Ahead Today

G3: US 1y inflation expectation, speeches by Fed Mester and Jefferson, Germany current account

Asia: Indonesia consumer confidence, India inflation

Market Highlights

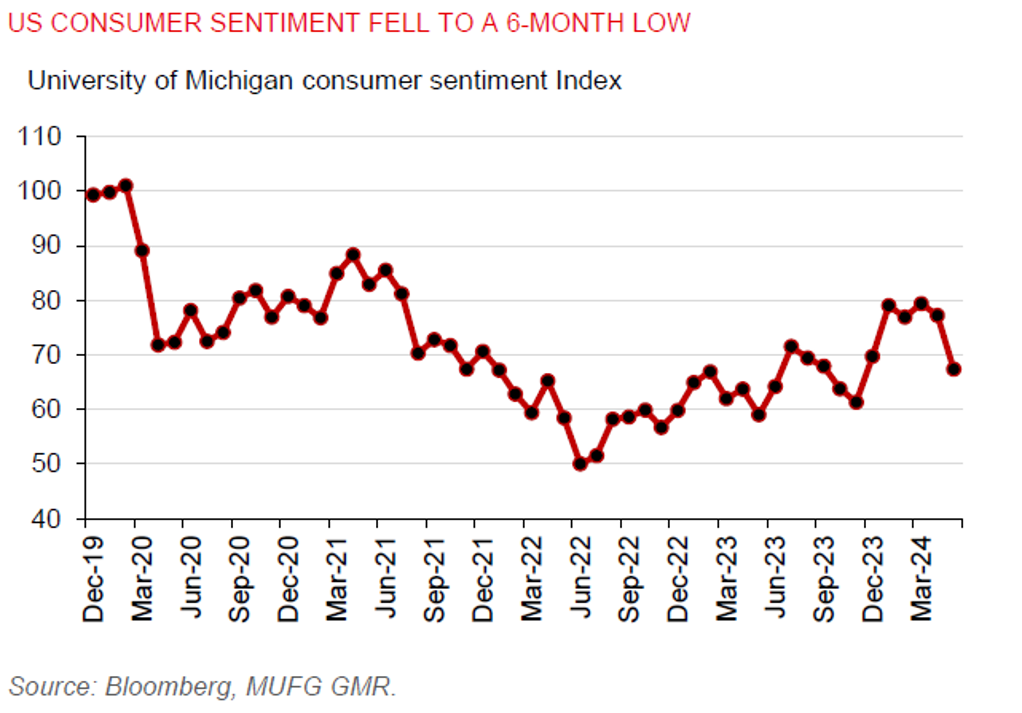

Strong corporate earnings in the US have underpinned a continued rise in US equities. Fed Bostic also said he remains optimistic the Fed will lower the policy rate this year, though the timing and pace of cuts are uncertain. Meanwhile, signs of economic softness in the US are emerging. Notably, US consumer sentiment has weakened to a 6-month low of 67.4 in May, from 77.2 in April, as reported by the University of Michigan survey. This follows from an unexpected rise in initial jobless claims and a softer April nonfarm payrolls data. This week, the release of retail sales numbers will provide more clues about whether US consumers will continue to stay resilient, especially after depleting most of their excess savings accumulated during the pandemic. Key macro data this week also include the all-important US CPI inflation.

ECB’s account of their monetary policy meeting on 10-11 April indicated that the policy rate will be cut in June, as inflation stays on track to moderate to 2%. Some policymakers had even thought about cutting rates in the April meeting, only to be overruled by a very large majority who supported keeping the deposit rate at 4% while waiting for more price and wage data to come in.

Regional FX

Regional FX

Asia FX weakened modestly against the US dollar last week amid a pickup in Brent prices. The JPY underperformed, but the IDR and THB were exceptions, as they gained 0.2% versus the US dollar.

China’s CPI inflation rose 0.3%yoy in April, up from 0.1%yoy in March. Aggregate financing – a broad measure of credit – also fell RMB200bn in April from a month ago, the first decline since comparable data began in 2017. Muted inflation and the decline in credit reflect still weak domestic demand. We anticipate the PBOC to lower borrowing costs this year, possibly starting in June, to help bolster a recovery in growth and lower bank funding costs. Moreover, US is poised to announce the imposition of tariffs on China’s electric vehicle and other strategic sectors. The move is likely symbolic, as China’s EV, solar power, and battery sectors aren’t dependent on US consumers. Still, leading up to the November US presidential elections, campaign narratives from either President Biden or Donald Trump on taking a tough economic stance towards China could dampen sentiment in the Asia region.