for exports such as industrial metals suggest there should be gradual improvement moving into 2025 as a base case, and this should continue supporting some Asian FX recovery heading into next year.