Ahead Today

G3: Germany CPI, US Dallas Manufacturing

Asia: China Official Manufacturing and Non-Manufacturing PMI, China Caixin PMI, Thailand Current Account and Exports

Market Highlights

Risk assets and industrial metal prices rose while the Dollar and US rates fell, as markets digested the combined impact of China’s stimulus, softer US inflation, rising geopolitical tensions, together with the surprise Japan LDP election results. Firstly, three of China’s largest cities – Guangzhou, Shenzhen and Shanghai – all eased rules for homebuyers over the weekend, with Guangzhou saying it will stop reviewing homebuyer eligibility and no longer limit the number of homes owned. Meanwhile, both Shanghai and Shenzhen said they will allow more people to purchase residences in suburban areas, as well as allow others to buy more homes. All these moves followed a flurry of monetary stimulus measures and an unequivocal Politburo statement on supporting the economy last week, together with the Chinese central bank quickly making effective rate cuts on Friday coupled with mortgage rate cuts from 1 November.

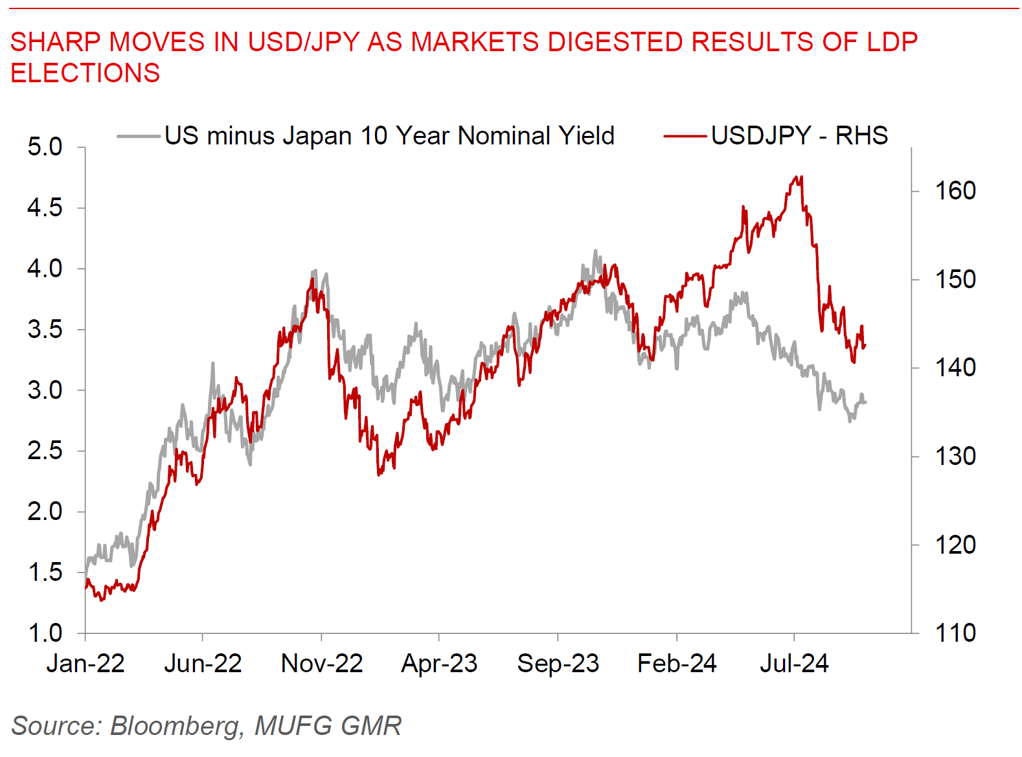

The second development which contributed to meaningful volatility was the win by Shigeru Ishiba in the LDP Elections held on Friday (see G10 FX Weekly: JPY vol picks up but what’s changed?). At one point USD/JPY rose closer to 146.50 as markets priced in an increased probability of Sanae Takaichi winning, who is a strong advocate of monetary policy easing and Abenomics. This reversed significantly post the second round of the election results, with USD/JPY falling closer to 142.13 at one point in Asia time. Our base case is for Ishiba to reflect the status quo of supporting Bank of Japan normalization and hence provide support for the Yen, as he has been a vocal critic of the BOJ’s monetary easing (and also Abenomics more broadly) in the past. Nonetheless, Ishiba’s comments over the weekend that from the government’s standpoint, “monetary policy must remain accommodative as a trend given current economic conditions” at least raises some questions in the near-term, and ahead of a possible General Election to be held perhaps sometime in October.

Regional FX

Asian FX markets were generally stronger, with USDCNH in particular falling below the 7.000 level again to 6.975 during Asian trading time, while the onshore CSI300 equity index rose 4.5% and metals such as iron ore surged due to China’s stimulus measures. Other key outperformers in Asia include THB (+0.92%), KRW (+0.6%), and MYR (+0.6%). Over the weekend, geopolitical tensions rose further in the Middle East, with Israel confirming it killed Hezbollah leader Hassan Nasrallah in an airstrike on Beirut, and coming on the back of a tumultuous two weeks where many of Hezbollah’s senior leadership were reportedly killed by Israel in various strikes. For Asian currencies, the key transmission would be through spikes in oil prices, but the offsetting point is the potential move by Saudi Arabia to boost oil production and regain market share hence capping oil prices thus far. Meanwhile, South Korea announced a stronger than expected industrial production August print of 4.1%mom (vs consensus of 2.8%mom), and in line with general trend of improvement in AI chip exports including out of Taiwan.