Ahead Today

G3: Eurozone Trade Balance

Asia: Thailand 4Q GDP, Indonesia Trade Balance, India trade deficit

Market Highlights

The Dollar sold off sharply, Asian currencies strengthened, equities rallied, while US yields fell on several key factors. First, markets greeted Trump’s plans for reciprocal tariffs with some skepticism, while perhaps focusing instead on the delay in timing to April and with that possible room for negotiations between countries. Second, the prospect of a possible Russia-Ukraine ceasefire brokered by Trump have raised some hopes of an end to the war, with senior officials from US and Russia likely to meet in Saudi Arabia this week, even as both Ukraine and Europe have been adamant that they have a seat at the table. Third, US Vice President’s JD Vance’s hard-hitting speech at the Munich Security Conference increases existential questions about transatlantic ties, but with that, also increases the probability that Europe could meaningfully raise defence spending (and as such boost aggregate demand). Fourth, US retail sales came in much weaker than expected, even as part of this might be due to weather driven effects. Last but not least, China’s President Xi Jinping is likely to chair a symposium on 17 Feb in a bid to shore up private sector confidence, with some of China’s key business and tech leaders from Tencent, Xiaomi, Yushu Technology and Huawei attending, and reportedly including Alibaba’s co-founder Jack Ma.

