Ahead Today

G3: US: Q2 GDP, personal consumption, initial jobless claims, durable goods orders; Germany IFO survey

Asia: Hong Kong trade

Market Highlights

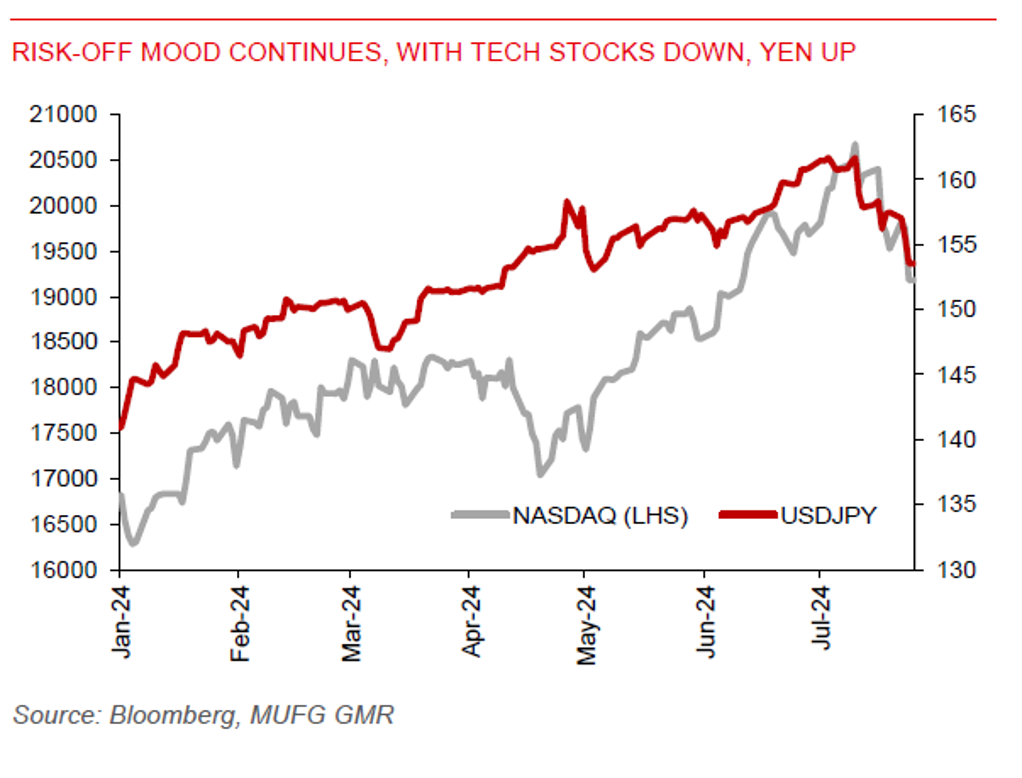

The global risk-off mood in markets has continued, amid US election uncertainty, tech earnings disappointment, and fresh signs of softness in global growth. This has pushed down US equity prices, with the tech sector notably leading losses, while strong gains were seen in both the yen (+1.1%) and Swiss Franc (+0.7%).

Meanwhile, the outlook for the US economy has remained relatively stronger than that for the euro area, which could limit the upside for EUR/USD from current levels. The US aggregate PMI rose to 55.0 in July vs 54.8 in June and market expectation of 54.2. This has mainly been driven by a rise in US services activity, helping to offset weakness in factory activity. Also, the first advance US Q2 GDP estimates due today could possibly show that growth has picked up. US growth momentum could also carry into Q3, underpinned by the services sector.

By comparison, the euro-area composite PMI fell to 50.1 in July from 50.9 in June, with both manufacturing and services PMI lower than markets had expected. Notably, euro-area manufacturing activity has remained in contraction, with the slump in Germany’s industrial activity becoming acute. Markets are now fully pricing for 2 ECB rate cuts this year.

Regional FX

Several Asian currencies seem to have benefitted from the USDJPY decline. The CNH gained 0.3% to trade around the 7.2700 per USD level yesterday, helping to contribute to the positive spill-over impact on the KRW (+0.4%), SGD (+0.2%), and THB (+0.1%). But Asian equities have broadly sold off. So, it remains to be seen whether recent regional currency gains will be sustained, with US Q2 growth and core PCE data coming up next, while markets will have to contend with the upcoming BOJ and FOMC meetings at the end of the month. The economic outlook for China has also not changed materially following the Third Plenum, while the downside risk to China’s growth from potential escalation of US-China trade conflict remain. Meanwhile, we think THB upside could be limited from current levels in the near term, following recent outperformance, as political risk is likely to return to the fore. The Thai Constitutional Court has set 14 August to announce its ruling on a petition by senators to oust PM Srettha.