Ahead Today

G3: Europe PMIs, US Empire Manufacturing

Asia: China monthly macro data, Indonesia trade balance

Market Highlights

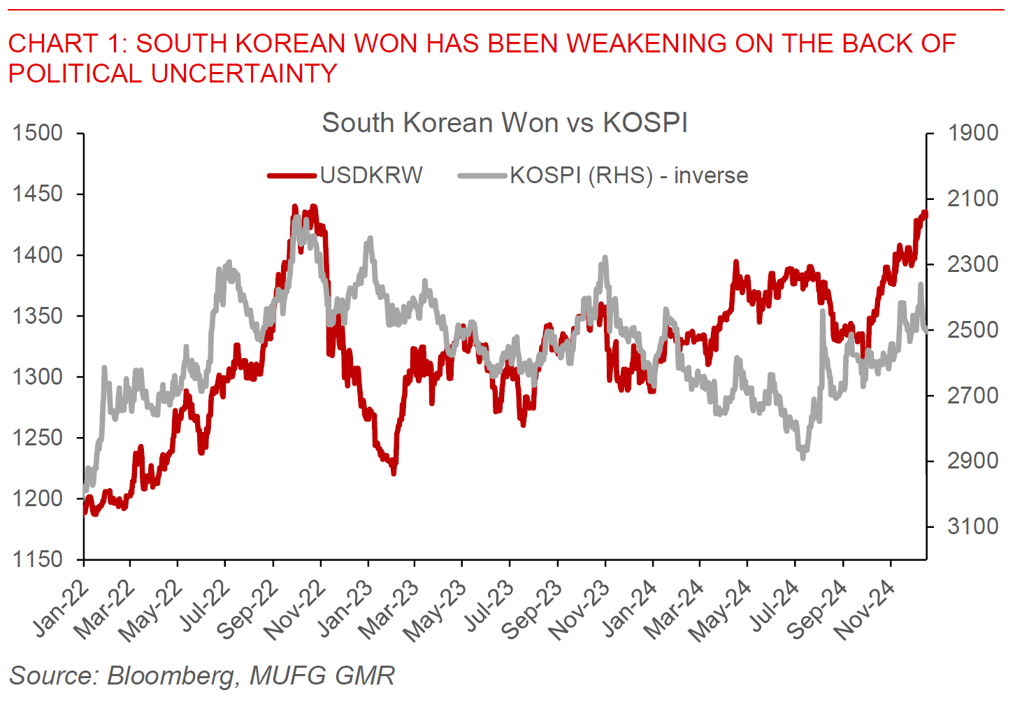

South Korea’s National Assembly voted to impeach President Yoon Suk Yeol in a 204-85 vote over the weekend, following the President’s dramatic but short-lived announcement of martial law on 3 Dec. 12 lawmakers from Mr Yoon’s People Power Party joined the vote to vote in favour of impeachment. Prime Minister Han Duck-soo becomes acting President, while Yoon remains in office but with his presidential power suspended. The focus now shifts to the Constitutional Court on whether it upholds the impeachment, which it will have to decide within 180 days. With 3 out of 9 Constitutional Court Justices currently vacant, a unanimous vote among the remaining 6 justices is required to upload the impeachment motion.

All these could create some political uncertainty for the South Korea won and assets in the near-term, even as we note that impeachment is not new for the country. If the Constitutional Court uploads the impeachment, a Presidential Election will have to be held within 60 days. In the impeachment case for President Park, the Constitutional Court took 90 days to decide and the new President Moon Jae-In was inaugurated 60 days later after the Presidential Election.

This week will be important with many key central bank meetings, most important of which will be the Fed and the Bank of Japan. We expect the Fed to cut rates by 25bps but will likely signal a more cautious tone for 2025.

Regional FX

Asian currencies were mixed to weaker with IDR (-0.50%), THB (-0.7%), and MYR (-0.4%) underperforming. USDCNH traded within a range to 7.278. The focus today in Asia will be on China’s monthly macroeconomic data, and to see perhaps if the recent stimulus measures have started to help stabilize activity in its economy. Consensus is expecting some marginal year-on-year improvement in retail sales and industrial production to 3.6% and 5.4% respectively. The recently concluded Politburo meeting and Central Economic Work Conference (CEWC) pledged to cut rates and the RRR further, together with fiscal stimulus measures to help support domestic demand. On that note, over the weekend, China’s regulators pledged to boost efforts to stabilize the housing and equity markets, as well as conduct more effective fiscal policies. Indonesia will release its trade surplus data today, which is expected to show a steady trade surplus of US$2.4bn.