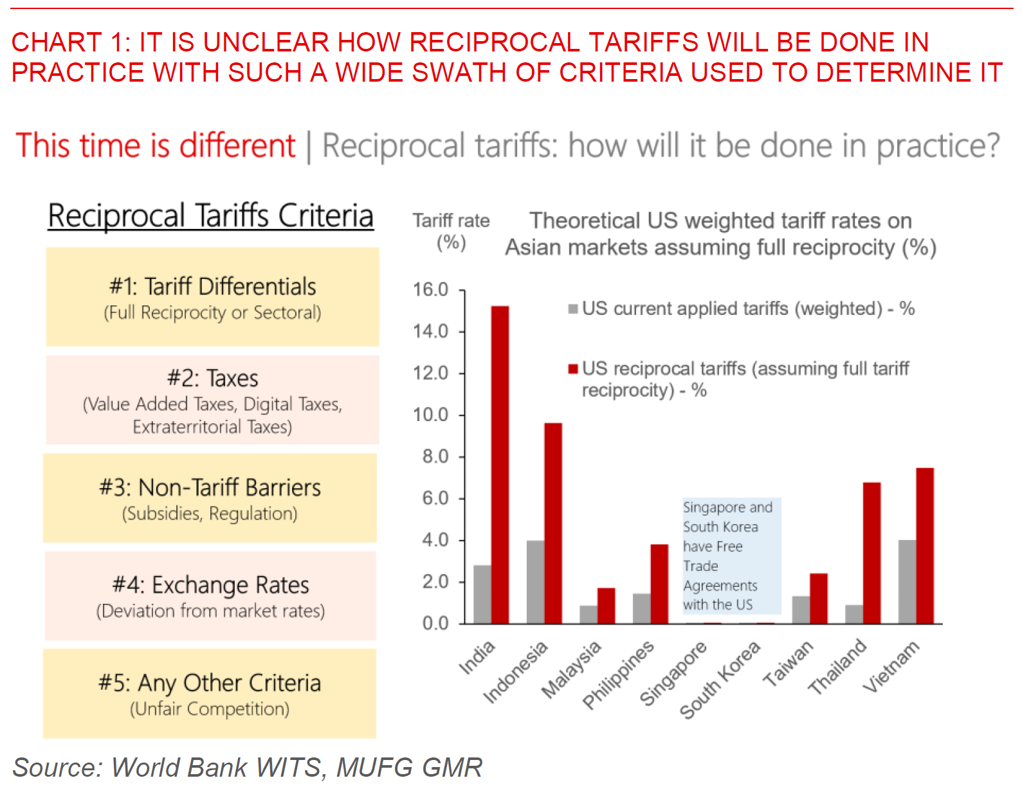

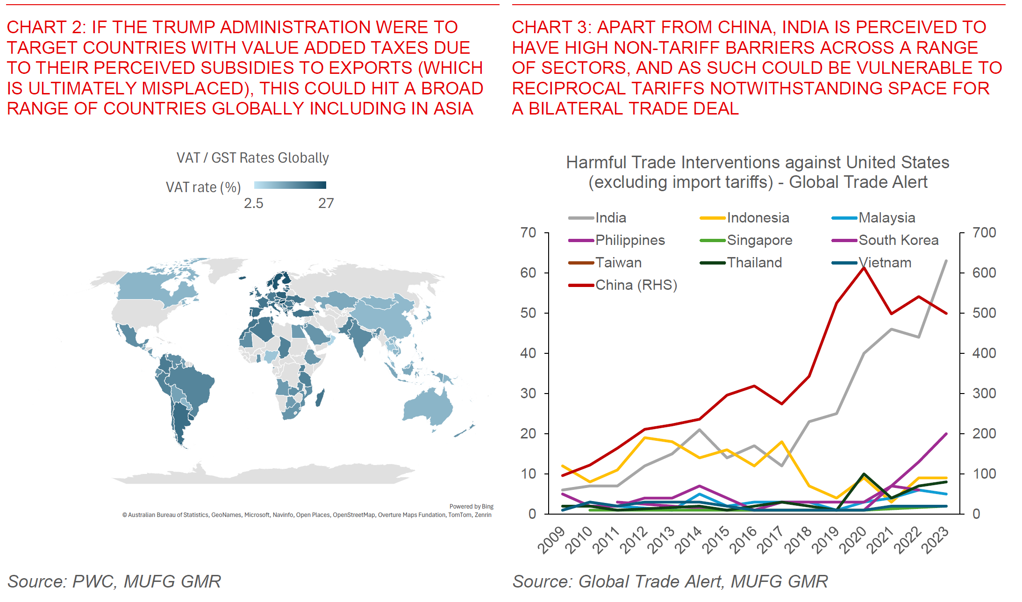

While we think that the market’s skepticism around Trump’s reciprocal tariff plan may make sense, the broad criteria that the administration is using to determine these tariffs which includes not just tariff differentials but also taxes (includes VAT), non-tariff barriers, and exchange rate misalignment raises the possibility that a whole swath of countries will be targeted in Trump 2.0.

In Asia, India continues to stand out as the most vulnerable to reciprocal tariffs, notwithstanding the good personal relationship between PM Modi and President Trump and the space for negotiations for a bilateral trade deal. Our analysis shows that US tariffs on India could rise to above 15% in theory from ~3% currently with full tariff reciprocity (see Asia – Reciprocal tariffs an eye for an eye). Beyond tariff differentials, India has a digital services tax, reasonably high Goods and Services tax rate of between 5-28%, and also reasonably high non-tariff barriers across a range of sectors. We maintain our cautious view on the Indian Rupee and forecast USD/INR rising further towards 88.50 by year end (see INR – Let it go).

Regional FX

Asian currencies were generally stronger heading into the weekend, with USD/CNH falling to 7.258 on the back of better risk sentiment in Chinese assets. Other Asian currencies also strengthened with THB (+1.3%), KRW (+1%), MYR (+0.8%), and PHP (+0.6%) key outperformers. China’s credit data was stronger than expected for January, with the details suggesting that stronger government financing activity and a pickup in corporate loans helping to offset negative household mortgage loan activity. China’s central bank governor Pan Gongsheng said that China’s price growth and consumer demand “can be stronger” because the nation’s economy is sound and there is reduced risks from local government debt and the property market. Chinese authorities will adopt a more proactive fiscal policy and accommodative monetary policy, while also keeping the exchange rate basically stable at an adaptive and equilibrium level.

Looking ahead, we will have Thailand’s 4Q GDP data. We are expecting Thailand’s growth to improve to 4%yoy from 3%yoy the previous quarter, bringing the full year estimate to 2.9%, and helped by improvements in tourism coupled with rollouts in cash handouts. Meanwhile, Indonesia’s trade surplus is expected to remain around the US$2bn level, while India’s trade deficit is expected to narrow slightly to US$21bn