Ahead Today

G3: Eurozone Consumer confidence, US Richmond Fed Manufacturing index

Asia: Taiwan Export Orders

Market Highlights

The big market move was the sharp continued weakness in the US Dollar albeit with some reversal at Asia open, with several markets still out on holidays earlier this week. From a cross asset perspective this was also combined with sharp spikes in hedges such as gold and to a smaller extent Bitcoin, while US assets including the S&P500 fell sharply. These moves come on the back of the continued theme of the decline of US exceptionalism, with some concerning signs last week that the Trump administration is looking for ways to fire Fed Chair Powell.

These sizeable market movements this week are also happening in the background of the IMF/World Bank Spring meetings, where finance ministers together with key officials gather in Washington to discuss the global economy and other policy priorities. Japan’s Minister of Finance Katsunobu Kato says he will discuss currencies with his US counterpart Treasury Secretary Scott Bessent during his trip to the US. While we think the Japanese Yen will come up as a topic of discussion, from Japanese authorities perspective, we do not think that sharp appreciation in JPY will be Japan’s interest either given the negative impact on exports amidst higher tariffs and slower global growth. On that front, according to Bloomberg News, Bank of Japan officials see little need right now to change their existing stance of gradually rising interest rates.

Regional FX

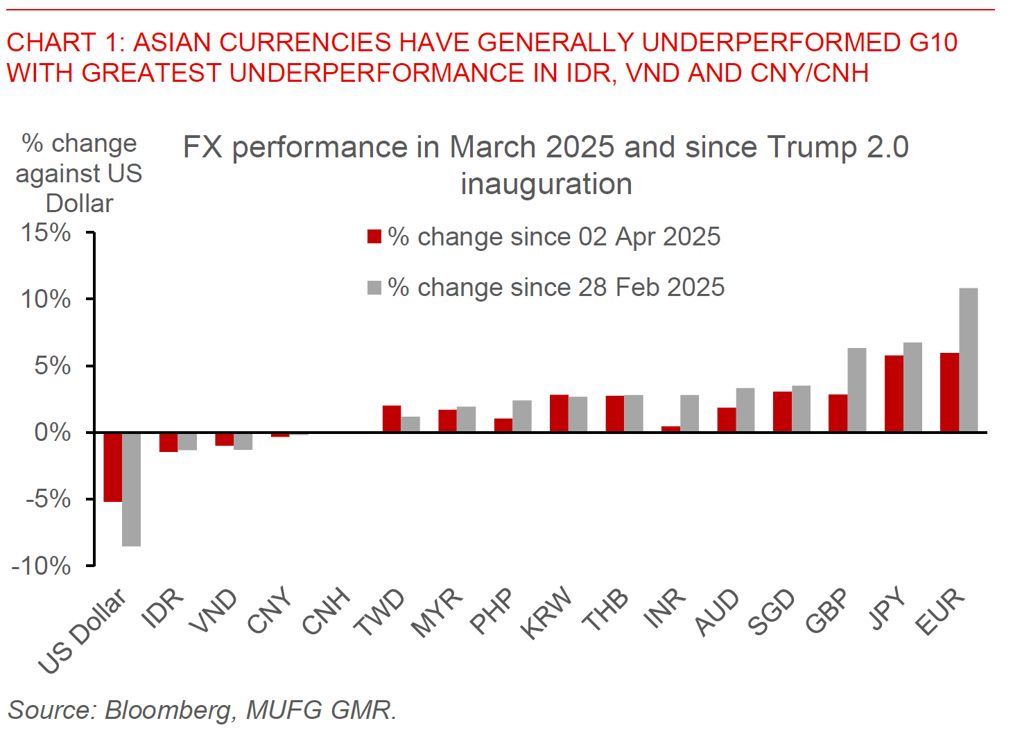

While the Dollar is weaker, this is not homogenous with Asia FX still underperforming the move stronger in G10 currencies (at least so far) certainly with respect to the likes of EUR and JPY. Nonetheless, there are no doubt also dispersion in outcomes across currencies, with INR (+1%), PHP (+0.8%), SGD (+0.9%), and THB (+1%) outperforming over the past week, while the likes of VND (-0.2%) and IDR (-0.2%) underperforming. China kept its loan prime rate unchanged for April at 3.1% for the 1-year and 3.6% for the 5-year, as was expected by markets. Meanwhile, Indonesia’s trade balance for March was much higher than expected at US$4.3bn driven by better than expected export growth of 3.2%yoy. Some of this could however reflect timing of key Lebaran holidays and so we could see some pullback in the subsequent month. Beyond the trade balance, the key driver for FX has been financial flows, and on that front continued concerns around the new Prabowo government’s priorities including fiscal policy and the new sovereign wealth fund are weighing on IDR right now. In signs of some further progress in trade deal talks, US Vice President JD Vance held talks with Indian Prime Minister Narendra Modi in New Delhi, with the White House saying in a statement that the talks yielded “significant progress in the negotiations” for a bilateral trade agreement, and that the sides had finalized a roadmap for a possible deal to reduce the tariff burden. US Trade Representative Jamieson Greer also said in a statement that India’s constructive engagement so far has been welcome, even as he mentioned that there is a serious lack of reciprocity in the existing trade relationship with India.