Ahead Today

G3: US new home sales, conference board consumer confidence, Richmond Fed manufacturing index, FOMC meeting minutes

Asia: Trade data from Thailand and HK, Singapore industrial production

Market Highlights

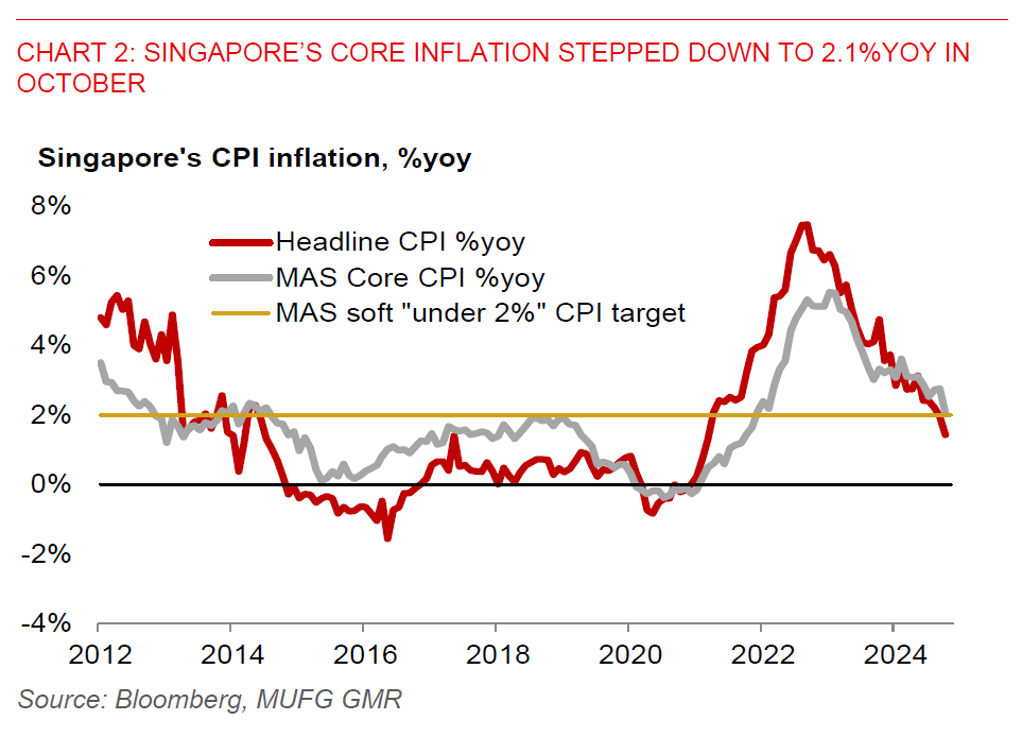

The US dollar index (DXY) fell 0.7% on Monday, while the US 10-year yield declined by more than 12bps to 4.27%, following Donald Trump’s nomination of Scott Bessent as US treasury secretary. EURUSD has also picked up modestly but stayed below the 1.0500-level. Bessent has possibly been seen by markets to take a more measured approach to imposing trade restrictions, easing market concerns that Trump could go to extremes with tariff hikes. The OIS markets have pared back expectations for Fed rate cuts to just 68bps through end-2025, compared to about 110bps of cuts being priced before the US election results. We believe market reaction to Bessent’s nomination may just be a blip for the US dollar. A likely renewed market focus on US tariffs in early 2025 would still support the US dollar.

The Fed minutes from the 6-7 November FOMC meeting will also be released. The minutes could show policymakers seeing lower downside risk to growth given resilient US economic data, while adopting a cautious stance on rate-cuts amid still sticky US core inflation. We anticipate US core PCE inflation to rise by 0.3%mom in October, bringing the year-on-year print to 2.8%, up from 2.7% in September. This, along with inflationary-type economic policies from the incoming Trump administration, may slow the pace of Fed rate cuts in 2025.

Regional FX

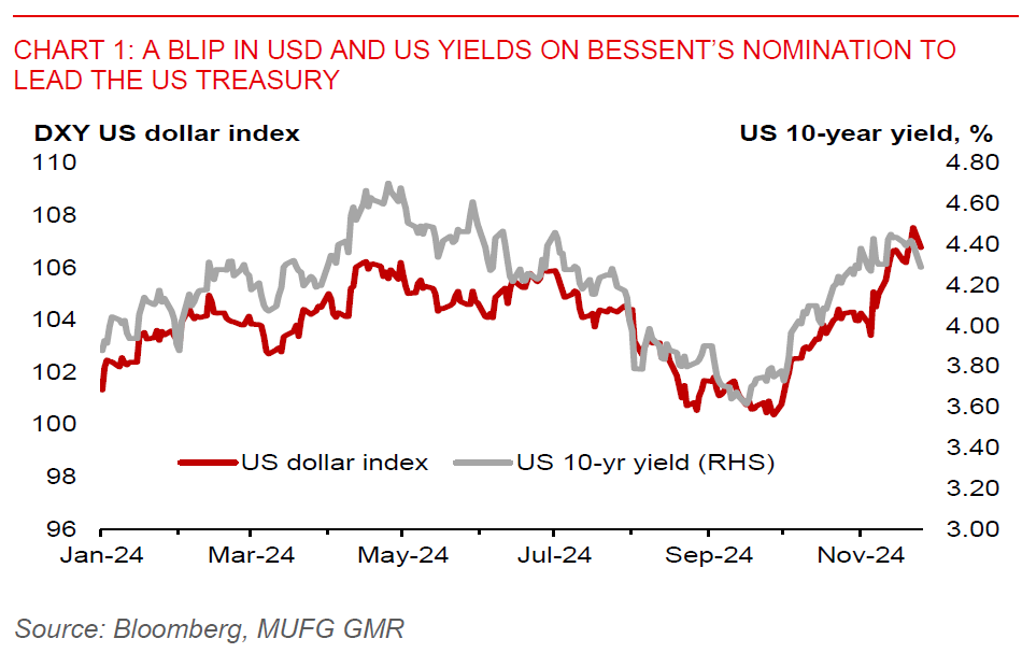

Most Asian ex-Japan currencies were up against the US dollar yesterday, with MYR (+0.4%) and TWD (+0.4%) leading gains in the region. While USDSGD was relatively stable yesterday, we still look for further upsides, as the MAS will likely loosen its tight policy setting in January 2025, amid easing inflation and rising risk to growth from potential US tariff hikes early next year.

Singapore’s disinflationary trend has been well-entrenched, with core CPI (ex-private transport and accommodation) moderating to 2.1%yoy (-0.3%mom) in October from 2.8%yoy in September. The pace of disinflation was faster than our expectation of 2.5%, reinforcing our view that the MAS will ease its tight policy setting in January 2025. The deceleration in price gains was mainly due to easing inflation in services, electricity and gas, retail, and other goods. We maintain our outlook for core inflation to ease to under 2% by end-2024, giving room for MAS policy easing. Moreover, we think the balance of risks will shift to growth as Trump is likely to impose some form of tariffs on China, which would have negative spillover effect on Singapore’s economy. Meanwhile, Singapore’s headline inflation slowed to just 1.4%yoy in October, from 2%yoy in September, underpinned by lower core inflation, a decline in private transport inflation, and slowing accommodation inflation.