Ahead Today

G3: Fed FOMC Meeting, US Treasury Quarterly Refunding, US ISM Manufacturing and Prices Paid

Asia:China Caixin Manufacturing PMI, Indonesia CPI, India Manufacturing PMI, Hong Kong Retail Sales

Market Highlights

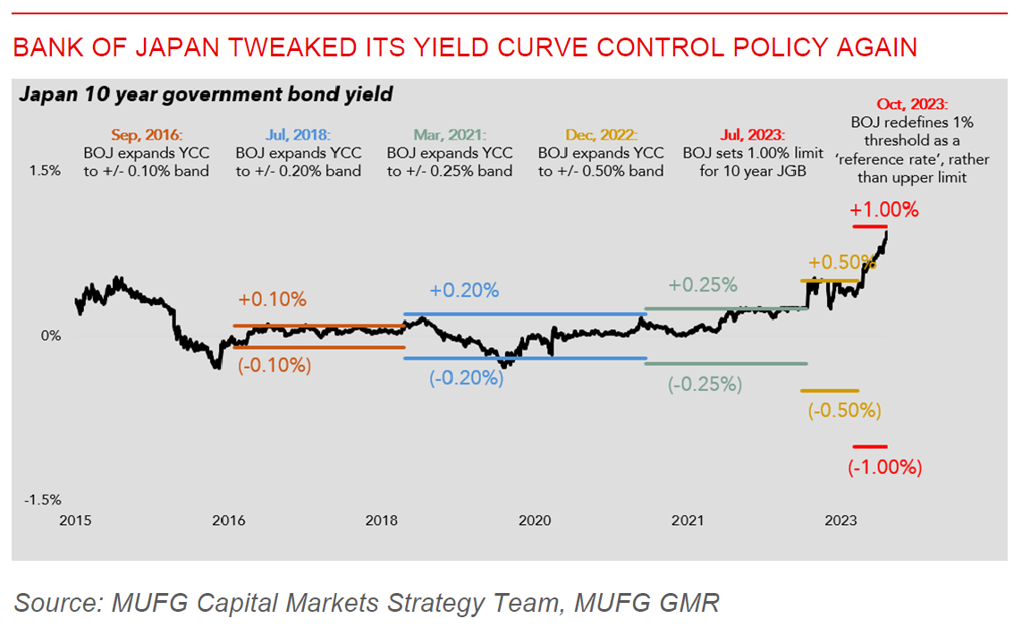

It was not quite goodbye just yet to Bank of Japan's yield curve control (YCC), but the central bank certainly took another measured step towards removing YCC in yesterday's meeting. The BOJ has now cast its previous 1% hard cap on 10-year JGB yields “as a reference", while highlighting that its operations above 1% will be “nimble” to allow rates to move in line with fundamentals. The post-policy statements indicated there is still some distance towards achieving the Bank of Japan’s virtuous cycle of sustainably higher wages and inflation, although this also came with a meaningful upward revision to both FY23 and FY24’s CPI inflation forecast, with a tweak higher to FY25’s CPI outlook.

Markets were meaningfully disappointed by the decision, with JPY falling sharply against the US Dollar by more than 1 big figure to 151.25. This in turn triggered a barrage of verbal intervention from MOF officials, even as official data indicated Japan did not officially intervene in FX markets in October.

The Federal Reserve’s FOMC policy decision is up ahead today, where markets will watch closely for Chair Powell’s tone in his press conference. The US Treasury will also announce its projected funding mix and needs in its Quarterly Refunding announcement, which takes unusual focus given the rise in US long-term yields.

Regional FX

CNH fell against the Dollar to 7.34, with the official Manufacturing and Non-Manufacturing PMIs disappointing consensus at 49.5 and 50.6 respectively, indicating the still narrow rebound for China’s economic recovery thus far. Meanwhile, China’s twice-a-decade financial work conference concluded on Tuesday, with President Xi Jinping saying that China must “comprehensively strengthen financial supervision”, with risk prevention the “external theme” of finance work, while adhering to the purpose of “finance as serving the real economy”. Thailand released better than expected current account balance and exports growth numbers, while Taiwan’s advance 3Q GDP estimates surprised on the upside helped by better exports and private consumption. South Korea’s exports for October also picked up to 5.1%yoy, albeit this was slightly lower than expected, and in line with green shoots in regional exports across Asia.