Ahead Today

G3: US ISM Manufacturing

Asia: Singapore Retail Sales

Market Highlights

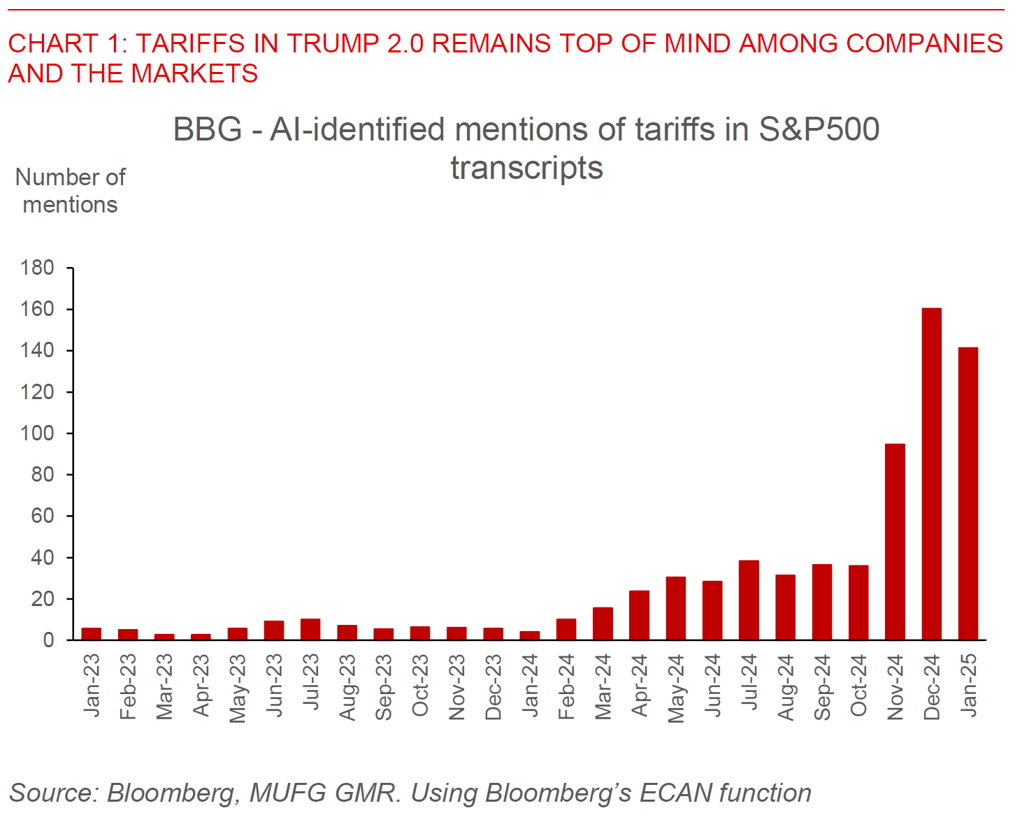

The old adage that it’s not how you start but how you finish may apply for markets as well in life. Nonetheless, if the first few days of the year are anything to go by, our forecasts for weaker Asian currencies in 1H2025 are starting to play out even if there are country specific idiosyncrasies at play (see Asia FX Outlook 2025). On the global front, US labour market data came in better than expected with a drop in both initial jobless claims and continuing claims. The China PMI data was a mixed bag, with weaker manufacturing for both the official and Caixin releases, but this was accompanied by stronger non-manufacturing PMI heading into the new year. Interestingly Chinese equity markets looked to have brushed off some of these numbers, with the focus perhaps squarely on the future – ie. the looming trade war between Trump 2.0 together with China’s retaliatory measures, with USD/CNH close to 7.340 as we speak and EUR/USD now below 1.030. There remain some unknowns for markets which are far harder to quantify but which are pertinent, including the impact of recent suspected terror attacks in the US, and the ongoing escalation of wars. Looking ahead, markets will focus on US ISM Manufacturing together with the prices paid sub-component.

Regional FX

Asian currencies were generally weaker to start the year, with THB (-0.9%), IDR (-0.6%), and MYR (-0.4%) underperforming. Risk sentiment across Asia were somewhat soft to start 2025, with onshore Chinese equity markets falling 3% and offshore markets dropping 2%. Indonesia surprised markets with President Prabowo announcing a paring back of a planned value-added tax hike from 11% to 12%, with the higher levy now only applying to luxury items such as private jets and yachts, while also saying that certain vehicles and motorbikes will be subject to VAT. The expected revenues from this move will likely be far lower, and as such, will not be enough to fund President Prabowo’s flagship social support such as the free lunch program. More than the policy decision, the way in which it was announced in a last-minute fashion into the new year just before the VAT hike was supposed to take effect could raise questions about policy uncertainty moving forward in the new administration. All these could go some way to explain IDR’s underperformance yesterday, with Bank Indonesia coming out to say they are in the market to intervene and Finance Minister Sri Mulyani downplaying concerns by saying the 2024 fiscal budget deficit came in much smaller than expected.

In India, USD/INR continued its ascent higher rising to 85.7550, with forward points both in the onshore and offshore markets remaining elevated in the front-end. We have turned more cautious on INR, and forecast USD/INR rising to 86.80 by 1Q2025 and 88.50 by 4Q2025, with INR weighed down by spike in gold imports, soft goods exports, higher FDI repatriation, weaker portfolio inflows and increased RHS hedging (see IndiaPulse: INR – Let it go?). We think RBI’s FX policy could turn less interventionist and allow INR to adjust weaker, even as RBI will unlikely let INR go completely.