Ahead Today

G3: US: retail sales, import price, initial jobless claims; Germany CPI

Asia: Bank of Korea policy rate decision

Market Highlights

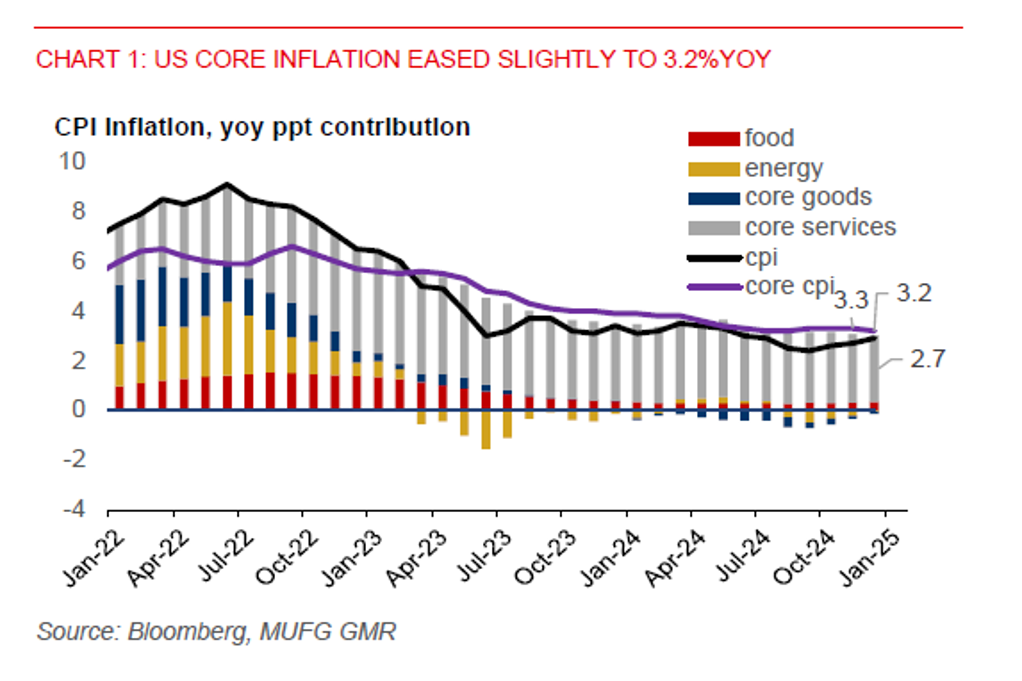

US headline inflation rose 0.4%mom in December, from 0.3%mom in November and faster than Bloomberg consensus of 0.3%. This was mainly due to volatile energy prices, which rose 2.6%mom, contributing 43% of the rise in headline inflation. However, contributions from other price categories had largely eased. Core goods disinflation has resumed, with used car price growth slowing to 1.2%mom from a September peak of 2.7%mom. Core services inflation was steady at 0.3%mom, with shelter price inflation also at 0.3%mom.

Notably, core inflation was 0.2%mom in December, down from 0.3%mom in November and less than Bloomberg consensus of 0.3%. From a year ago, the core gauge slowed to 3.2%yoy from 3.3%yoy in November. With core inflation finally easing, the Fed is likely to stay on its rate-cutting cycle. The broad US dollar index (DXY) fell 0.3% to below the 109.00-level, extending the 0.6% fall in Tuesday’s session. US 2-year yield fell 10bps while the 10-year fell about 14bps following the inflation report.

The pullback in the US dollar, along with renewed market expectations for a BoJ rate hike in January, has led to USDJPY falling as much as 1% to the 156.00-level. BoJ governor Ueda’s latest speech has revived market hopes for a January rate hike.

Regional FX

Asian ex-Japan currencies mostly strengthened against the US dollar in Wednesday’s session, amid a decline in the broad US dollar index (DXY). KRW and INR led gains in the region with a 0.4% and 0.3% rise against the US dollar, respectively. However, this could just be a temporary reprieve, as looming US tariff hikes mean that Asian currencies could still come under renewed pressure.

Meanwhile, IDR fell 0.3% against the US dollar following a surprise 25bps Bank Indonesia rate cut. This would inevitably put pressure on the rupiah at a time when US yields are still elevated. We may thus look to revise up our USDIDR forecast, which currently stands at 16,250 by end-Q1. Given rising global uncertainties, it’ll also be hard to estimate the exact timing of BI rate cuts going forward, as BI’s priorities could seemingly shift between supporting economic growth and the rupiah. Moreover, it’s unclear the composition, pace, and extent of US tariff hikes. But what’s clear is that there will be room for BI to continue easing policy as the Fed lowers rates and given BI’s current tight policy setting. We look for BI rate to end this year at 5.25%, implying another 50bps of rate cuts.

The key macro data highlight today is the Bank of Korea policy rate decision. We expect BoK to lower rates by 25bps to 2.75% as early as this month, given a struggling economy and the ongoing domestic political crisis.