Ahead Today

G3: Speech by Fed’s Waller, Germany IFO business survey

Asia: Singapore inflation, Taiwan industrial production

Market Highlights

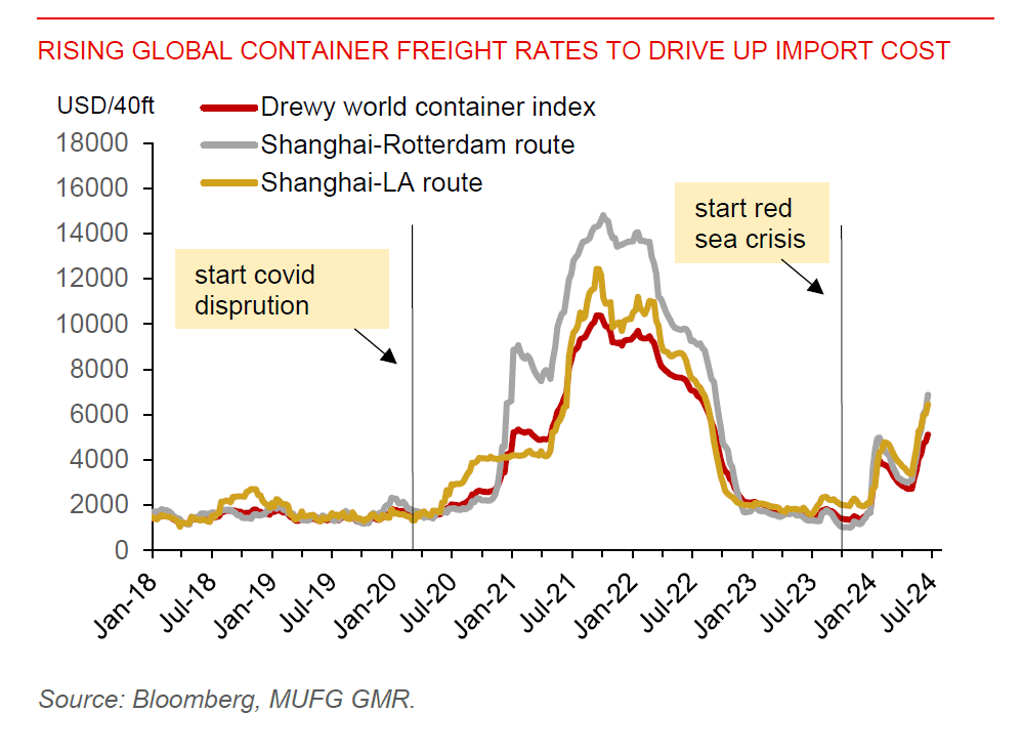

Global container freight rates have surged, fuelling a renewed pickup in import costs globally. This has been driven by higher seasonal demand, along with the red sea crisis that has rerouted the Asia-Europe shipping lines around the longer Cape of Good Hope route. The Drewy world container index has increased by three-fold to US$5116.87/feu year to date, led by a four-fold surge in container rates between the Shanghai-Rotterdam route. The rerouting of shipping lines has led to increased demand for bunkering and transshipments at Singapore’s ports, causing port congestion. Singapore’s container volumes rose almost 8% in the first 5 months of May compared to the same period a year ago, while the container terminal utilization rate nearly hit 90%.

Meanwhile, the advance US PMI data for June shows an acceleration in manufacturing and services activities, adding to the narrative of a still largely resilient US economy. Indeed, US manufacturing PMI rose to 51.7 vs. 51.3 in May, the services PMI picked up to 55.1 vs. 54.8 prior, while the composite index inched up to 54.6 from 54.5 prior. However, housing activity has remained pressured by high interest rates, with existing home sales staying subdued at 4.11mn on a seasonally adjusted annualized rate in May, which was near to the covid period low of 4.09mn.

Regional FX

The key data highlight for Asia today is the inflation data from Singapore. We look for core inflation will only inch down to 3%yoy in May, from 3.1% in April. This likely won’t be enough for the MAS to loosen policy setting in its July quarterly meeting. Indeed, core inflation has been sticky so far, picking up to 1.1% in April from 0.8% end-2023 on a 3m/3m sequential rolling basis. While moderation in the labour market suggests core inflation should continue to ease, we think the pace of decline will likely be slow, given the impact of past administrative price hikes, notably the 1ppt GST hike at the start of the year. Moreover, the outlook for Singapore’s economy has improved, as it appears to be emerging from a credit downcycle while business expectations for the next 6 months have become more positive.