Ahead Today

G3: US Non-Farm payrolls

Asia: Vietnam exports and industrial production

Market Highlights

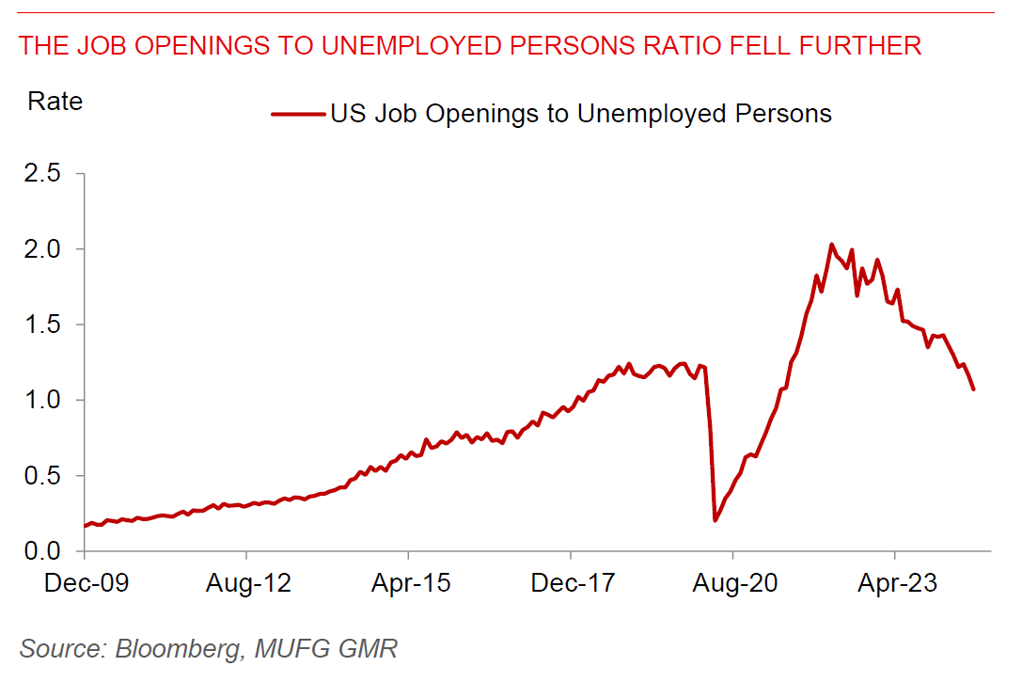

Today’s US non-farm payrolls print will be crucial in determining the size of the Fed rate cut in the September meeting, coupled with the trajectory of US rates moving forward. This print will also come on the back of several key indicators released over the week which showed a rapidly softening outlook for the US labour market and economy more broadly, even as layoffs have remained low and contained thus far. In particular, the Fed’s Beige Book was one of the most downbeat in a while, with 9 out of 12 districts reporting declining or flat activity, while nationwide employers were said to be more selective with their hires and less likely to expand their workforces citing concerns about demand and an uncertain economic outlook. Meanwhile, the ADP employment print yesterday surprised meaningfully on the downside at 99k in August, from 111k the previous month. The JOLTS jobs opening data softened further in July.

The jobs opening data was important as the details suggest a greater probability away from a US soft landing under Fed Governor Waller’s Beveridge curve framework. In particular, with the job vacancy rate moderating further to 4.6%, quit rates remaining low at around 2%, while layoff rates at around 1%, these numbers could imply unemployment rates at 4.5%. A job vacancy rate of 4.3% remains a key tipping point when unemployment rate rises more quickly according to his framework. Governor Waller will give a speech after non-farm payrolls, and markets will watch closely to see if he turns more dovish and communicate more forcefully on rate cuts.

Regional FX

Asian FX markets strengthened against the US Dollar with the weaker US labour data, with THB (+1.7%), IDR (+0.83%), PHP (+0.7%) and KRW (+0.7%) outperforming. The Philippines inflation data released yesterday was softer than expected at 3.3%yoy, with core inflation also softening further on a mom basis. The data shows that rice prices contributed 0.6pp out of the 1pp decline in yoy inflation rate, while the rest of the disinflation was split between food and some services components. All these means that the balance of risks tilt towards earlier and more BSP rate cuts through our forecast horizon. We're officially pencilling in a 25bps cut in December, and another 50bps cuts through 2025 by the BSP. Post the CPI release, the BSP continued to say they will take a measured approach to price stability, while reiterating downside risks to CPI outlook for 2024 and 2025. The other key currency to highlight is the Indian Rupee, which continues to move against the direction of stronger Asian currencies. The RBI was likely active in the market in curbing USD/INR from breaching the 84.0 handle. We still think sharp INR weakness is unlikely given fundamental support such as from bond index inclusion flows, but we have recently tightened the range we expect USD/INR to trade at between 83.50 to 84.0 (see Will INR weaken further?).