Ahead Today

G3: US Mortgage Applications

Asia: RBI Monetary policy decision

Market Highlights

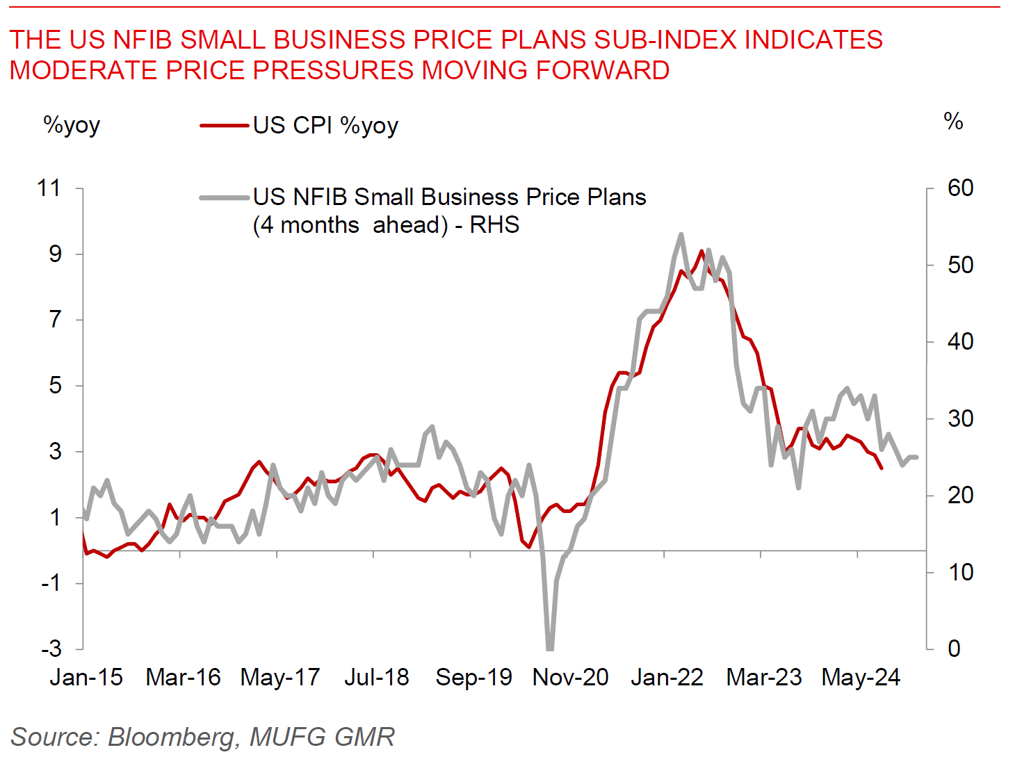

Markets saw some modest relief rally overnight, with Fed speakers overnight pointing to a continued path of rate cuts, even as there was uncertainty around the response of Israel to Iran, together with market disappointment over the lack of details over China stimulus. Atlanta Fed President Raphael Bostic said the Fed must balance both risks to inflation and also threats to the labour market, while NY Fed President John Williams said the central bank is “well positioned” to pull off a soft landing for the economy with the goal to move interest rates to a “neutral” setting. Meanwhile, the US NFIB Small Business Optimism Index saw some modest downward surprise, with details such as the price plans and hard to fill job-openings sub-indices pointing to continued moderation in price pressures.

FTSE Russell announced that South Korea will join its key WGBI bond index in its September 2024 review. Nonetheless, the actual inclusion will only be effective a year later in November 2025, and subsequently phased in over a one-year period on a quarterly basis, which is likely a slower inclusion than would be expected from today’s announcement. In the statement accompanying the decision, FTSE Russell commended South Korean authorities for their steps to improve market accessibility including extending trading hours for the won and making it easier for overseas investors to settle bond trades. Post the inclusion, South Korean government bonds will represent 2.2% of the WGBI index, with around US$700bn of bonds eligible to be included. Estimates for the impact to inflows vary depending on assumptions on actual AUM tracking the WGBI, ranging from around US$25bn on the low end all the way up US$70bn of passive inflows on the higher side. WGBI bond index inclusion has been one of the key factors around why we have been positive on KRW, and we forecast USD/KRW at 1270 by 3Q2025 (see Asia FX outlook: Ride with the tide).

Regional FX

Asian FX markets traded mixed on the back of disappointment with China’s stimulus announcements. PHP (-1.1%), IDR (-1%) and THB (-1.3%) underperformed while USD/CNH rose closer to the 7.0722 levels. On the back of the announcement around South Korea’s inclusion into WGBI, FTSE Russell also included Indian Government Bonds into the its FTSE Emerging Markets Government Bond Index (EMGBI). This will commence from September 2025, with the inclusion phased in over a six month period. IGBs will form a weight of 9.4% post the inclusion, with the China dropping by 6% in the index weight. While estimates vary widely, we believe that the AUM tracking the FTSE EMGBI is far smaller than WGBI. As such, the actual flow impact to Indian bonds may only be around US$2-5bn over the time period by our estimates. The bigger impact could come once Bloomberg Barclays includes Indian bonds into its key Global Agg Index, which may bring an additional US$10-15bn of inflows. We will have the RBI Monetary policy decision today and while we expect RBI to keep rates on hold, there’s a good chance that the central bank may strike a less hawkish tone and change its policy stance to neutral, with a view to eventually cut rates in December. (see IndiaPulse – Bringing forward the 1st RBI rate cut)