Ahead Today

G3: US: mortgage applications, wholesale inventories, PMI, new home sales; eurozone PMI

Asia: Malaysia CPI, India manufacturing PMI

Market Highlights

The DXY US dollar index is on a firmer footing following a bounce towards the end of last week. Except for the yen, other major currencies in the DXY basket (including the EUR, GBP, CAD) have weakened against the US dollar. Markets have also turned to a risk-off mood this week with declines seen in the EM equity indices.

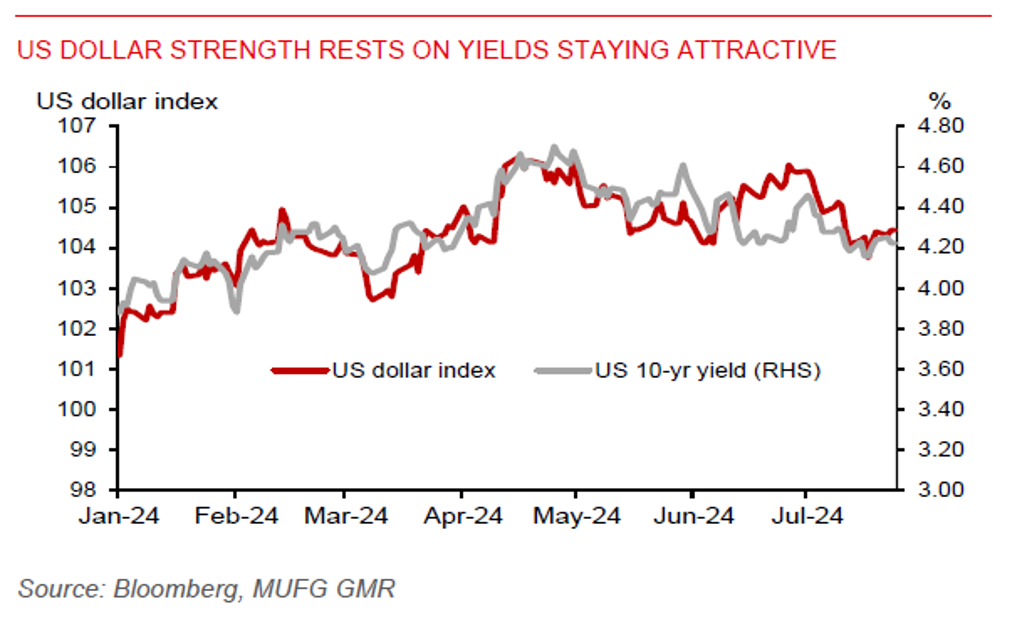

Election risks in the US have risen, amid a global risk-off mood and a firmer US dollar. Following President Biden’s withdrawal from the election, Vice President Kamala Harris have consolidated support from party delegates and will likely become the Democratic Party nominee to contest against Trump for the presidency. While the odds of a Trump victory have eased, it remains high at 58% vs. a peak of 70%, according to PredictIt data. But whoever wins the election will likely take a tough economic stance against China, given the latter’s large trade deficits with the US. A major risk to the US dollar staying firm could rest on long-term Treasury yields staying at an attractive level.

We think there’s scope for the yen to hold on to its gains. But the BOJ meeting next week will be key to determining whether recent gains can be sustained. Meanwhile, there could be more downside in the Australian dollar. It has not received a boost from China’s Third Plenum and PBOC’s 10bps cut to the 7-day reverse repo rate and loan prime rates. Moreover, iron ore prices have fallen, while markets have pared back RBA rate hike expectations.

Regional FX

Asian FX performance was mixed against the US dollar. The CNH held steady at a weak level of around 7.2900 per US dollar, the KRW surprisingly gained 0.3% despite risk-off market sentiment, while the Taiwan dollar (-0.3%) was leading losses in the region. Asian currencies could be on a backfoot this week with US Q2 GDP data due this Thursday possibly showing growth momentum improving, while core PCE inflation (due this Friday) could also pick up modestly on a month-on-month basis. Meanwhile, SGD weakness could be contained, with MAS likely to keep its tight S$NEER policy setting unchanged at its quarterly meeting tomorrow, despite softer June inflation data. And there is limited positive impact on the Indian rupee following Modi government’s budget announcement to narrow the FY25 fiscal deficit target to a 5y low of 4.9% of GDP, which is lower than the 5.1% deficit in the February interim budget.