Ahead Today

G3: US Industrial Production, Germany Zew Expectations

Asia: Hong Kong Unemployment rate

Market Highlights

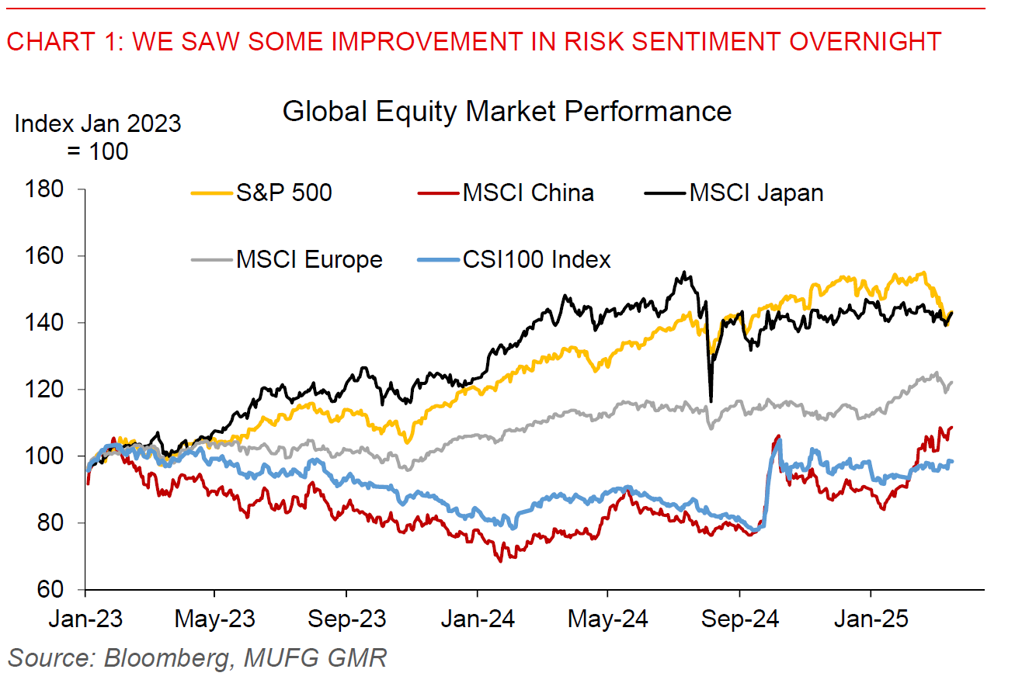

Risk sentiment picked up overnight with the S&P500 up 0.6%, with the Dollar Index turning weaker by 0.2%. There were likely 3 key reasons for these market moves yesterday. First, US retail sales while weaker than expected from a headline perspective, the components which feed into GDP was stronger than anticipated, with the Atlanta Fed’s GDP nowcast rising to -2.1% from -2.4% previously. Second, Bloomberg News reported that US Trade Representative Jamieson Greer is looking to bring more order to the upcoming announcement of new tariffs on 2 April, among other things reinstating parts of a traditional policy process including asking for public comment on the reciprocal duties. While there is still uncertainty around the severity of the upcoming tariffs, this news if right should still imply somewhat better policy implementation than has been seen since the start of Trump 2.0. Third, China’s Jan-Feb macro data while mixed showed some acceleration in industrial production, retail sales and fixed investment, although this was tempered by a still weak property market and loan demand. We have revised our USD/CNY forecasts to 7.40 from 7.50 for 2Q2025, and our China 2025 GDP forecast to 4.6% from 4.5% previously (see ChinaPulse – Jan-Feb numbers show both resilience and vulnerability). Looking ahead, markets will look for US industrial production coupled with Germany’s Zew expectations for possible guidance, and ahead of FOMC later this week.

Regional FX

Asia FX pairs were generally stronger overnight with the weaker Dollar trend, with KRW (+0.7%), THB (+0.26%), SGD (+0.3%) and INR (+0.24%) outperforming, while MYR (-0.2%) and TWD (-0.13%) underperforming. USD/CNH fell to 7.2281 with some resilience in China’s macro data released yesterday coupled with authorities action plan to boost consumption. India released its trade deficit number yesterday which was much smaller than expected at US$14bn from US$23bn the previous month. Part of this was due to lower gold and oil imports due to higher prices for the former. Nonetheless, at least part of this smaller deficit was due to weaker consumer goods and capital goods imports, and may be indicative of softer domestic demand. While this number in itself is positive for the Indian Rupee, and also poses some downside risks to our current account deficit forecast of 1.5% of GDP, for INR the capital account still matters much more than the current account historically for FX given that it is a currency sensitive to growth capital and expectations. As such, if yesterday’s smaller trade deficit data is at least partly indicative of softer domestic demand trends in India, this may continue to weigh on equity and foreign capital inflows moving forward. We think INR should still be biased weaker, with a central bank which is pivoting towards growth and likely to cut rates further moving forward, coupled with uncertainty around the impact of reciprocal tariffs on India. We forecast USD/INR at 88.50 by end-2025, with weakness likely to be more front-loaded in 1H2025.